Courtesy of David at Oxen Group

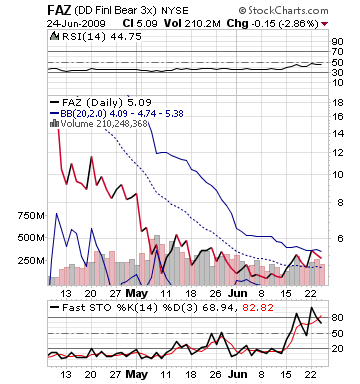

Buy Pick: FAZ

Tomorrow, the market looks bearish, in The Oxen Group’s opinions. Tomorrow, jobless claims will be coming out, which are supposed to be down 3,000 from last week, after they rose 3,000 last week. It just does not appear that will happen tomorrow, which will be a bearish indicator. Further, after the Fed report, the market gave up all earnings, making us believe that the market priced in gains earlier in the market and gave up earnings after that.

Tomorrow, the market looks bearish, in The Oxen Group’s opinions. Tomorrow, jobless claims will be coming out, which are supposed to be down 3,000 from last week, after they rose 3,000 last week. It just does not appear that will happen tomorrow, which will be a bearish indicator. Further, after the Fed report, the market gave up all earnings, making us believe that the market priced in gains earlier in the market and gave up earnings after that.

Futures are up an extremely high amount, but in after hours, we saw Nike and Monsanto report weak earnings. To make matters worse, GDP numbers come out tomorrow. Another signal of just how weak our economy is currently.

In the financial sector, Bank of America, one of FAZ’s holdings, will be headed into court tomorrow with the Fed under investigation. Not bullish for anyone! And, the Oracle of Omaha said he doesn’t see any "green shoots." With the market looking to make a move up and be pulled down, FAZ should be a solid pick up for a nice price and move up from there. The market will move down and give up any gains as the bearish market sets in. FAZ is a bit undervalued after some recent movement downwards, but the fundamentals of the finance sector are such that they should move down tomorrow. Slow stochastics are moving up, showing that the financial bear market looks to be moving up. The final bit of news that is bearish for the financials is that Chase is raising fees on transfers. Overall, however, the Fed rally will not last and with what we expect bearish news, FAZ should be a perfect inverse play.

Entry: 10-25 minutes

Exit: Recommend exiting after 2-4% increase.

Resistance: Upper 6.00