Green Shoots at Family Dollar (FDO)

TraderMark at Fund My Mutual Fund

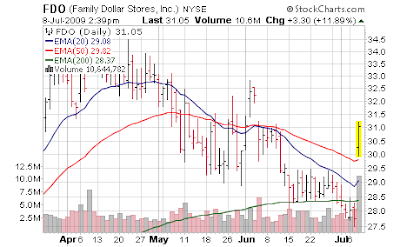

No slowdown in dollar stores as Americans on Main Street are wrecked by the Great Recession. Family Dollar (FDO) just reported a very nice set of numbers – obviously the Street was under the impression the recession is over judging from the stock the past 2 months. Actually broke down below the 200 day moving average as of the last week.

Despite Wall Street’s protestations (and Dennis Kneale’s), Americans remain stuck in the Walmart section of retail, not Target [Dec 26 2007: Target Shoppers Turning into Walmart Shoppers] Remember, since I’ve started this blog not 2 years ago the % of Americans on food stamps has jumped from 1 in 11, to 1 in 9. [Jun 8, 2009: 1 in 9 Americans on Food Stamps] This appears to be helping Family Dollar which unlike most "dollar stores" has food items as well.

The gross margin expansion is mighty impressive – especially for a retailer; the same store sales growth in this retail environment is simply a damning indictment of how bad off more and more Americans are becoming. I continue to conclude "The Street" does not get what is going on out there in everyday America.

Via CBSMarketwatch

Via CBSMarketwatch

- Discount retailer Family Dollar Stores Inc. said Wednesday that its fiscal third-quarter profit rose a better-than-expected 36%, aided by budget-conscious consumers seeking bargains on food and other consumables and improved home goods and apparel discretionary sales.

- Net income rose to $87.7 million, or 62 cents a share, from $64.7 million, or 46 cents, a year earlier. Analysts, on average, estimated the company would earn 59 cents a share, according to FactSet.

- Sales in the quarter ended May 30 rose 8.3% to $1.84 billion, the 6,600-store chain said. Comparable-store sales climbed 6.2%, helped by increased customer traffic and the higher amount customers spent per transaction.

- Family Dollar forecast sales for the fourth quarter to rise between 4% and 6% with comparable sales increasing as much as 4%. Per-share profit is expected to rise to 39 cents to 43 cents a share from 38 cents a year earlier. Analysts surveyed by FactSet expected profit of 39 cents a share.

- Family Dollar’s gross margin, or percentage of sales after minus the cost of goods sold, widened to 36.2% from 34.6% partly after the company lowered freight expenses and cut inventory loss or theft. Analyst Michael Baker of Deutsche Bank said the increase was the company’s biggest since 1991.

- Chief Executive Howard Levine is updating the company’s technology chain-wide to allow it to accept credit cards and food stamps, which he said were increasingly used by U.S. households. He also has expanded the retailer’s food assortment as consumers focused more on basic items. The number of households who rely on food stamps to supplement their income grew to an estimated 15 million households as of March, compared with approximately 19% a year earlier, he said.

- To help the company keep the new middle-income shoppers it has attracted in the economic downturn, Family Dollar also is adding signs in stores and making other improvements to make shopping at its stores a better experience, he said.