The Oxen Group’s Pick: VIA – B

Courtesy of David at The Oxen Group

On Monday, to start the week, Viacom Inc.’s Class B (VIA-B) stock looks ready for a nice move. The stock should benefit from some fundamental and technical analysis. The market is in a sideways trend, currently, waiting for the Q2 earnings to be released to see where the market is at, and the market is no longer able to move on just about anything. Therefore, fundamental news will really make it for this market.

On Monday, to start the week, Viacom Inc.’s Class B (VIA-B) stock looks ready for a nice move. The stock should benefit from some fundamental and technical analysis. The market is in a sideways trend, currently, waiting for the Q2 earnings to be released to see where the market is at, and the market is no longer able to move on just about anything. Therefore, fundamental news will really make it for this market.

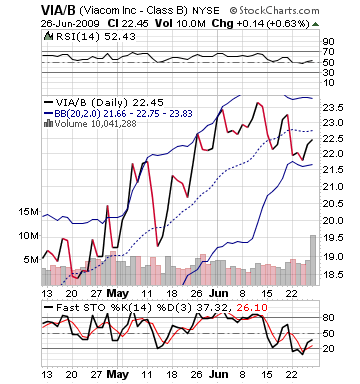

Viacom will benefit from the bullish news coming out from "Transformers: Revenge of the Fallen." The movie has been a box office smash, which was released by Paramount Pictures, a subsidiary of Viacom Inc. Transformers made $112 million this past weekend, winning the box office, becoming the top grossing movie thus far this year in the first weekend. Most analysts and studios were not expecting as outstanding results, and the movie is falling just short of "Dark Knight" last year. In just five days, Transformers II did 2/3 the total earnings of Transformers I, and it performed well besides weak reviews. The next closest movie, "The Proposal," only accrued $18.5 million. Technically, this news should send a shot into Viacom. The stock has been oversold, near its lower bollinger band, and it has been trending up on fast stochastics, meaning there are a lot of potential buyers ready to enter the stock.

Monday’s market is not looking bullish or bearish, with little fundamental news on the horizon and nothing too important as far as earnings. Asia is mirroring an expected sideways market that should play out in the USA. The last bit of positive news would be that this is the July 4th week, and this week tends to be bullish. Wait for a pullback on VIA.

Entry: 15-30 minutes in, after pullback

Exit: 2-4% increase from buy in

Resistance: 25.50 upper

Table of Results

| DATE | Stock | Entry | Exit | %Change |

| 5/29/2009 | GPS | 16.99 | 17.67 | 4.00% |

| 5/30/2009 | TM | 80.77 | 81.72 | 1.18% |

| 6/2/2009 | SRS | 18.06 | 18.6 | 3.00% |

| 6/3/2009 | DUG | 16.68 | 17.35 | 4.00% |

| 6/4/2009 | TLAB – SS | 5.95 | 5.84 | 2.00% |

| 6/5/2009 | XOP | 35.84 | 35.85 | 0.00% |

| 6/8/2009 | BLK | 164.76 | 168.87 | 2.50% |

| 6/9/2009 | USD | 20.3 | 21.12 | 4.00% |

| 6/10/2009 | SINA | 30.17 | 31.07 | 3.00% |

| 6/11/2009 | SRS | 18.39 | 19.3 | 5.00% |

| 6/12/2009 | NSM | 13.23 | 13.56 | 2.50% |

| 6/15/2009 | ERY | 18.32 | 19.05 | 4.00% |

| 6/16/2009 | SKF | 41.21 | 42.85 | 4.00% |

| 6/17/2009 | SRS | 20.17 | 20.97 | 3.90% |

| 6/18/2009 | DIG | 28.36 | 29.21 | 3.00% |

| 6/19/2009 | RGR | 11.88 | 12.35 | 4.00% |

| 6/22/2009 | TYH | 86.42 | 81.85 | -5.28% |

| 6/23/2009 | ADI | 23.32 | 23.34 | 0.01% |

| 6/24/2009 | SONC | 9.26 | 9.63 | 4% |

| 6/24/2009 | FAZ | 5.13 | 4.93 | -4.00% |