GM Blames Bankruptcy, Trade-In Programs, Man in the Moon for Latest Miss

Courtesy of Mish

Courtesy of MishGM and Toyota Missed again. As usual GM has an array of excuses although admittedly not the man in the moon, at least not yet. Please consider U.S. Auto Sales Slide as GM, Toyota Miss Estimates.

U.S. auto sales in June again failed to reach a 10 million annual pace as General Motors Corp. and Toyota Motor Corp. fell short of analyst estimates, suggesting that the industry hasn’t started to rebound yet.

The annual rate fell to 9.69 million cars and light trucks last month, from 9.9 million in May and 13.7 million in June 2008, Autodata Corp. said. Total sales fell 28 percent, to 859,847 vehicles, the 20th straight monthly decline, the Woodcliff Lake, New Jersey-based company said.

Analysts surveyed by Bloomberg had projected that the annual pace for June would climb above 10 million for the first time this year. GM blamed its worse-than-expected results on a new U.S. program to spur trade-ins of older vehicles, saying that kept some buyers on the sidelines. The company said its June 1 bankruptcy filing also scared off some customers.

Sales dropped 42 percent from a year earlier at Chrysler, 34 percent at GM and 32 percent at Toyota. Chrysler, which exited bankruptcy during June, cited an end to most sales to fleet customers such as rental companies for its drop.

Traffic ‘Fell Off’

“Traffic definitely fell off during the last 10 days of the month,” said David Fischer, owner of 30 auto franchises, mostly in Michigan and Florida. “In my opinion, it was because of consumers waiting to understand the cash-for-clunkers law.”

Ford’s deliveries fell 11 percent last month, according to a statement today from the Dearborn, Michigan-based company. The declines were 23 percent for Nissan and 30 percent for Honda.

The sales decline for this year’s first six months was the worst since at least 1976, according to Bloomberg data.

Tight credit is still holding down sales and may reduce the annual total by as many as 2 million vehicles, GM’s DiGiovanni said. “There’s no question credit is hurting our market.”

Ford, passed by Toyota in annual U.S. sales in 2007, outsold the Toyota City-based company for the third month in a row and leads the Japanese automaker for this year’s first half.

Ford’s total sales fell to 155,195 vehicles from 174,091 a year earlier. Sales of its cars declined 17 percent in June, while the Fusion mid-size sedan had a 26 percent gain. Mustang sales were down 30 percent and F-Series pickup trucks, Ford’s biggest seller, fell 7.4 percent.

Consumer confidence is still the biggest hurdle to auto sales, Toyota U.S. Vice President Bob Carter said on a conference call.

Consumer Confidence Survey

Inquiring minds are digging into the Consumer Confidence Survey™ Press Release to see if Toyota’s Claim can be justified.

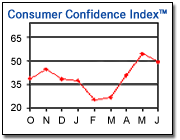

The chart shows that Consumer Confidence has actually been on a tear since March although there was a slight dip in June. However most of the improvement is in expectations rather than "present conditions" which fell to 24.8. Those saying jobs are "plentiful" decreased to 4.5 percent from 5.8 percent according to the survey.

Present conditions are unlikely to improve until jobs do, and jobs are unlikely to improve for quite some time.

Inventory Clearing

Any substantial increase in auto sales (if and when it comes) will probably be in clearing 2009 models at huge losses, and at the expense of 2010 sales and pricing power. Consumers want bargains, and bargains they will get.

At some point GM sales will rebound and when it happens expect to see hoopla, fireworks, and a lot of misguided credit taking for turning the corner to profitability. However, the fact remains, US taxpayers are never going to be repaid for their "investment" in GM.