Courtesy of Jake at Economic Data

World Growth Projections Moved Markets? Nope

.jpg) I hate that the media needs to explain EVERY market move. And yesterday’s explanation was flat out ridiculous.

I hate that the media needs to explain EVERY market move. And yesterday’s explanation was flat out ridiculous.

Bloomberg of all sources reported:

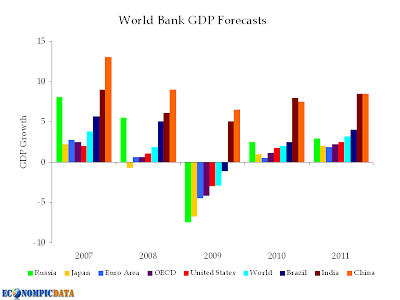

Stocks and commodities slid as the World Bank said unemployment and poverty will rise in developing nations and predicted a 2.9 percent contraction in the global economy this year. That compares with a prior estimate of a 1.7 percent decline. Growth is expected to return in 2010 at 2 percent, less than the 2.3 percent forecast about three months ago.

Here is the detail of the news that "moved the market" yesterday.

Cumulative forecasts for 2007-2011 is even more telling.

The World Bank’s forecast is that the United States economy will grow a total of 4% over the five years, a level which would historical take a bit over a year. And that news IS ugly, but did it really move the markets yesterday?

As I pointed out on June 11th (yes, 11 days ago) via Twitter:

World Bank sees global economy contracting 3% in 2009 (double the level thought 2 months ago)

Can I see the future? Actually no… I can just read the NY Times from June 11th (again, 11 friggin‘ days before yesterday’s sell-off).

Underscoring the risk that hopes for a quick turnaround anywhere may be premature, the World Bank said Thursday that it expected the global economy to shrink by nearly 3 percent in 2009, far deeper than the 1.7 percent contraction it predicted just over two months ago.

Why can’t the media just admit that markets don’t always (or usually) move due to specific daily events. Rather, the sell-off was likely just due to the fact that the equity markets have run up 40% in three months even though the economy is in serious trouble.

![]() Source: World Bank

Source: World Bank