This article by Karl Denninger helps explain Zero Hedge’s previous article on Goldman Sach’s principle trading unit and the ETF-underlying pair trades.

Market Gaming: Pressin’ Their Bets

Courtesy of Karl Denninger, The Market Ticker

Props to Zerohedge on tracking this:

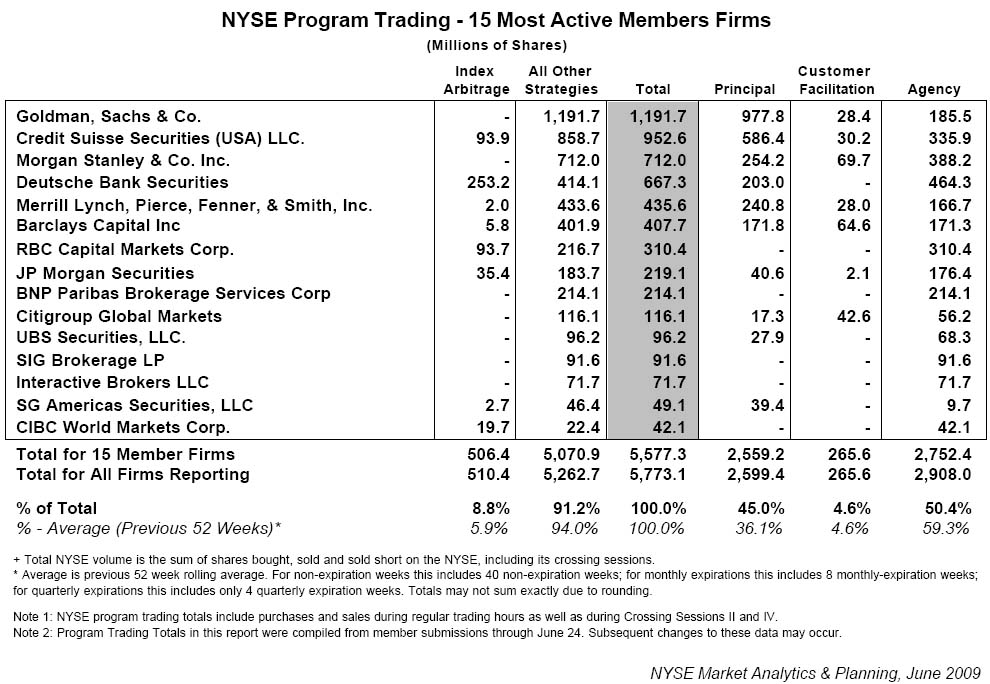

Just released NYSE data indicate a 50% ramp up by Goldman’s principal Program Trading unit. Whereas the prior week saw Goldman trading only 631 million principal shares on the NYSE, the most recent data indicate a massive rise to 977.8 million. Also notable is Credit Suisse’s doubling in principal program trades to 586 million from 245 million. Zero Hedge is compiling materials to demonstrate the phenomenal gamble CS is taking by being the largest holder of the ETF-underlying pair trade. The ensuing implosion, once the market loses the invisible futures bid, will likely destroy Switzerland’s second biggest bank and likely take down the country with it.

This is ridiculous.

Someone needs to start listening to Volcker, who has strongly promoted returning to the Glass-Steagall separation of commercial banking and trading activity.

Program trading is now up to 40.4% of all NYSE volume – approaching half.

For those who aren’t savvy in this stuff what’s going on here is a pair trade between the underlying instrument(s) and the ETFs on the exchanges. This is an arb play and it works until it doesn’t – for an example of "doesn’t" in the single-name world witness what happened to VW/Porsche earlier this year when the arb speculators on their merger got rammed, or those hedgies who were playing the Citibank preferred-conversion arb earlier this year.

These are allegedly "hedged" transactions in that there is an alleged unbreakable correlation that protects the person doing it from loss.

In truth there is no such thing as an unbreakable correlation and the alleged "protection" against getting reamed is illusory. This is the same sort of "genius trade" that was run with AIG’s CDS positions – remember the claim that "we’re unlikely to ever see a loss"?

How’d that work out?

Here’s the chart from Zerohedge (original source the NYSE itself; click for a larger version):

Someone has to get out in front of this and stop it before it blows up in everyone’s face and we have yet another round of "banking problems", this time among so-called "investment banks" that in fact are now commercial banks since they converted and thus have an "Uncle Sam" backstop.

This sort of principal trading is outrageous and in this sort of volume amounts to market manipulation writ large. Like all manipulation it can only work for a certain (but impossible to determine in advance) amount of time, and when it fails it will inflict ruinous losses on the participants in the scheme along with anyone inside the blast radius (which includes you if you happen to be long the markets when it comes apart!)

I have no problem with speculators pressing their bets. I have a major problem with them doing it with taxpayer money and backstops, where the inevitable losses that will come when, not if it blows up will not be their loss, it will be our loss.

CONGRESS MUST PUT A STOP TO THIS CRAP RIGHT NOW, SINCE OUR SO-CALLED "REGULATORS" ARE CLEARLY REFUSING TO DO SO!