Sign up for a free subscription to Phil’s Stock World Report, click here!

Can’t bypass a title starting with "Good News Alert!"…

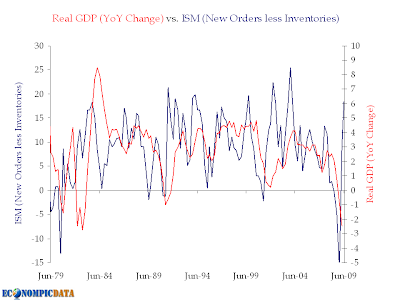

Good News Alert! New Orders less Inventory Jumps

Courtesy of Jake at Econompic Data

A data point that I wouldn’t have looked into directly, but it does show how an inventory correction plus a jump in new orders may lead to a short term bounce in GDP. First lets go David of the Disciplined Investor with the summary:

Many data points have been cited as green shoots since they are simply "less bad". For example, if earnings continue to decline, but at a lower rate, this has been cited as a positive or green shoot. Well, one data point that is actually positive is the New Orders minus Inventories (NO-I) data point.

Reproduced chart below (original from Argus Research)

Back to David’s analysis (bold mine):

Ten industries saw new orders increase with five showing declines. The issue, and you (EconomPic) highlighted this in one of your recent posts,

"Mother of All Inventory Corrections"

is the five declining issues are contracting at a larger rate than the 10 growing industries.

Generally, a new orders index number above 48.8 is consistent with an increase in manufacturing orders. The new orders index for June equaled 49.2 although down from 51.1 in May.

In short, I do think it is a pretty positive print. I would like to see the new orders index find some stability though. Lastly, we need to see jobs created and simply come in at a "less bad" number.

I’ll agree that it does point to a possible surprise on the upside in Q3 GDP, but the question remains whether an inventory correction can lead to a prolonged recovery.