What a difference a week makes!

What a difference a week makes!

Just a week ago, I was apologetic for being so bearish on the markets. People were complaining that the writers at PSW were "too negative" and that we were out of step with the MSM, who saw nothing but "green shoots" under every economic rock. On June 28th, I wrote an article comparing the US consumer to the NY Yankees as a way of explaining how the analysts can be so wrong in their expectations for a recovery. I pointed out that, although they are the winningest team in baseball history, I can still remember a 10-year dry spell from 1965-1975, saying: "Like the US consumer, you come to EXPECT the Yankees to be in contention and you may make your bets that way out of habit, but that storied history of performance is NOT going to stop you from hitting a 10-year losing streak is it?"

Like the Yankees, the media EXPECTS the US consumer to win. After so many consecutive years of stuffing our faces and shopping until we drop, the global media simply refuses to believe that the US consumer can do anything more than stumble slightly before getting right back on the horse and refinancing or whatever it takes to get out there and start charging once again. As the US consumer makes up 70% of our economy, it’s no wonder all the sentiment polls think prosperity is just around the corner because everyone believes the US consumer is simply resting. The homebuilders telll us things will rebound, the manufacturers tell us things will rebound and the companies reporting earnings, who are "beating" expectations by only doing 35% worse than last year, are all giving us sunny outlooks as well because the US consumer is coming to save us all.

Isn't it amazing how, just 7 days later, the media has suddenly gotten on a totally different bandwagon? Just as a crowd turns on a star ballplayer who strikes out in a clutch situation, the MSM has turned sour on the US economy and has changed their outlook on the US consumer from "resilient" to "dead" overnight. While extremism grabs a lot of headlines, sometimes the truth can be found in the very dull places between the labels. I have long pointed out (some may say ranted) that commodity prices were unjustifiably high and were jeopardizing the recovery by pulling money out of the pockets of already-nervous consumers and pulling disposable income away from job-creating industries in favor of imported necessities like food and fuel.

This is no way to grow an economy and hopefully this little stumble will gain a few converts who will join us in cracking down on the thievery practiced by Goldman Sachs and their ICE partners as well as other commodity pushers who are willing to squeeze the industrialized addicts to death in order to extract the last dimes from a dying global economy. Thanks to Matt Taibbi's article in Rolling Stone, some very uncomfortable light is being shined on Goldman Sachs and the rest of what Matt calls "The Wall Street Bubble Mafia" that has been systematically dismantling the American middle class ever since they accidentally made wealth gains during the Kennedy/Johnson era.

This is no way to grow an economy and hopefully this little stumble will gain a few converts who will join us in cracking down on the thievery practiced by Goldman Sachs and their ICE partners as well as other commodity pushers who are willing to squeeze the industrialized addicts to death in order to extract the last dimes from a dying global economy. Thanks to Matt Taibbi's article in Rolling Stone, some very uncomfortable light is being shined on Goldman Sachs and the rest of what Matt calls "The Wall Street Bubble Mafia" that has been systematically dismantling the American middle class ever since they accidentally made wealth gains during the Kennedy/Johnson era.

Way back in September of 2006, I noted the way Goldman was stirring the commodity pot, saying: "This is the kind of out-of-control commodity spending that took down Amaranth, only it’s happening in slow motion at the investment houses." That bubble took an additional 12 months to pop, but the rapid rise in commodities in the first half of the year is now leading to an accelerated deflation on the other side. Oil plunged all the way to $63.50 in pre-market trading, down $10 in 7 days and erasing 25% of the year's run-up. Don't blame the dollar – it's barely moved and will cause the commodity bulls a world of hurt if it does begin to recover but there was a tremendous amount of posturing this weekend from the BRIC countries aimed at holding the dollar in check along with a Bloomberg featured article calling the dollar "the world’s biggest Ponzi scheme."

According to Bloomberg: "The dollar isn’t crashing because those invested in it are propping it up and adding to their holdings. After all, the magnitude of Asia’s foreign-exchange holdings means it can’t dump the dollar without shooting its economies in the foot." Again, it's nice to see the MSM catch up with me over 2 years later as, in my Dec 2006 article "Burn Dollars to Fight Gravity," I said:

That’s where the old Roach Motel Theory kicks in – not as it applies to oil, but as it applies to dollars. The Chinese have a Trillion US dollars! While they may threaten to diversify them into something more stable Mr. Paulson is going to point out to them that they are not the only roach in the motel.

Japan also has a Trillion of our dollars, we send them more every time we buy a Toyota but the biggest joke of them all is that we’ve been shipping these ever devaluing dollars to OPEC and every other oil producing country at the rate of $165Bn a month (what, did you think Jihads just fund themselves?). Oil is traded in dollars, people who want to sell oil must accept dollars, people who want to buy oil need dollars to buy it…

Ha ha! So the devaluing US dollar will hurt China, Europe (the least), OPEC AND every one of that top 10% of the world’s richest people who have 85% of the dollars that are floating around. I challenge you to find a government, no matter how communist, that can afford to ignore them! So, we will keep printing dollars and China will keep buying them, as will everyone else.

So kudos to Bloomberg for catching up and let's keep in mind that the dollar has been pronounced dead over and over again in the 30 months since I wrote that article but, here we are, holding the line at 80 once again – with oil at the same $62 it was then and gold clearly the 2-year outperformer, up 45% from $650 at the time. Is oil too low or is gold too high? That's going to be a key indicator for us to watch this summer and the movement of oil, gold and the dollar will be a lot more important over the next 30 days than all the earnings reports we are likely to hear.

As I said in the Weekend Wrap-Up, there is nothing "new" happening here, this is all the same old stuff we've been observing for two years now. It's only "news" to the sheeple who get their market information from the talking heads on corporate news and are whipped from one frenzy to another as the focus studies tell the media whether to focus on a bull or bear market this week. While investor sentiment is important and something we keep a close eye on, we also follow these obscure things called fundamentals and make intelligent (hopefully) investing decisions that are often going against the grain of the crowd. While we remain mainly in cash, this downturn is a buying opportuntiy and we expect at least an interim bottom to be put in this morning as we test the lows I predicted in Thursday morning's post, which were: Dow 8,250, S&P 888, Nasdaq 1,750, NYSE 5,700 and Russell 488.

To the extent that commodity stocks lead the downturn I will be less concerned as we WANT to see money coming out of that sector and moving towards deserving earnings winners. Let's start playing the great game of corporate survivor and see who comes out on top with real earnings data, rather than speculation.

Speaking of speculation – the Shanghai Composite was STILL up today, gaining another 1.2% but was well against the grain in Asia as the Nikkei fell 1.4%, the Hang Seng dropped 1.2% and the Bombay Sensex dropped 6.2% as the Indian government projected the largest budget deficit in 18 years, consuming 6.8% of the GDP – still far better off than the US but — shhhhhh! "Those of the view that the budget would encompass all sorts of exciting structural economic reforms have just had their hopes firmly dashed," said Robert Prior-Wandesforde, an economist at HSBC. "Instead this was largely a populist budget focussed mainly on the poor with plenty of promises of additional infrastructure spending." Meanwhile China is suffering floods and riots this weekend and those two are supposed to be the "hopeful" countries that will drive global growth!

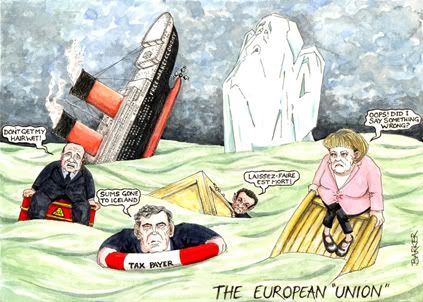

Europe is down about 1.5% ahead of the US open (8:30) but led down by commodity pushers is not a bad thing if the broader markets can hold the line. Indexes are generally back to April highs and not holding this level will look pretty ugly. From a technical standpoint, if Europe can't bounce back over the 200 dmas by Wednesday, we'll be looking at a very ugly pattern that can quickly drop us back 10% to the April lows. For the FTSE, we need to hold 4,182 with 4,231 as the 200 dma. The DAX needs to hold the line at 4,591 with the 200 dma at 4,674 and the CAC is in the worst shape, right on the breakdown line of 3,126 and well below the 200 dma at 3,174. If we lose the European indexes, the US is sure to follow so we'll be doing a lot of level-watching for the first few days of the week.

Europe is down about 1.5% ahead of the US open (8:30) but led down by commodity pushers is not a bad thing if the broader markets can hold the line. Indexes are generally back to April highs and not holding this level will look pretty ugly. From a technical standpoint, if Europe can't bounce back over the 200 dmas by Wednesday, we'll be looking at a very ugly pattern that can quickly drop us back 10% to the April lows. For the FTSE, we need to hold 4,182 with 4,231 as the 200 dma. The DAX needs to hold the line at 4,591 with the 200 dma at 4,674 and the CAC is in the worst shape, right on the breakdown line of 3,126 and well below the 200 dma at 3,174. If we lose the European indexes, the US is sure to follow so we'll be doing a lot of level-watching for the first few days of the week.

We'll be watching our sectors this morning and keeping an eye on the 10 am ISM Service Report for June as we need to make an improvement over May's reading of 44 (with anything under 50 showing contraction). There is NO data at all tomorrow and Wednesday we get Consumer Credit in the afternoon with Wholesale Inventories on Thursday and Trade Data with the Michigan Consumer Sentiment Survey on Friday. All in all, a light data week and earnings officially kick off with AA on Wednesday but the real action doesn't begin until next Tuesday, when our friends at GS report in the morning along with JNJ and MTB, followed by INTC and YUM Tuesday night.

We're going to be playing earnings with a $5,000 stake and we'll be running through a variety of option trading strategies to see if we can profit from the volatility. Our first play will be made on AA, ahead of their Wednesday evening report so make sure you are signed up for a trial report membership as not everything will be published in the morning posts. Hopefully we'll put in a bottom this morning and recover well enought that the EU markets hold their levels, then everyone can take a breath and we'll have a proper test on Tuesday as everyone gets back to work after the long weekend.