There's nothing in the street

Looks any different to me

And the slogans are replaced, by-the-bye

And the parting on the left

Is now the parting on the right

And the beards have all grown longer overnightI'll tip my hat to the new constitution

Take a bow for the new revolution

Smile and grin at the change all around me

Pick up my guitar and play

Just like yesterday

Then I'll get on my knees and pray

We don't get fooled again

On May 25th, at a speech in Hong Kong, Paul Krugman said: "I will not be surprised to see world trade stabilize, world industrial production stabilize and start to grow two months from now. I would not be surprised to see flat to positive GDP growth in the United States, and MAYBE even in Europe, in the second half of the year." Although Krugman also questioned: "In some sense we may be past the worst but there is a big difference between stabilizing and actually making up the lost ground. We have averted utter catastrophe, but how do we get real recovery?" The markets ignored the BUT (economists do tend to say BUT a lot) and the Dow rallied 200 points the next day.

In fact, the Dow rallied 200 points on Monday May, 18th as well as Tuesday, May 26th (Monday was a holiday) and Monday June 1st, with those 3 "Monday's" accounting for 600 of the 500 points the Dow has gained since Krugman's first speech. Oil is up over 10% on that "rosy" outlook as well, starting at $60 on the 26th and flying up (with the help of GS) since, all on hopes that the economy will be "back to normal" next quarter. Of course that's not what Krugman said at all but so what?

In fact, the Dow rallied 200 points on Monday May, 18th as well as Tuesday, May 26th (Monday was a holiday) and Monday June 1st, with those 3 "Monday's" accounting for 600 of the 500 points the Dow has gained since Krugman's first speech. Oil is up over 10% on that "rosy" outlook as well, starting at $60 on the 26th and flying up (with the help of GS) since, all on hopes that the economy will be "back to normal" next quarter. Of course that's not what Krugman said at all but so what?

Yesterday, with the Dow down 150 points from Friday afternoon's 8,800 level, Krugman made a speech in London, where he said: "I would not be surprised if the official end of the US recession is dated, in retrospect, some time this summer." He said in retrospect because the context was that he expects the kind of recovery you won’t know you are having until 6 months or so later, when you can look back and say – "Oh, that’s where we bottomed," as opposed to a V recovery where the bottom is ovbious.

He also said: "Almost surely unemployment will keep rising for a long time and there’s a lot of reason to think that the world economy is going to stay depressed for an extended period." I think the LA Times summed it up well saying:

Evidently, though, all the bulls have to hear is "recession over" to shovel more money into stocks.

That’s a good thing for every investor who’s still riding the spring rally. But it’s vexing the folks who are waiting for some kind of significant setback to get aboard. Since the surge began on March 10, the Standard & Poor’s 500 index hasn’t had a pullback deeper than 5.4% before buyers have jumped back in. "It’s tough to keep this market down," said Todd Leone, head of block trading at Cowen & Co. in New York.

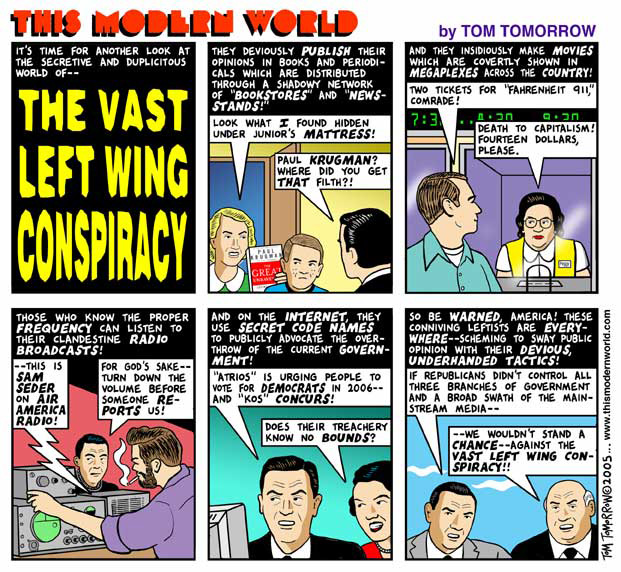

This is, by the way, the same Paul Krugman who is the "evil liberal writer" for the NYTimes who conservatives disagree with on every word that comes out of his mouth except, perhaps, when he says the recession may end – in which case he becomes a "Nobel Prize-Winning Economist" and that gives them the green light to BUYBUYBUY! It would be funny if not so ridiculously tragic….

Here’s what Krugman won the 2008 Nobel Prize In Economics for:

- The middle class is being destroyed by the rich, who must be taxed to redress their wrongs. Also very pro-union in this clip.

- Krugman blaming "Allan Greenspan and Phil Graham" for the economic crisis.

- Krugman saying: "We have shifted to an economy that caters to a very small, very well-off elite."

- Krugman vs. O’Reilly, funny in retrospect in that everything O’Reilly claimed was working has since turned into an obvious disaster.

What kills me about Krugman is he won a Nobel Prize for saying the exact same thing I was ranting about in my own posts at the time but, what can you do? I am happy to toil here in obscurity while Krugman goes to all the boring lectures (while I like the sound of my own voice just fine, sitting on a panel of "noted economists" would force me to keep the suicide hotline on speed-dial).

My own obscure economic observation of this morning was to short oil at 3:07 am, when I said to members (mostly the European ones, who were awake): "They jammed oil up from $68.50 to $69.25 ahead of the EU open based on Krugman’s call so I’m shorting oil futures here. DD at $69.50 and DD at $70, maybe a repeat of last week where they spike it up or maybe Europeans aren’t so dumb and we sell off from here."

Here’s what I had picked up from the Dow Jones Wire:

At 0632 GMT, front-month July light, sweet crude oil futures on the New York Mercantile Exchange rose 95 cents to $69.04 a barrel on Globex. July Brent crude oil futures on London’s ICE futures exchange were 90 cents higher at $68.78 a barrel.

Crude oil market participants focused on dollar and share price movements much of Tuesday’s trading in the absence of oil-related cues, said Shuji Sugata, an analyst with Mitsubishi Corporation Futures & Securities in Tokyo. "Technically, the market is still on an uptrend and traders are following that. But Many traders are keeping a wary eye out for any signs of sudden collapse," he added, citing still weak crude fundamentals. Koichi Murakami, a broker and senior analyst with Tokyo-based Daiichi Shohin, agreed there was the possibility of a drop given there are no signs of demand recovery. "Recent gains in crude were mostly baseless."

Still, "there’s steam in the market to test $70 again later this week, if indicators like U.S. oil inventories and IEA global oil data show some signs of recovery in demand," Murakami added. U.S. crude oil inventories will likely display a fall of 500,000 barrels in data due Wednesday from the Department of Energy, according to a Dow Jones Newswires survey of analysts. Stockpiles of gasoline and distillates, which include diesel and heating oil, will likely increase.

These guys are just too funny: "There’s no reason at all for the rally but we’re buying and we plan on getting out at the top." Yeah, good plan! Anyway, we're done with that trade already as we bottomed out at 5:30 at $68.60 and now we're hoping for another silly run-up so we can resload our shorts. At $10 per penny per contract – those oil futures are fun, fun, fun!

These guys are just too funny: "There’s no reason at all for the rally but we’re buying and we plan on getting out at the top." Yeah, good plan! Anyway, we're done with that trade already as we bottomed out at 5:30 at $68.60 and now we're hoping for another silly run-up so we can resload our shorts. At $10 per penny per contract – those oil futures are fun, fun, fun!

Europe was having fun, fun, fun until to DAX took the 5,000 support level away. After getting off to a great start on the Krugman "news," the EU markets did a fast fade into lunch, dropping 1% from their opens. The early EU rally was led by – you guessed it – Energy stocks, as Barclays Wealth said the outlook looked bright for those investors putting their confidence in oil as it continues to hit new highs. "In the short-term, we are moving into the crucial 'driving' holiday season in the U.S. which is likely to increase demand," said Henk Potts, equity strategist at Barclays Wealth, "plus the constant threat of weather disruption in hurricane season will also affect the short-term price. Most importantly though, the most crucial factor for the price of oil will be the speed and strength of the recovery of the global economy."

This is, of course, the same Henk Potts who has been cheerleading crude as it went from $100 to $140 and then crushed all who heeded his call. This is just the British version of the Goldman call on oil and we'll see if US investors can be fooled again but it sure is working in Europe as oil is already (7:30) back to $68.40 and we'll begin shorting it again at $68.50 or if it crosses back under $68.25. Mr. Potts, of course, fails to take into account the record inventories, record amount of oil in storage at sea and record OPEC surplus capacity – all factors the smooth out any short-term price fluctuations he's fantasizing about. We've already been told this is going to be one of the lightest hurricane seasons in many years, with 30% less storm activity than any of the past 5 summers.

7:50 Update: We're touching $69.50 in the futures on oil but the dollar is down and gold is up so the conditions aren't as good at they were earlier for a short play so no official move yet. Maybe we luck out and get another crack at $70 to short, that was a 5% gainer in one day on Friday with huge money to be made in options and futures. Perhaps I'll regret not pulling the trigger here at $69.50, which is ridiculous enough to short at on its own but the coordinated global hype machine makes it hard to be brave on the short side.

Asia was less brave than Europe this morning with 1% pullbacks in China and Japan on the heels of a stunning 8% pullback on the Baltic Dry Index, now down 11% since last Wednesday. "Asian markets were lower reflecting the growing concern that the rally is becoming inconsistent with the pace of the recovery," said Sanjay Mathur, non-Japan Asia chief economist at the Royal Bank of Scotland. "Rising U.S. bond yields and commodity prices are progressively becoming additional headwinds to the valuation and earnings cycle." In fact, just yesterday, the International Air Transport Association DOUBLED their 2009 loss estimates for the industry to $9Bn, citing rising fuel prices and a 15% drop in revenue since their Q1 outlook was taken.

“There is no modern precedent for today’s economic meltdown. The ground has shifted,” Giovanni Bisignani, the association’s director general, said Monday in a speech at the association’s annual meeting in Kuala Lumpur, Malaysia. “Our industry has been shaken. Our future depends on a drastic reshaping by partners, governments and industry. Whether this crisis is long or short, the world is changing,” Mr. Bisignani said. “It will not be business as usual in the post-crisis world.”

“There is no modern precedent for today’s economic meltdown. The ground has shifted,” Giovanni Bisignani, the association’s director general, said Monday in a speech at the association’s annual meeting in Kuala Lumpur, Malaysia. “Our industry has been shaken. Our future depends on a drastic reshaping by partners, governments and industry. Whether this crisis is long or short, the world is changing,” Mr. Bisignani said. “It will not be business as usual in the post-crisis world.”

The transport association expects cargo demand to fall 17 percent this year and passenger demand to drop 8 percent, to 2.06 billion travelers. The global industry’s projected $9 billion loss is a slight improvement over the $10.4 billion loss in 2008, when fuel bills climbed to $165 billion as oil prices soared. This year, the association expects airline fuel bills to fall back to $106 billion, but Mr. Bisignani warned that oil prices could be pushed up again as the global economy began to recover.

So you can understand if we still have some concerns about the "recovery" that the US markets are so intent on celebrating but we have our cash ready to BUYBUYBUY with the sheeple if they can make it over our critical 40% lines of NYSE 6,232 and S&P 946. Heck, we're even looking at VLO as a buy if they can get oil over $70! We're already in UYG as a big holding in our $100K Virtual Portfolio and certainly it's time to consider gold now that we can take another stab at $960 but all that is contingent on making and holding our two lagging levels – which have been keeping us on the sidelines for quite a while now.

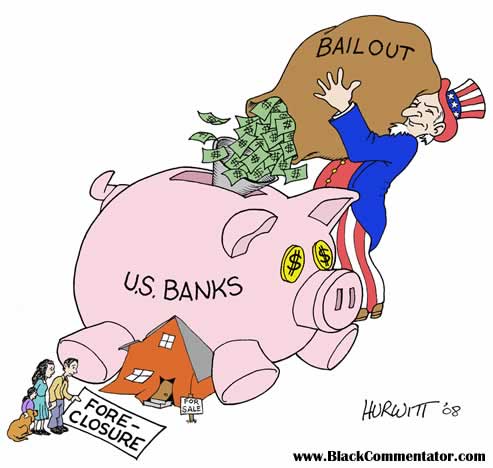

Today we have the super-boost of the TARP money being repaid by 9 banks, even as the US is so worried about the global economy that we are asking the EU to put more rigorous stress tests on their own banks as we don't feel that their economic outlook is pessimistic enough. No, don't ask me to explain the logic – there is none… Our man Timmy will be in Italy this week in a G8 Finance Minister meeting and, according to the Journal:

Today we have the super-boost of the TARP money being repaid by 9 banks, even as the US is so worried about the global economy that we are asking the EU to put more rigorous stress tests on their own banks as we don't feel that their economic outlook is pessimistic enough. No, don't ask me to explain the logic – there is none… Our man Timmy will be in Italy this week in a G8 Finance Minister meeting and, according to the Journal:

The U.S. has an ally in the International Monetary Fund, which on Monday warned that economic recovery in the euro zone could be retarded by banks burdened with bad assets. "To secure recovery and a return to self-sustaining growth, policy makers need to take further decisive action, especially in the financial sector," the IMF said in a report. Mr. Geithner could encounter resistance, however, from his European counterparts, many of whom argue that publicizing the weaknesses of individual banks increases the risk that they will fail.

Sounds great doesn't it? I wonder where we can invest in these banks? Oh that's right, we already have! Trillions of our dollars have been given to them already and today we will act like the return of $50Bn of it means everything is all better. The IMF estimated in April that European banks would need another $600 billion to cover losses and rebuild capital by the end of next year, NONE of which has been provided by the EU so far.

So we are determined to go with the flow, even though we do seem to be flowing up a pretty steep wall of worry at this point. We did take a short play on DIA into the close as well as July puts on XTO, which triggered a spread so we're not worried about them. QID was also a spread and we went long on COF by selling July puts. Aside from our on and off oil futures, we did go short on USO again at $37.50, so we'll see how that goes but we have our cover play ready there.

There was a real absence of volume yesterday, even into the super-stick save close, which let us pick up round 2 of our DIA $85 puts into the "rally" for just .55 as I called it almost on the button at 3:23 saying: "On the whole, no reason to get out of DIA puts, same play as this morning. DIA $85 puts topped out at $1.05 and just came in at our DD point at .72 and should be cheaper than that soon, but keep in mind that that makes .96 a 20% gain and we should be thrilled to get it." I don't know whether we'll get our 20% or if we'll be forced to get out this morning – without real volume I can't see how we break over the top but anything can happen as it took just 10% of a normal day's volume to goose the Dow 150 points into the close. If people are willing to throw that kind of cash in to save the market almost every day, who are we to argue?

Can we really talk ourselves into a good economy? My 7-year old daughter engages in thinking like, if it's too late to go to a movie she wants to see, she says: "Maybe there will be no traffic and no line because everybody already went in and sometimes they start the move late because of all the commercials and I don't mind if we miss the beginning and I really NEED to see it and I don't want to miss it and what if it's not there anymore next weekend?" Sound familiar? It's generally the bull premise for the economy – "If this and that and that and that happen and this and that doesn't happen (even though it is) then everything will be perfect so we should BUYBUYBUY now or we're going to miss it."

I'm no fool, I know better than to argue with a 7-year old or a runaway bull market so we'll just be getting in the car and heading to the theater, even though we're fairly certain it will all end in tears…