What to Buy: ERX/ERY

Courtesy of David at The Oxen Group

On Thursday, The Oxen Group wants to approach the Oxen Buy Pick a little differently. A pattern we are noticing is that economic data is moving this market no matter what other fundamentals and technicals may be out there. Tomorrow, the day will be ruled by unemployment figures coming out from the Labor Department. The estimated number is 9.6%. If we hit that or are below, then the market is going green. If not, we are going red the whole day. It all depends on that 9:30 AM announcement.

On Thursday, The Oxen Group wants to approach the Oxen Buy Pick a little differently. A pattern we are noticing is that economic data is moving this market no matter what other fundamentals and technicals may be out there. Tomorrow, the day will be ruled by unemployment figures coming out from the Labor Department. The estimated number is 9.6%. If we hit that or are below, then the market is going green. If not, we are going red the whole day. It all depends on that 9:30 AM announcement.

The oil market, as well, will move with this announcement. It is hard to predict which way it will swing. If we were betting, we would say a miss higher and into the red. But its impossible to know for sure. Therefore, if it misses and it is higher you want to buy Direxion Daily Energy Bear ETF (ERY). This ETF is inverse energy and gas stocks and will benefit by the increase in joblessness, as that means less demand for oil and gas.

On the other hand, less unemployment than expected should be a catalyst for the market with Direxion Daily Energy Bull ETF (ERX). [ERX and ERY] are 3x ETFs and will have some serious movement. We know that the oil market depends on this as Asian oil prices had no movement whatsoever. Analysts believe the unemployment rate lingered over the market. If unemployment is lower than expected, buy ERX. If unemployment is higher than expected, buy ERY. We believe getting into the stock as quickly as possible is good. Check back between 9:30 AM – 10:00 AM to see what we chose.

Entry: Recommend buying within first 15 – 30 minutes if ERX, first 15 minutes if ERY.

Update: Buying ERY

David bought ERY – the update was posted at Oxen Trades.

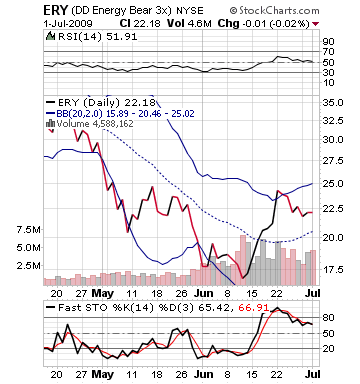

…The estimated number was 9.6%. We did beat that, but everyone right out the bat is much more concerned with the nonfarm payrolls, which showed that 467,000 jobs were cut when only 375,000 were expected. That is a huge miss and is far more telling tan the 9.5% unemployment rate. Therefore, ERY is jumping up out of the gate. Buy in right at the start of the market like we had suggested last night. This thing will move up, trade sideways, and then continue to trend up. Additionally, the initial jobless claims were higher than expected, also adding fuel to the fire. ERY is neutral on RSI and the middle of its stochastic ranges, which means that with the positive news it will add a lot of sellers, about the same as buyers, which is why you want to get in as earlier. If it moves very high, we should start to see heavy resistance as the stock moves towards 25 points. The oil market is going to continue struggle throughout the day on this news, which severely threatens the oil markets.

Entry: Recommend buying within first 15 minutes.

Exit: We recommend exiting after a 3-5% increase.

Stop Loss: We recommend a 3% stop loss on all buy in prices