Used car prices are going up – is this a sign of recovery and inflation or a complicated symptom of a deflationary environment? This debate illustrates, perhaps, why the same economic data can be interpreted in opposite manners by intelligent people. – Ilene

Used Cars and the Inflation / Deflation Tug of War

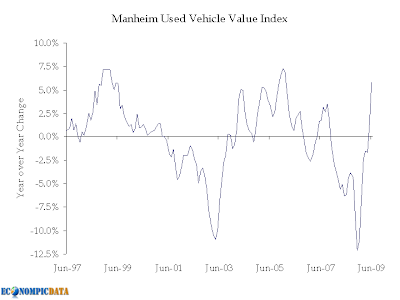

Courtesy of Jake at Econompic Data

Scott Grannis, of the blog California Beach Pundit, is quickly becoming my new favorite blogger to disagree with because he:

- Provides intriguing data

- Has a strong opinion

- Supports his opinion well

- These opinions run counter (in almost every case) to mine

In general he believes in the recovery and inflation, whereas I don’t and believe deflation is a real possibility.

One example was yesterday’s post regarding ISM Prices. In his view, the jump in ISM prices (by jump I mean they finally didn’t fall month over month) means deflation is no longer a threat. On the other hand, I believe that may be a result of the temporary jump we saw in commodities. He continues his ‘don’t worry about deflation’ message with yesterday’s post that (again) gave me the exact OPPOSITE initial reaction. Here goes:

According to Manheim Consulting, used vehicle prices jumped 16.4% in the first half of 2009 on a seasonally adjusted basis. Once more we are reminded that a weak economy and rising unemployment do not necessarily create deflationary conditions.

In other words, an increase in the price of used cars (off a large previous fall) proves that deflation is no longer an issue and we should (if anything) worry about inflation.

He adds:

I think the rise in prices also has something to do with the return of money velocity. Consumers retrenched violently in the fourth quarter of last year, hoarding cash and repaying debt in the face of tremendous uncertainty. Money velocity collapsed. Now that confidence is returning, money is getting spent again. The economy is recovering some of the ground it lost.

Using what I refer to as the logic test, this makes no sense. If people are trading down (i.e. increasing demand for a cheaper / used good) this has deflation written all over it (not necessarily for that good, but for the broader economy). My logic and posted in his comments section was:

If used cars are substituted for new car purchases AND used cars tend to be significantly cheaper than new cars AND less people are employed when people drive cars longer only to buy the next used, rather than new… wouldn’t this be deflationary?

Terrible English by me? Yes. Regardless… his reply (the dynamic power of blogs):

You seem to be arguing that if people spend less on cars (buying used instead of new) that would be deflationary. It would be deflationary if car prices in general fell as a result of less demand for cars. But since used car prices are rising and the BLS reports that new car prices are also rising this year, then consumer’s desire to spend less on cars is not deflationary, at least in the current climate.

Good point, except that according to the BLS they haven’t risen despite the fact that BLS methodology does not take into account promotional financing to determine price levels. This means if there are financing deals, rather than discounts, to attract customers (results in the same lower monthly present value of the car) then the BLS will not reflect that until the figures are revised at a later date. Interestingly enough, the BLS shows a MASSIVE decline in used car prices.

What gives? Well, the BLS details (bold mine):

Although the CPI uses the N.A.D.A. Official Used Car Guide to obtain prices, other sources are available. The two most commonly used sources are the Kelley Blue Book and the Black Book . Information on trends in used car and truck prices can be obtained from several other sources.

Manheim Auto Auctions constructs a price index based on sales at their auctions. These are wholesale auto auctions only open to professional buyers. Manheim runs a chain of these auctions and has thousands of vehicles to use as source data. They do not do adjustments for depreciation or quality changes. The index comes out monthly.

In other words, Manheim can be thought of as a leading indicator for used car market prices as this index involves the professional buyers filling inventory to sell to the final consumer. Assuming they can pass these higher costs through, the question remains; what does this increased price level indicate?

While Scott did touch upon supply briefly, it turns out the MAJOR cause for a "jump" in prices (a jump which only brough used car prices back 1997 levels) is the lack of supply, not new demand.

Auto News details:

"Dealers need used-vehicle inventory and are not getting it as much through trade-ins due to still-low new-vehicle sales," Kontos said.

Webb said that total auction volume was down more than 5 percent through June compared with the year-earlier period. In all of 2008, the industry sold 9.24 million vehicles, a 3.0 percent decrease from 2007.

Why? Per Used Cars blog:

A slew of recent studies have all come up with the same conclusion: Americans are holding onto their cars longer than they ever have before. A report by automotive industry analysts R.L. Polk & Company says the average age of vehicles on our roads is a year older now than it was a decade ago. So how old is that? The study says the average age of all the cars and trucks registered at the end of 2008 was 9.4 years old. To top it off, the good people at R.L. Polk also looked at vehicle scrap rates, which have fallen from 9.5 percent in 1970 to just 5.1 percent last year.

So… used car prices (at auctions) are rising due to the decreased used car supply at dealers as consumers are driving their cars longer and avoiding the purchase of a new car that they may or not be able to afford. To me this is deflationary over the longer run, with one HUGE caveat / concern… supply destruction.

This story shows what can happen when there is a significant change in supply (lower supply = higher prices). My fear is that the global economy has another downturn and supply is permanently destroyed when the government finally accepts that they cannot save every GM, Chrysler, etc… At that point I do feel that inflation, even with reduced demand, is a real threat. BUT, until then, deflation is my concern…