No change from yesterday.

No change from yesterday.

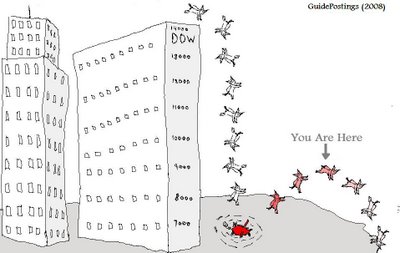

We're going to be watching the same bounce levels as we were yesterday and that was 8,370 on the Dow, which was the level I predicted we'd test in the morning post and was the day's high on the morning "rally" at 10:06, after which the Dow quickly dropped 80 points. Now, with the Dow finishing the day 16 points lower, we're going to need an even bigger boost just to hit our test zone (50 points). Pre-markets are up about half of that but that's a pretty poor response to the OECD raising China's GDP forecast to 7.7% from 6.3% and also raised it's global outlook for members to -4.1% from -4.3% and they expect a 0.7% increase in GDP in 2010.

Aside from the fact that -4.1% still sucks, keep in mind that the OECD is like the global Chamber of Commerce whose charter is: "To achieve the highest sustainable economic growth and employment and a rising standard of living in Member countries, while maintaining financial stability, and thus to contribute to the development of the world economy and to contribute to sound economic expansion in Member as well as nonmember countries in the process of economic development." In other words, this is like your local business council telling you it's a great time to come downtown and enjoy the fine holiday shopping – not exactly a leading economic indicator. Is the OECD fiddling while the World burns or are they really onto something? We'll get a better picture from the IMF, who give their mid-year forecast on July 7th as they actually wait for the half to end, rather than rushing out a statement to forestall a decaying trendline.

Even while I'm writing this (7:15) the futures are being jammed up like crazy and it looks like "THEY" don't want to risk a real test and are going to try to get a gap open above our resistance points. Aside from Dow 8,370, we'll be looking for S&P 900, Nasdaq 1,780, NYSE 5,800 and Russell 500. Failing those keeps us in a very serious downtrend and we still have to get past Durable Goods at 8:30, which are looking to be a bad number, probably down more than 1% from up 1.9% in April. Redbook Retal Sales for June are off 4.4% in the first 3 weeks, which doesn't include Wal-Mart but WMT doesn't sell many durable goods (as anyone buying their stuff can attest).

.gif)

At 10 am we have New Home Sales but, at 352,000 last month (for the year) – what's the point? Can they go lower? Can less than 19 homes a day be built in each state? Think about it – how many people can possibly be employed in construction when we're only building an average of 19 new homes a day in each state? There are 100M existing homes in this country and, even if they lasted an average of 300 years, you'd still need to replace 330,000 a year! The way they build homes these days, that's hardly a worry – so keep in mind this number is dead, dead, dead. We'll hear the spin from LEN tomorrow and KBH on Friday but figure there are 10 major builders and hundreds of local builders all fighting to sell those 19 homes a day in each state – hard to imagine a good report there, not to mention the price declines:

Oh yeah! Things are sure looking like we're right in the middle of a rebound aren't they? I'm sure tomorrow's 600,000 newly unemployed people will agree that it's got to be time to BUYBUYBUY (end sarcasm font). We also have Crude Inventories at 10:30 today and expectations are for a 1.3Mb draw in crude and a 1Mb build in gasoline and an 800Kb build in distillates but, if last week's big miss was any indication, this is a pipe dream by the oil bulls and we may have a lot less gas demand than they expected. Distillates may prove a problem too judging by the constantly downgraded airline outlooks. Planes that don't fly tend to use less fuel – logic that seems too complex for energy speculators to grasp.

Over in Asia this morning, the Hang Seng was up and up all day, rising 353 points (2%) and just coming back to test the former June support at 18,000. The Shanghai added 1% and seems like they never want to go down (or somebody doesn't want them going down anyway) and the Nikkie pulled a nice reversal after lunch and added 40 points for the day – still pathetic looking but impressive considering they are shaking off HORRIBLE export numbers. Japan's May exports fell 40.9% from last year, the 21st consecutive monthly decline and quite a bit worse than April's 39.1% drop. Thank goodness for China or things would have been much worse – exports to China "only" fell 29.7% – yes, let's count on that to turn the global economy around!

Over in Asia this morning, the Hang Seng was up and up all day, rising 353 points (2%) and just coming back to test the former June support at 18,000. The Shanghai added 1% and seems like they never want to go down (or somebody doesn't want them going down anyway) and the Nikkie pulled a nice reversal after lunch and added 40 points for the day – still pathetic looking but impressive considering they are shaking off HORRIBLE export numbers. Japan's May exports fell 40.9% from last year, the 21st consecutive monthly decline and quite a bit worse than April's 39.1% drop. Thank goodness for China or things would have been much worse – exports to China "only" fell 29.7% – yes, let's count on that to turn the global economy around!

Europe is also fighting off bad data as markets there are up across the board. The DAX is right at the top of it's "dead cat" line at 4,750 and the CAC can look a bit better than pathetic by getting over 3,280 while the FTSE still has a lot of work to do to get back over 4,280. Euro-Zone's service sector PMI came in at 44.5, well below the 45.8 expected by irrationally exuberant economists (above 50 is growth, below is contraction) and the composite PMI was 44.4 but that was, at least, an improvement from May's 44 reading. Still, this represents 13 consecutive months of contraction, the longest streak in 11 years of measurement and we're still a long way from neutral, let alone positive movement. The June data suggested that the rate of improvement lost considerable momentum toward the end of the quarter. "This is especially noticeable in services, where rising unemployment appears to have hit demand," said Chris Williamson, chief economist at Markit.

Wow, "rising unemployment appears to have hit demand," who would have ever though that could happen? The PMI figures suggest the recovery is likely to be gradual at best. "In fact, we expect the economy to be more or less flat for the next four quarters," said Dominic Bryant, an economist at BNP Paribas. "This is worse than the likely performance in the U.S. and U.K. and reflects the less aggressive action of policy makers in the euro zone in the areas of monetary policy, fiscal policy and banking-sector support." But Dominic is being too optimistic as the UK stimulus is NOT working (and whether the US stimulus is working remains to be seen).

8:30 update: Durable goods UP 1.8%, a massive beat of the down 1.1% expected and the futures are on fire, up about 1% across the board so we should open well above our bounce zones and now we only need to hold them for the day. Of course we still need to get past home sales and crude inventories and then there's the Fed at 2:15 but this number will put a positive spin on the incoming data so it will take surprisingly bad news to offset this. Since home sales are dead and not likely to get deader, it will be up to oil and that is very dollar dependent and the dollar is very Fed dependent so it's all about the finish today.

8:30 update: Durable goods UP 1.8%, a massive beat of the down 1.1% expected and the futures are on fire, up about 1% across the board so we should open well above our bounce zones and now we only need to hold them for the day. Of course we still need to get past home sales and crude inventories and then there's the Fed at 2:15 but this number will put a positive spin on the incoming data so it will take surprisingly bad news to offset this. Since home sales are dead and not likely to get deader, it will be up to oil and that is very dollar dependent and the dollar is very Fed dependent so it's all about the finish today.

Well maybe the OECD is right, you can pick apart the durable goods numbers but the bottom line is we just put in our second strong month there. We are neither bullish nor bearish at the moment, only cashish and we'll be happy to play the upside once we get past the Fed and tomorrow morning's final revision to Q1 GDP, expected to be down 5.7%. If we can shake that off as well as the usual massive job losses, we may be able to play the upside, using our dead cat levels as support lines.

A leading component of the durable goods report was aircraft orders up 68.1% so I'm going to make BA the play of the day, coming off their 10% drop on the Dreamliner delay. I don't mind that BA delays launching a plane until they are certain it is perfectly safe – quality control is a good thing when your product is meant to hold 300 people lives in its hands. If the competition (and there's only 1 real competitor) was able to steal the business, I might worry but the A380 and the 787 are very different designs and it's very unlikely a BA customer will switch rather than wait. There are several fun ways to play BA at the moment:

-

Selling naked July $42 puts for $1.23

- This gives you a net entry at $40.77 and we expect $40 to hold.

-

Buying August $38 calls for $6.95 and selling July $44 calls for $1.90

- That is a net entry of $5.05 on the $6 spread. You can buy the long calls naked first and hope to get a better selling price.

-

Buying Jan $35 calls for $10.60

- You have the same ability to sell the front-month calls but, on that play, you can afford to be patient as long as the markets hold up in general, hopefully selling covers when BA gets back to $50.