Expect Seven Years of Subpar Growth and High Unemployment

Courtesy of Mish

Courtesy of Mish

BLS data shows Unemployment Rate Tops 10% In 15 States.

Unemployment topped 10 percent in 15 states and the District of Columbia last month, according to federal data released Friday. The rate in Michigan surpassed 15 percent, the first time any state hit that mark since 1984.

The Federal Reserve this week projected that the national unemployment rate, currently at a 26-year high of 9.5 percent, will pass 10 percent by the end of the year.

The Labor Department said it’s the first time in 25 years that any state has suffered an unemployment rate of at least 15 percent. In 1984, it was West Virginia.

The state unemployment report underscores the damage that the longest recession since World War II has inflicted on companies, workers and communities.

The other 14 states where unemployment topped 10 percent last month were: Alabama, California, Florida, Georgia, Illinois, Indiana, Louisiana, Nevada, North Carolina, Ohio, Oregon, Rhode Island, South Carolina and Tennessee.

While Michigan’s rate was the highest in the U.S. in June, the record-high for the state was 16.9 percent in November 1982.

Fed Walks Prediction Up

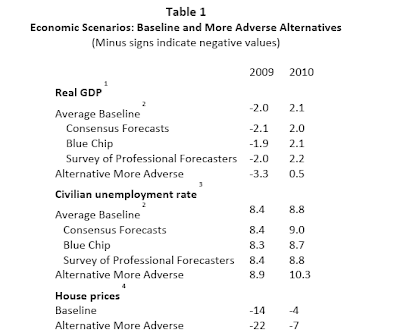

As noted in Optimistic Unemployment and Housing Forecasts Looking Downright Silly the Fed previously forecast the unemployment rate at 8.4% for 2009 while I called for 9.8% by August. The Fed’s adverse scenario for 2009 was 8.9%.

Here are the Fed’s assumptions for the recently conducted "stress-free test" as laid out in the Fed’s Stress Test White Paper.

Now that the unemployment rate is 9.5% the Fed is calling for 10% by the end of the year.

We could see that by September. What the Fed is doing is slowly walking its prediction up, to match the dismal jobs picture as it unfolds.

No Return to ‘Full’ Employment Until 2015

Former Fed governor Meyer sees No Return to ‘Full’ Employment Until 2015.

The U.S. won’t see a return to “full” employment for another six years, helping to hold down inflation, according to former Federal Reserve Governor Laurence Meyer.

“I think there’s going to be a long legacy of the financial crisis and the deep recession,” Meyer said in an interview today on Bloomberg Radio.

The economy is “a very, very long way off” from its potential growth rate, Meyer said. While the expansion will probably be “modestly above trend next year” and “significantly above trend in 2011,” that won’t help restore the nation to a “normal” job-market, he said.

“Full” employment — or a jobless rate around 5 percent — won’t return until 2015, he said.

“We’re staring in a hole; we’re going to start from a 10 percent unemployment rate,” Meyer said. “The unemployment rate is going to come down very slowly.”

Meyer said that the jobless rate will probably be 9.5 percent to 10 percent by the end of 2010, and 8.5 percent by the end of 2011, Meyer said. “That’s still very high,” he said. “That’s the defining feature of the outlook going forward.”

Meyer Is A Blazing Optimist

9.5-10% by the end of 2010 is unrealistic. The odds are unemployment rate hits or exceeds 11% in 2010 is high. He is right that the rate will come down slowly.

Given that he does not define his terms it is hard to know what he means by "full employment" but I expect the unemployment rate will still be north of 7% by 2015. In fact we might be in and out of several recessions by 2015 with the rate far higher than anyone remotely thinks possible. Even 8% might be blazingly optimistic.

Of course we do not know what magic the BLS will play with the numbers and there could be some sort of major disruptive innovation that brings jobs much faster. I just would not be counting on it like Meyer is (whether he knows it or not).

Bear in mind we are talking about the official unemployment rate. The true unemployment rate right now is 16.5% and rising as noted in Jobs Contract 18th Straight Month; Unemployment Rate Hits 9.5%.

Those official unemployment rates under 5% we saw in 2007, were a confluence of many once in a generation things happening simultaneously, most notably housing going gangbusters, commercial real estate going gangbusters, cash out refis going gangbusters, and subprime auto lending going gangbusters.

Secular Peak in Consumption and Risk Taking

It’s time to face the hard facts. Housing is not coming back; auto manufacturing is not coming back; and the buildout of a myriad of Home Depots, Lowes, Pizza Huts, Nail Salons, Strip Malls, Applebees, and Walmart store growth is not coming back to anything approaching the levels we have seen recently.

Yes, there will be a bounce in all of those, but it is virtually guaranteed none of those will return to 2006-2007 levels of insanity for a decade, at least.

A secular peak in consumption and risk taking has been reached and is reversing.

Realistically, growth was far above where it should have been for close to seven years because of the Fed induced lending boom, insane lending standards, and extreme leverage and risk taking everywhere epitomized by "liar loans" and zero-percent down housing. Now is the payback time. We should be expecting growth to be below trend for the next seven years, with a few outliers tossed in for good measure to keep everyone excessively optimistic.