Click here for a FREE, 90-day trail subscription to our PSW Report!

Quote: "Power alters the basic neurological processes in the brain and inhibits those parts of the brain that would allow a person to show restraint. It allows them to systematically ignore the consequences of their actions." Adam Galinsky, Kellogg School of Management.

Spitzer Agonistes Redux

Spitzer Agonistes Redux

Courtesy of Jesse’s Café Américain

It is too bad Eliot could not have exercised better judgement, knowing that he would be targeted by the powers on Wall Street and Washington when he took them on. See the quote at the top of this blog for the most likely reason.

That he was exposed in his scandal by an intense Federal investigation speaks to the depth of the corruption of Washington under Bush, and even now, by the financial powers.

He is right of course, and everything that the Obama Administration is doing on the economic front is a sham.

There is a ‘new regulatory spirit’ and the Democrats under the skillful hand of Larry Summers and Barney Frank seek to channel it into irrelevancy.

Spitzer Says Banks Made ‘Bloody Fortune’ on U.S. Aid

By Laura Marcinek

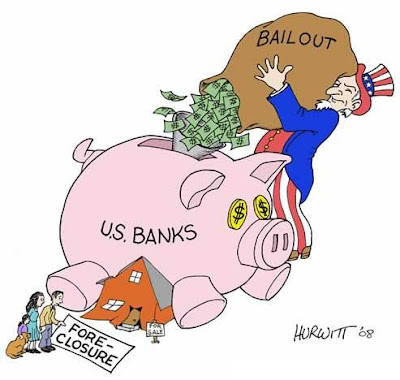

July 14 (Bloomberg) — Eliot Spitzer, the former New York governor and attorney general, said U.S. banks made a “bloody fortune” while receiving taxpayer money without a proven benefit to the wider economy.

Politicians understand the “populist rage” with excesses in the financial industry and in this case the “public is right,” said Spitzer in a Bloomberg Television interview today. “We have saved financial services, we have not created a single job. We are still bleeding jobs.”

As New York attorney general, Spitzer was known as “the sheriff of Wall Street.” He changed business practices and collected billions of dollars in settlements from financial corporations such as Merrill Lynch & Co., American International Group Inc. and Marsh & McLennan Cos. He later became governor, resigning in March 2008 after he was identified as a client of the Emperors Club VIP, a high-priced prostitution ring.

Spitzer said new rules proposed by President Barack Obama’s administration are irrelevant because regulators failed to enforce existing regulations.

“Regulatory agencies already had the power to do everything they needed to do,” he said. “They just affirmatively chose not to do it.”

“You don’t need new regs to do it, you just need the will to do what they were supposed to do,” he said.

‘Hands Off’

Former Federal Reserve chairman Alan Greenspan had “avowed a theory of hands off” while he oversaw the financial markets and didn’t consider himself a regulator, Spitzer said…. more here.

For the Bloomberg’s interview with Eliot Spitzer, click here.