For a free subscription to Phil’s Stock World, click here (it’s easy, no credit card required).

A Study Suggesting Short-term Downside

Courtesy of Rob Hanna at Quantifiable Edges

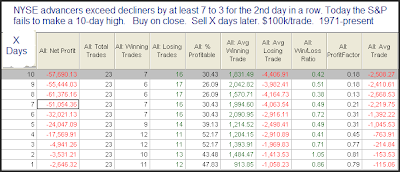

Below is a study that has been shown a few times in the Subscriber Letter. It popped up last night via the Quantifinder. It looks at what happens when two days of strong breadth fail to take the SPX to a new 10-day intraday high. I’ve re-run the stats and posted them below.

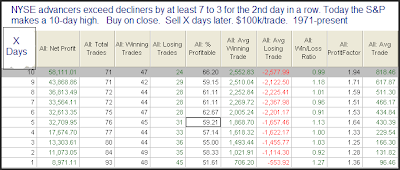

The failure to make a 10-day high after two strong up days suggests there was a strong move down prior to this. Most often the strong down move will reassert itself or at least cause a pullback. As a point of comparison, below are the numbers when the back-to-back the strength does coincide with a 10-day high:

Strong negative expectations turn positive under this scenario. I’ve shown before how positioning is important when interpreting action. This is another example of that.