What dip? Ironically, GS gets upgraded by Meredith Whitney in the middle of our dip buying plans… Goldman Sachs upgrade gives world markets a boost,

Europe had been trading only modestly higher while Wall Street futures had been pointing to a lower opening. That changed after Meredith Whitney told CNBC Television that she had upgraded her recommendation on U.S. investment bank Goldman Sachs Group Inc. to "buy" and raised her price target to $186 a share — a day before it reports its second-quarter earnings. Whitney, who has been viewed as bearish on the sector, also said Bank of America Corp. could be good value.

In early trading, Goldman Sachs was up 2.9 percent at $145.98 while Bank of America rose 3.9 percent to $12.34…

*****

Today David of The Oxen Group’s buying our favorite evil company, GS, on a dip. – Ilene

What to Buy: GS

Courtesy of David at The Oxen Group

Courtesy of David at The Oxen Group

The buy pick is made every evening at Midnight before the next day begins. The pick is a single day trade of a stock or ETF. The Oxen Group provides analysis, entry/exit points, resistance levels, and a rating for the pick. Picks are only single day trades.

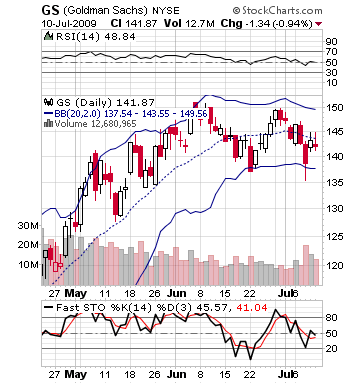

The Oxen Group is going to recommend the evil stock on Monday, as it seems to have become more and more in the past few years. Goldman Sachs (GS) may be a very solid play on Monday as buyer interest will be rising on the stock going into earnings. The stock is expected to hit a ridiculous $2 billion profit for the company’s Q2 on Tuesday’s earnings release.

The market is looking bearish for tomorrow. Going into the weekend, we got bad consumer sentiment reports, a sell off in the market, and nothing to spark our interest over the weekend. Until we see a multitude of companies giving investors reason to buy, the market will continue to be sideways to slightly bearish. Monday morning, the only company reporting earnings of any concern is Fastenal (FAS), and it does not have the capabilites to move a market.

Economic news is limited to a budget report. It will be another day of investor’s anticipations. Well, what company is going to have better anticipation than Goldman Sachs? We believe the stock will dive in the morning, but it should trend at a nice pace up from a bottom throughout the day. The company has been in the red 4/6 trading days after news of a stolen code caused the stock to dive. Buying on this weakness in a very strong company is a great decision. On that technical front, fast stochastics are trending upwards slightly, but they are oversold. This signals that the stock should be on an upswing with buyers entering the stock. If you want to add some risk with more possible reward, hold over night and watch some solid earnings take you higher.

Entry: Recommend buying in 25-45 minutes into session.

Exit: We recommend exiting after a 2-4% increase.

Stop Loss: We recommend a 3% stop loss on all buy in prices

Upper Resistance: 146.50 – 147.00