[For a free subscription to Phil’s Stock World, click here – it’s easy, no credit card required]

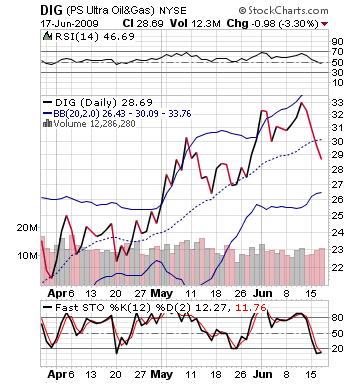

Pick: Ultra Proshares Oil and Gas ETF (DIG)

Courtesy of David at the Oxen Group

The Oxen Group, for Thursday, is optimistic to hope for a good day from the market. Too many red days even in a bearish trend, means a correction every few days. Tomorrow, futures are already up as investors may be getting excited about jobless claims, which have been bullish for the past few weeks. Additionally, Research in Motion will be releasing earnings that are expected to be very positive for the tech sector and TARP paybacks were successful.

The Oxen Group, for Thursday, is optimistic to hope for a good day from the market. Too many red days even in a bearish trend, means a correction every few days. Tomorrow, futures are already up as investors may be getting excited about jobless claims, which have been bullish for the past few weeks. Additionally, Research in Motion will be releasing earnings that are expected to be very positive for the tech sector and TARP paybacks were successful.

The market is due for a fundamental correction, as there are some bargains presenting themselves again. One of these is oil, oil service companies, and oil ETFs. After oil prices have slipped, with a late small gain today, oil may be ready for a move on Thursday. Gasoline wholesale prices have continued to slip, which is signalling a pullback in gas prices. Further, oil may get a boost from a very bullish Chinese inventory announcement that shows the Chinese economy is pumping again, helping to increase oil prices in the Asian market. We like Ultra Proshares Oil &Gas (DIG) to rally, with major holdings in Exxon and Chevron, which have both been hit with losses for the past four days. DIG has lost 13% in the past four days and moved down too quickly, presenting an opportunity for money to pour into the stock. If jobless claims are bullish and gas prices rescind, investors will push this stock up as inventories really did not get a chance to increase the oil market, which was a bullish indicator. Oil looks ready to rise, therefore, BUY DIG!

Entry: Recommend buying within first 10-25 minutes.

Exit: We recommend exiting after a 2-4% increase.

Upper Resistance: 30.50

David’s Oxen Trade Results:

| Date | Stock | Entry | Exit | %Change | |

| 5/29/2009 | GPS | 16.99 | 17.67 | 4.00% | |

| 5/30/2009 | TM | 80.77 | 81.72 | 1.18% | |

| 6/2/2009 | SRS | 18.06 | 18.6 | 3.00% | |

| 6/3/2009 | DUG | 16.68 | 17.35 | 4.00% | |

| 6/4/2009 | TLAB – SS | 5.95 | 5.84 | 2.00% | |

| 6/5/2009 | XOP | 35.84 | 35.85 | 0.00% | |

| 6/8/2009 | BLK | 164.76 | 168.87 | 2.50% | |

| 6/9/2009 | USD | 20.3 | 21.12 | 4.00% | |

| 6/10/2009 | SINA | 30.17 | 31.07 | 3.00% | |

| 6/11/2009 | SRS | 18.39 | 19.3 | 5.00% | |

| 6/12/2009 | NSM | 13.23 | 13.56 | 2.50% | |

| 6/15/2009 | ERY | 18.32 | 19.05 | 4.00% | |

| 6/16/2009 | SKF | 41.21 | 42.85 | 4.00% | |

| 6/17/2009 | SRS | 20.17 | 20.97 |