David at The Oxen Group’s getting back into energy.

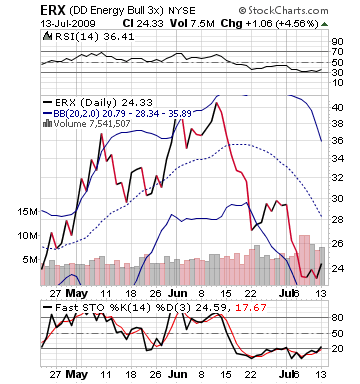

What to Buy: ERX

What to Buy: ERX

The Oxen Group has been pushing for the downward trending of oil over the past couple of weeks as it was just way too overvalued, but as oil dipped below $60 per barrel, investors, who are looking to put money back into the market, may find tomorrow is the start of a movement back up for oil. That is why we are recommending Direxion Daily Energy Bull ETF (ERX) Earnings season is under way, and thus far, the big names of Family Dollar, Alcoa, and CSX all have done better than expected and seen the economy bottoming.

Tomorrow, Goldman Sachs and Johnson & Johnson release earnings and pre-market, which could continue the trend. We are bullish on Goldman Sachs to blow the earnings out of the water and continue to provide the market with a positive catalyst. The real news, however, that could spark some interest in the oil market is Singapore. The country reported that for their Q2 they moved out of a recession and are seeing growth in their economy. They even revised their country’s drawback from 6-9% to 4-6%, sending up the Asian markets and the price of oil. The oil market should get a major boost from this news.

Futures are already up in all three major indices, showing that investors are expecting to take the market higher. The retail sales number is the big economic indicator coming out tomorrow. While retail sales do not directly affect oil, this indicator could push the market one way or another. With oil having been driven down, ERX has suffered greatly. If oil has some movement up, ERX will make a major move.

Entry: Recommend buying in 15-30 minutes into session.

Exit: We recommend exiting after a 3-5% increase.

Stop Loss: We recommend a 3% stop loss on all buy in prices.

Upper Resistance: 27.50 – 28.00