Trader Mark comments on a few solar power companies, noting that they’re inadequately differentiated by American investors. Here are his thoughts.

Analyst: Yingli Green Energy (YGE) and Trina Solar (TSL) Expected to Take Market Share from US/Euro Solar Makers

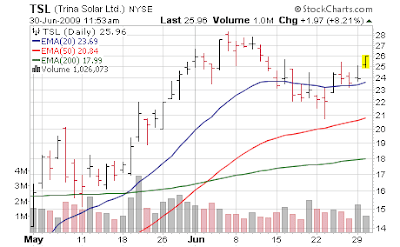

Courtesy of Trader Mark at Fund My Mutual Fund

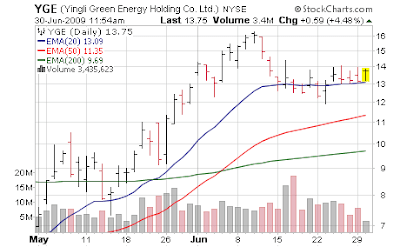

Courtesy of Trader Mark at Fund My Mutual Fund

I’ve been a long time investor in the solar space (circa late 06) and one thing that has really irked me over the years is the complete lack of differentiation. Much like the market as a whole nowadays, its "all or nothing" in this space. The one exception has been First Solar (FSLR) – an American "thin film" (different technology than most solar companies) producer. The Chinese names have especially all been thrown together in one pot and when its time to run up solar, they all go up together (in varying degrees) and when solar is out of favor they all get pole axed. Hence doing any due diligence is really a waste of time.

Yingli Green Energy (YGE) and a company that has cost me many real (and virtual) dollars over the years, Trina Solar (TSL) are 2 of the Chinese solar markets with good size, and the most integrated production models. This should have differentiated them over the years – but as I said above, not in American investors eyes. We like "big easy to understand, sweeping themes" – i.e. oil up, solar good. And that’s as comprehensive as it seems to get.

We are seeing some nice action in both these names today, on the back of an analyst report which is alluding to the advantages the two companies have. Now that silicon (which is the main cost component on the material side) has swooned after bottlenecks plagued the industry for 3+ years, the other main cost is labor. And you are not going to compete with the Chinese on labor costs…

- Both Trina Solar (TSL) and Yingli Green Energy (YGE) shares are trading higher today following upgrades by Morgan Stanley analyst Sunil Gupta. He thinks both companies are going to take market

share in the solar sector from U.S.-based and European rivals. Here are the details - Trina: Rating to Overweight from Underweight. Target to $37 from $7.30. The reasons for the more bullish stance: an expected industry inflection next year, Trina’s position as a low-cost producer, “and hence its potential to gain market share at the expense of high cost EU and U.S. producers.” He sees TSL driven by “high volume growth, low-to-moderate margins and relatively good working capital management.”

- Yingli: Rating to Equal Weight from Underweight, Target to $16.30 from $3.10. Gupta writes that is new stance on the stock is based on “easier domestic credit and capital market conditions, which have eliminated financial survival risk, opening up of the domestic China market and prospects of a gain in global market share.” He thinks Yingli, like Trina, will take share from the U.S. and European players due to cost advantages. That said, he thinks the stock’s valuation is “reasonable, but not compelling.”

This is a fair analysis as Trina seemingly always trades at a permanent discount to many peers for reasons I’ve never understood (granted management has not been the best in terms of communication with the Street) TSL was once our largest position due to that fact – but we still lost buckets of money as the market simply could care less about relative valuations.

All in all, nothing "new" is here in terms of the analysts reasoning other than the "industry inflection" point thesis – otherwise, these are all the same reasons to buy these 2 companies as we had 3 months, 6 months, 12 months, or 18 months ago. But my main hope is the market begins to weigh winners and losers and not throw every Tom, Dick, and Harry solar stock in the same space as those with competitive advantages. If we reach that point, than I’ll know it is not just a few hedge funds and daytraders who dominate this space.

All in all, nothing "new" is here in terms of the analysts reasoning other than the "industry inflection" point thesis – otherwise, these are all the same reasons to buy these 2 companies as we had 3 months, 6 months, 12 months, or 18 months ago. But my main hope is the market begins to weigh winners and losers and not throw every Tom, Dick, and Harry solar stock in the same space as those with competitive advantages. If we reach that point, than I’ll know it is not just a few hedge funds and daytraders who dominate this space.

As an aside, if you are not familiar with the dizzying array of companies in the Chinese solar space – Suntech Power (STP) is the largest in the group, and will also be an ultimate survivor in what I expect to be cutthroat competition even as the overall space grows in the years ahead.

Ironically, First Solar (the mutual funds favorite) – at the same time, is weakening in quite startling fashion. [May 26, 2009: Analyst – Some Analysts Switching Away from First Solar]

Long Yingli Green Energy in fund and personal account