We have a new section at Phil’s Stock World, it’s called Chart School.

We have a new section at Phil’s Stock World, it’s called Chart School.

We will be featuring Technical Charters and Analysis from some of the top people on the web. If you are interested in contributing or know someone you think would be a good contributor, contact Ilene@ our .com address (I don’t want her getting spam by putting her email in a post!) and let her know who you think would make a good addition to our roster. We’re looking not just for nice charts, but also for people who are skilled in explaining them. A good chart person needs to be a little bit of an artist, which is why I’m not one – my drawing skills make my daughters laugh, and not in a good way!

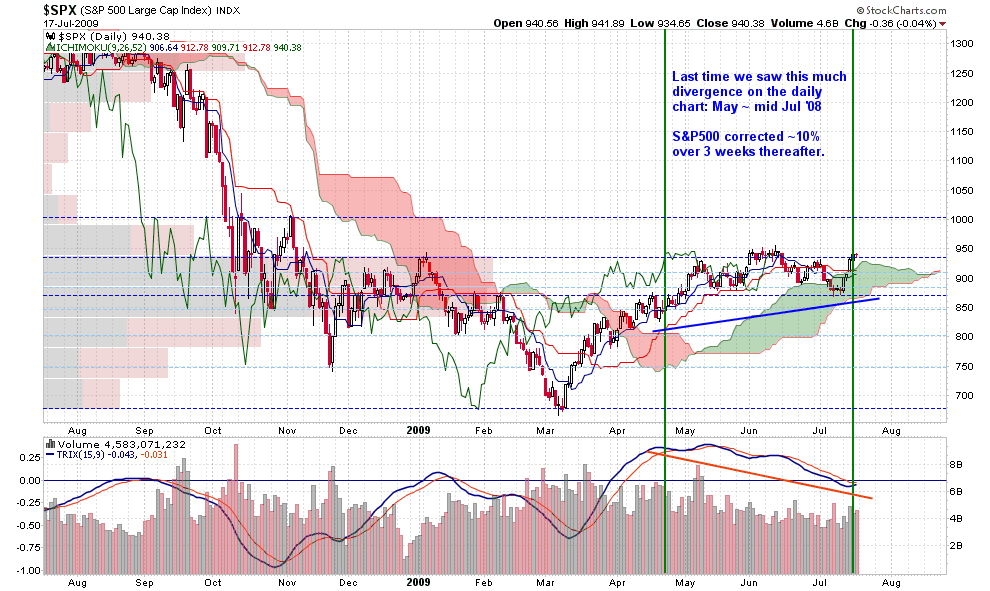

Like all good art, charts are subject to interpretation and different people will see different things, and come to different conclusions – from looking at exactly the same thing. That’s why I like to look at lots of different charts and try to check my bias at the door and let art speak for itself. Here’s a few that caught my eye this morning, starting with this interesting S&P chart by Ichimoku, who uses the SPX Price/TRIX daily divergence to catch a possible correction brewing just ahead of us (something I agree with for fundamental and technical reasons):

Interetsing stuff! Of course, I will caution members (as I had to when everyone was getting "Head and Shoulders" fever) that these are unprecedented market moves and "normal" charting techniques will often fail you here. We have record amounts of cash on the sidelines in proportion to the size of the market, which itself is trading on low volumes, which means it doesn’t take very much to override a bearish chart. It also would not take much of a panic to wash out the relatively small number of people who buy into the market every day.

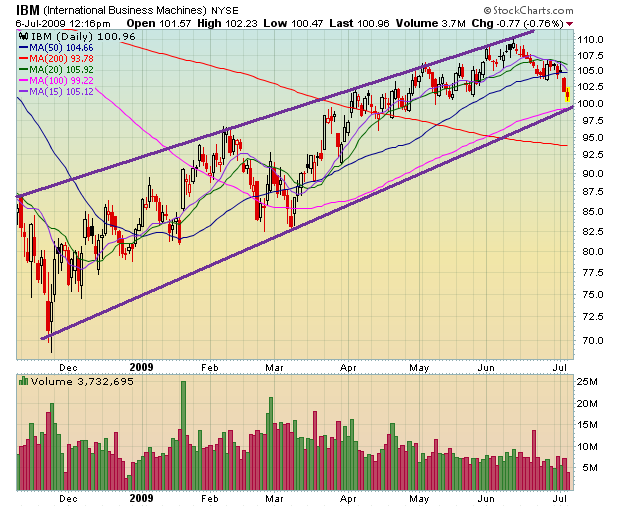

As I mentioned in yesterday’s comments, just 20M out of 1.3Bn of IBM’s shares were exchanged yesterday at prices that averaged $112.50 per share yet that $2.25Bn worth of rangey trading upped IBM’s total market cap by $6.5Bn. Should the other 98.5% of the shareholders decide they’d like to get the $115 closing price for their shares, they may find the "value" isn’t quite what the chart says at the moment. This is nothing against IBM, they are worth about $115 – as long as not too many people want to sell it at once or then, like the entire market in November and March, when IBM was trading at $82 and hit our Bargain-Basement Buy List, a stock is just worth whatever you can get for it at the moment.

As I mentioned in yesterday’s comments, just 20M out of 1.3Bn of IBM’s shares were exchanged yesterday at prices that averaged $112.50 per share yet that $2.25Bn worth of rangey trading upped IBM’s total market cap by $6.5Bn. Should the other 98.5% of the shareholders decide they’d like to get the $115 closing price for their shares, they may find the "value" isn’t quite what the chart says at the moment. This is nothing against IBM, they are worth about $115 – as long as not too many people want to sell it at once or then, like the entire market in November and March, when IBM was trading at $82 and hit our Bargain-Basement Buy List, a stock is just worth whatever you can get for it at the moment.

For example, what does this IBM chart tell you? Certainly it’s not telling you that IBM will be making a new high in 10 days… We did pretty much bottom out at $99.50 the next day but the move from $100 was 100% this week and IBM hit $110 (up 10%) before the earnings were announced. Market sentiment can turn charts on a dime and market manipulators tend to time their "news," like Meredith Whitney’s much publicized bullish call on financials, that was timed perfectly for Monday’s open or Nouriel Roubini’s "bullish" comments that were also used to goose the markets on Thursday. I’m not saying that Whitney was herself manipulating the markets but think how easy it is for GE/CNBC to SCHEDULE her for the date and time they wanted in order for her announcement to have the desired effect. While Whitney is thrilled to be taken seriously and credited for moving the market, Nouriel Roubini cried foul, citing CNBC as using him for their own agenda as they took his words entirely out of context.

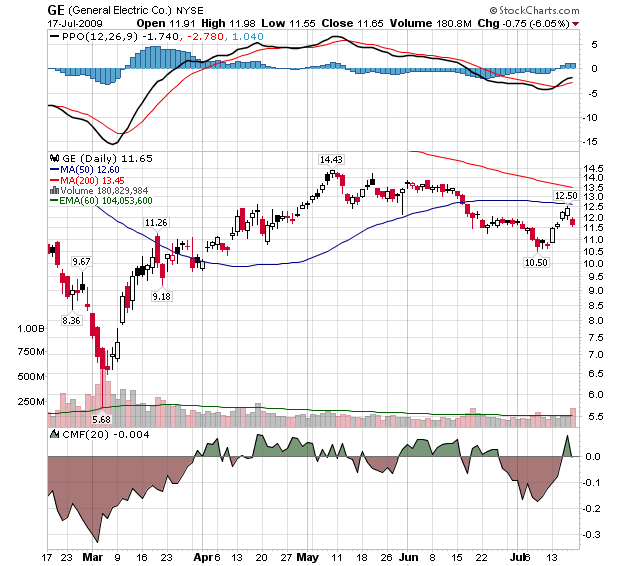

Why would the fine broadcasters at CNBC do such a thing? Well perhaps because parent company GE knew they were going to have a stinker of a quarterly report and wanted to garner some favorable market conditions to drop their bomb in to cushion the impact. Beleaguered CEO Jeff Immelt faced down a lot of angry shareholders in March as the stock dropped to less than 20% of the 2-year average. Still hovering around $12, what do you think the impact would have been if GE had announced mediocre results in an unfavorable market? As it was, the company dropped 8% on Friday but that was only giving up 1/2 of the Whitney/Roubini rally that was led by 5 days of pom-pom waving on GE’s financial network.

Why would the fine broadcasters at CNBC do such a thing? Well perhaps because parent company GE knew they were going to have a stinker of a quarterly report and wanted to garner some favorable market conditions to drop their bomb in to cushion the impact. Beleaguered CEO Jeff Immelt faced down a lot of angry shareholders in March as the stock dropped to less than 20% of the 2-year average. Still hovering around $12, what do you think the impact would have been if GE had announced mediocre results in an unfavorable market? As it was, the company dropped 8% on Friday but that was only giving up 1/2 of the Whitney/Roubini rally that was led by 5 days of pom-pom waving on GE’s financial network.

Now Immelt himself only owns 1.7M shares of GE stock but I’m sure he has just tons of options that are underwater. If that’s not motive enough, he has $123Bn worth of shareholders who will certainly want to know what happened to their other $300Bn and are losing their patience, so there’s some serious motive. The means is CNBC and the opportunity is the ability to filter the news in order to create an environment that allows you to add $20Bn in market cap over 4 days ahead of an earnings report that shows you should have gone $20Bn the other way. Case closed, book ’em Danno!

Does that sound too conspiratorial? Maybe I am being a little unfair. After all CNBC did report that Barclays Capital analyst Jason Goldberg lowered his estimates on a number of banks (not GE) Monday but he also projected the second quarter will show a continuation of several positive trends seen in the first quarter, including a strong capital-markets environment and a solid mortgage-refinance backdrop. Goldberg also expected an improvement in service charges and for market-related write-downs to continue declining so, generally, a positive report. On Tuesday afternoon, when the markets were flagging, CNBC reported that Barclays had raised their 2009 target for the S&P 500 to 930 from 875 saying: "Looking ahead, we think the market will break through the midpoint (850) of its recent range (1000-700) this summer before enjoying the second leg of the ‘recovery rally."

Does that sound too conspiratorial? Maybe I am being a little unfair. After all CNBC did report that Barclays Capital analyst Jason Goldberg lowered his estimates on a number of banks (not GE) Monday but he also projected the second quarter will show a continuation of several positive trends seen in the first quarter, including a strong capital-markets environment and a solid mortgage-refinance backdrop. Goldberg also expected an improvement in service charges and for market-related write-downs to continue declining so, generally, a positive report. On Tuesday afternoon, when the markets were flagging, CNBC reported that Barclays had raised their 2009 target for the S&P 500 to 930 from 875 saying: "Looking ahead, we think the market will break through the midpoint (850) of its recent range (1000-700) this summer before enjoying the second leg of the ‘recovery rally."

It is interesting to note that Barclays is the single largest shareholder of GE, something I must fail to overhear in the disclosure statements when the guests come on CNBC, and that their 424M shares jumped over $400M in value this week. I’m sure things are on the up and up at Barclays as they just appointed Bush’s Under-Secretary of State for Economic Affairs, Reuben Jeffery III, to the Board of Directors. Mr Jeffrey was a managing partner at Goldman Sachs and was also the chairman of the Commodity Futures Trading Commission under Bush during the biggest commodity rally in history before being promoted to Under-Secretary for all his good work there.

Yes charts can be very useful in giving you a picture of developing trends but what’s been killing traders lately, and especially the poor bears last week, is the way those technicals have been snapped for seemingly no reason at all. When Disney owns ABC and GE owns NBC and CBS is owned by the World’s 86th richest man ($9Bn) and Fox is owned by 132nd richest man ($4Bn), who also now owns the Wall Street Journal – WHAT DID YOU THINK WAS GOING TO HAPPEN?

Ned Beatty explained this all to us in Network, way back in 1976, when he told us:

Ned Beatty explained this all to us in Network, way back in 1976, when he told us:

There is no America. There is no democracy. There is only IBM and ITT and AT&T and DuPont, Dow, Union Carbide, and Exxon. Those are the nations of the world today… One vast and ecumenical holding company, for whom all men will work to serve a common profit.

What do you think the Russians talk about in their councils of state — Karl Marx? They get out their linear programming charts, statistical decision theories, minimax solutions, and compute the price-cost probabilities of their transactions and investments, just like we do. The world is a business. It has been since man crawled out of the slime.

Well it seems to me we are still stuck in that slime. It’s a new age of market manipulation where all of your news comes from the same corporations and every wave of consolidations drives the wealth of this nation into the hands of fewer and fewer people. As pointed out on Boston Legal recently, not only are we losing our choices in news sources, banks, car companies etc. but now our nation is once again getting bought up by foreigners. In the ’80s it was Japan, now it’s China. Japan ended up getting hosed because they bought at the top but China is sitting pretty, having stockpiled over $2Tn in dollar reserves right when our few remaining corporations are desperate for cash.

Well it seems to me we are still stuck in that slime. It’s a new age of market manipulation where all of your news comes from the same corporations and every wave of consolidations drives the wealth of this nation into the hands of fewer and fewer people. As pointed out on Boston Legal recently, not only are we losing our choices in news sources, banks, car companies etc. but now our nation is once again getting bought up by foreigners. In the ’80s it was Japan, now it’s China. Japan ended up getting hosed because they bought at the top but China is sitting pretty, having stockpiled over $2Tn in dollar reserves right when our few remaining corporations are desperate for cash.

I wonder which network will be sold to China first? Rupert Murdoch (who is already very tight with China) already opened the doors to foreigners taking over US media interests. Our stock markets have already started trading like those crazy Asian markets. Why? Manipulation is why. Control of the media by government and business allows focused messages to go out to the people so investors can be stampeded in and out of the markets at the will of the people who control the message. Heck, maybe it is time to give China a turn after the way we’ve messed things up over here.

Now that China has Africa on track, I’m sure they can come over here and straighten things out!