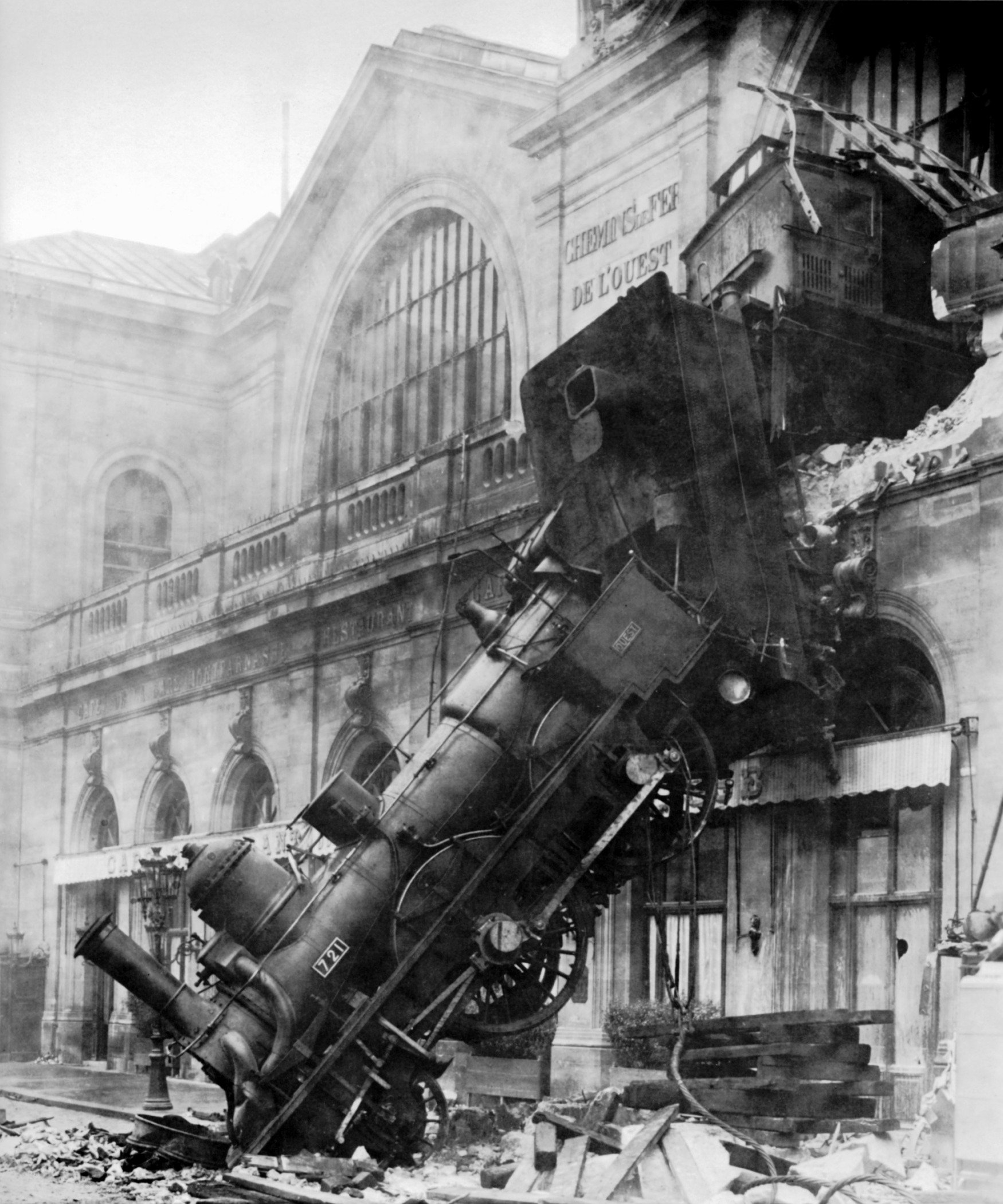

America’s Fiscal Train Wreck

Courtesy of Edward Harrison at Credit Writedowns

Courtesy of Edward Harrison at Credit Writedowns

I think a technical recovery will happen in the Q4 to Q1 timeframe. But this recovery is likely to be weak, if it happens at all. Downside risk remains. Unfortunately, the Obama administration has fired all its bullets, spending huge political capital bailing out the big banks and putting together a weak stimulus package we all knew was going to fail.

Now, Joe Biden is trying to save face, talking as if recovery is guaranteed and no further stimulus is necessary. Yet, on the eve of the G-8 summit, it takes Gordon Brown to remind us that the Great Depression II meme is still at play. If the United States wants to keep deflationary forces at bay, it will need to support the economy with fiscal stimulus.

that the Great Depression II meme is still at play. If the United States wants to keep deflationary forces at bay, it will need to support the economy with fiscal stimulus.

The problem is the U.S. government budget deficit. In April, in a post called “The Cult of Zero Imbalances,” Marshall Auerback made the case for stimulus, aware of the downside risks for the dollar and bond prices because of that deficit. Yes, there are risks for America associated with deficit-inducing stimulus in the short-term, but they can be mitigated if the Obama Administration actually showed a plan to reduce the longer-term deficit. But, as David Leonhardt has argued, Obama’s team has no deficit reduction plan whatsoever.

So now we must contemplate America’s fiscal train wreck; and that is exactly what Richard Berner at Morgan Stanley is doing. Here is an excerpt of his research note published today.

America’s long-awaited fiscal train wreck is now underway. Depending on policy actions taken now and over the next few years, federal deficits will likely average as much as 6% of GDP through 2019, contributing to a jump in debt held by the public to as high as 82% of GDP by then – a doubling over the next decade. Worse, barring aggressive policy actions, deficits and debt will rise even more sharply thereafter as entitlement spending accelerates relative to GDP. Keeping entitlement promises would require unsustainable borrowing, taxes or both, severely testing the credibility of our policies and hurting our long-term ability to finance investment and sustain growth. And soaring debt will force up real interest rates, reducing capital and productivity and boosting debt service. Not only will those factors steadily lower our standard of living, but they will imperil economic and financial stability.

Later in his missive, Berner, rightly admits that economists warning about deficit spending in America have been singing this tune for quite some time. And, as with he boy who cried wolf, no one believes them any longer. No less than former U.S. Vice President Dick Cheney said “deficits don’t matter.”

Well, they do matter. Eventually, the day of reckoning will come. Berner puts it this way.

Some are concerned that our reckless fiscal policy will trigger a downgrade of the US sovereign debt rating, making the financing of our burgeoning deficits more difficult. While worries that the US will default on its debt are illogical, global investors and officials are concerned about the credibility and the sustainability of our fiscal policies. So am I. They fear that we will adopt policies that will undermine the dollar and the domestic value of dollar-denominated assets through a combination of risk premiums and inflation. I worry about that too, although such policies probably would be accidental rather than deliberate. As a result, interest rates may have to rise significantly to compensate investors, including reserve portfolio managers and sovereign wealth funds, for such dangers. While the dollar will for now retain its reserve-currency status, such concerns put it at risk.

Definitely read his piece which is linked below. He does an excellent job of demonstrating that healthcare is a large part of the problem and sounding the alarm for fixing it once and for all.

Source

America’s Fiscal Train Wreck – Dick Berner, Morgan Stanley

Photo: Train wreck at Montparnasse Station, Paris, France, 1895. Wikipedia.