Click here for a FREE, 90-day trail subscription to our PSW Report!

Commercial Paper Falls at Record Pace

Courtesy of Mish

Courtesy of Mish

Corporate borrowing costs continue to climb along with the steep plunge in commercial paper. Please consider Commercial Paper Falls Most Ever.

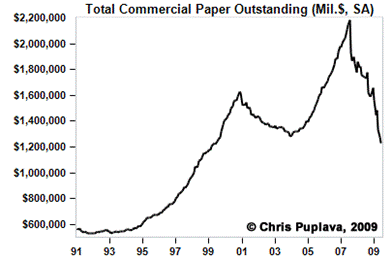

The U.S. commercial paper market, the cheapest source of corporate cash, is shrinking at a record pace, raising the cost of capital for borrowers from Consolidated Edison Inc. to Kellogg Co.

The market for company debt due within nine months has plunged 28 percent since April 8 to $1.1 trillion, its longest and deepest slump, Federal Reserve data show. Investor demand for all but top-rated commercial paper, or CP, evaporated after September’s collapse of the $62.5 billion Reserve Primary Fund sparked a run on money-market accounts, and as the recession sapped companies’ need for short-term credit to expand.

Proposals from the U.S. Securities and Exchange Commission in June may worsen the slump by restricting money-market funds, which hold 40 percent of the paper, to only top-rated debt. That would force more companies to sell bonds that may cost an extra 8 percentage points in interest, or $8 million a year for every $100 million borrowed.

“You’re not going to build that plant, you’re not going to expand, you’re not going to hire folks,” said Brian Kalish, a director at the Association for Financial Professionals, which represents 16,000 corporate treasurers, bankers and investors. “We’re creating this world of haves and have nots.”

More than 60 companies sold bonds this year to repay commercial paper, including Consolidated Edison, Verizon Communications Inc. in New York and Kellogg, the 103-year-old maker of Keebler cookies and Rice Krispies cereal, according to data compiled by Bloomberg. Non-financial companies have sold $306 billion of investment-grade bonds this year, a record pace.

“Treasurers aren’t sleeping at night because they don’t know if they can roll over commercial paper,” said Anthony J. Carfang, a partner at Treasury Strategies Inc, a Chicago consulting firm. “They’d rather lock in money for five years and pay a little more.”

Commercial paper outstanding fell $39.7 billion, or 3.5 percent, during the week ended yesterday, its 14th straight decline, the Fed said today. At $1.097 trillion, the CP market is less than half its peak of $2.22 trillion in July 2007, with about 10 percent of it owned by the Fed, central bank data show.

The market for second-tier CP also has also shrunk by almost half to $44.1 billion since August 2007, with daily issuance down to $2.66 billion in June, the least in more than a decade and a third of what was sold a year earlier, Fed data show.

Commercial Paper Charts

Inquiring minds are asking for charts of this phenomenon. Chris Puplava at Financial Sense was happy to oblige.

Total Commercial Paper Seasonally Adjusted

Total Commercial Paper Year Over Year Changes

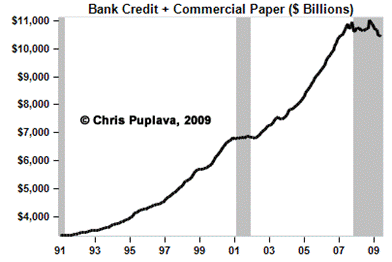

Total Commercial Paper Plus Bank Credit

Total Commercial Paper Plus Bank Credit Year Over Year Changes

Thanks Chris!

The commercial paper market is vanishing and it will not come back. Indeed, it’s the end of the free lunch for corporations to be able to perpetually roll over short-term debt effectively achieving long term financing at short-term rates.

This decline in commercial paper is indicative of the fundamental shift in the risk appetite of banks, investors, and consumers alike. This secular shift in willingness to take on risk also applies to credit cards, home equity lines of credit, mortgages, lending in general and of course consumer spending in general.

These attitudes shifts are a huge part of the deflationary environment we are in.