Holy cow, what a week!

Holy cow, what a week!

It is hard to believe that last weekend I wrote: "You can hardly find anyone who doesn’t think we’re going back to the March lows. I stand by my statement to Members in yesterday morning’s Alert where I said: "It’s ridiculous for the Dow to go back to 7,500 and ridiculous for the S&P to go back to 800. While it’s easy to make squiggly lines on a chart show 10% drops ahead (which seems like a normal 50% retrace of the gains overall) I just think it’s dead wrong from a valuation perspective so I’m not inclined to play it, especially when those valuations are about to slap you in the face over the next few weeks. Maybe I’m wrong and maybe earnings will suck and Q2 will be a miss and guidance will be lower but right now I say – Show me the misses."

Here we are, just 7 days later and I found myself writing an article about the ridiculous media cheerleading that went on last week. How did the MSM go from 100% bearish to 100% bullish at the stoke of Monday? Well, according to Cramer, it was Whitney, Whitney, Whitney and the logic seems to be that, since she called the problems in the financials early on, she MUST be right by calling an end to the problems now. Of course what Whitney actually said was the banks should have a good quarter as the government pushes for massive mortgage refinancing (all those 1% fees really add up!) and she also said she sees unemployment shooting up another 35% to 13% or higher but hey – at least she said something positive about the banks and that's all the media needed to hear to tear up the previous week's entire playbook and switch sides so completely, you have to review the tape just to be sure we didn't imagine the whole doomed, "head and shoulders" outlook of the week before.

What did I have to say about all this nonsense last weekend? I was emphatic, and I'm usually not, and I said for those who would listen: "So here we are, back at the bottom of the trading range I predicted back in March and even as far back as November, when I said that, based on the fundamentals the crash should settle out at Dow 8,650." I need to be clear about this so you don't think I'm mindlessly flip-flopping. 5% below 8,650 is 8,200 and 5% above is 9,100 – THAT is our trading range so when we get down around 8,200, we like to buy and, at around 9,000, we like to sell. Of course, over at PSW, we don't just watch the markets, we also make trades and we bought like crazy at that bottom. While Cramer was pounding the SELLSELLSELL button and the H&S crowd was saying S&P 700 or whatever, I put out the first large group of buy/writes and naked short sells (our preferred method of entry) in over a month.

I won't bore you by going over it here but if you go back to the post, there is a list of 18 plays and EVERY SINGLE ONE is a winner and ALL BUT ONE are up 10% for the week or more (so there's still time to buy CAL). That is pretty good. Yes, a monkey with a dartboard could have picked winners this week – but we picked them LAST week, when no one else had the guts to – and that gave us the best prices as well as a nice, high VIX to sell our hedges against. As I extolled members last week, you can't "buy low and sell high" if you don't buy low!

I won't bore you by going over it here but if you go back to the post, there is a list of 18 plays and EVERY SINGLE ONE is a winner and ALL BUT ONE are up 10% for the week or more (so there's still time to buy CAL). That is pretty good. Yes, a monkey with a dartboard could have picked winners this week – but we picked them LAST week, when no one else had the guts to – and that gave us the best prices as well as a nice, high VIX to sell our hedges against. As I extolled members last week, you can't "buy low and sell high" if you don't buy low!

By all means, DO NOT, recommend this newsletter to anyone! Do not use your member link to send them a free trial subscription to our reports. They may get some interesting market insights and, even worse, you may win $1,000 (and you WILL get a renewal discount for all referrals) and, even worse than that, they may win $500 just for checking us out. That would be TERRIBLE! (note the very subtle reverse-psychology employed in this marketing note!)

Monday morning, pre-Whitney, I had not found a reason to change my tune when I asked "Are we done at 1/3?" which was the amount of retracement of the rally off the bottom we had. I had posted plays on FXP on the previous Friday (also could have made your friends money in that pesky newsletter) and we had a near double as the FXP leaped up to $13.75 at the open and not being greedy was BRILLIANT as I said: "it’s a good idea to kill the short-term trade and take the profits off the table." Now I do not have any particular psychic abilities – It is ALWAYS a good idea to take big profits off the table. Very, very few people get rich with one gigantic profit. Most people who are successful make a profit, get some cash, reinvest it and make another profit until they are, as my friend Charles Dow liked to say "accidentally rich."

Ahead of the open on Monday, the futures were not looking good but that did not stop my game plan from being: "For now, let’s just enjoy the ride as we have little upside resistance and a very heavy negative sentiment that can lead to a lot of bears getting caught with their pants down as it will be hard for the earnings news and economic data of the coming week to be as bad as what has now been priced in during the panic of the last 30 days… It doesn’t take much to force short-covering at these levels of bearishness, perhaps something like Goldman Sachs upgrading the tech sector or Atlanta Fed President Dennis Lockhart saying: "I see the economy beginning to recover in the second half of this year” like he did yesterday… With any luck, the truth shall set us free – or at least back to 8,650." See, again, not psychic – we just read the papers and draw conclusions!

Monday morning we took GOOG $530 calls ahead of the $30-point run and wisely killed those ahead of earnings for a small gain. We also did a spred of DIA $81 puts at .65 and $83 calls for .40 that worked out very well, especially for those who held on during the week! That was 10:21 in Member Chat and the Dow was at 8,150 with 5 days to expiration. Our logic was that a 200-point move in either direction would probably give us a nice win. Little did we know we'd be up 600 by Thursday's close…. GLD March $90s were very cheap looking at $6.95, now $8.60 (up 24%) but we still like it for an inflation hedge after reading John Mauldin's bleak outlook on Europe this morning! TNK was a hedged buy/write at $6.85/7.18 and very on track but, other than some $5,000 Virtual Portfolio moves (detailed in their own post), we were done buying for the day before lunch.

Tuesday morning we thanked Ms. Whitney for the rally and, despite Cramer jumping on the bull bandwagon and making me wonder what the scam was (it turned out to be GE's upcoming poor earnings that needed cover) but we posted some pretty aggressive targets for our indexes and every single one of them was taken out this week: Dow 8,500, S&P 930, Nasdaq 1,825, NYSE 6,000 and Russell, 510. Those are the levels we'll be looking to hold on a pullback next week. We expected a bumpy ride and we sure got one on Tuesday but finished the day near our middle targets.

Fortunately, our level watch prevented us from getting into too much trouble with DIA puts. My 9:53 Alert to members said: "I like the DIA $84 puts, now $1.29 if we break below 8,300 AND the S&P is below 900. If either of those conditions change then take the small loss and protect 20% gains as you may be able to go in and out several times." The Dow never broke that 8,300 level again after that quick dip in the morning. We rolled an existing GS put spread that's still in transit but aggressive selling of $150 puts (at the money at the time) ahead of earnings saved us there. AIG puts were a no-brainer with the worthless stock over $15 and we were able to take out July $14 puts covers for virtually nothing on Friday's silly run-up, leaving us with naked Aug $14 puts again. We dipped into DIA puts again at 11:44 but again our levels took us out of the play. INTC Jan $17.50s for $1.28 were a speculative earnings call and are huge winners at $2.32 (up 81%).

We continued to play the DIA puts on and off but again, the key play was the spread. At 3:18 I again said to members: "DIA spread of $83 puts for .60 and DIA $84 calls for .60 can be fun as a 200-point move in either direction over 3 days pays off but very possible a sharp move in either direction will let you take one off the table and have a free ride on the other side." Of course the $83 puts were wiped out but the $84 calls finished the week at $3.55, up net 195% for 72 hours work! This is just a simple way of playing volatility in the markets when the VIX is low. Rather than sell options, we can buy option combinations that have attractive risk/reward profiles. We had a JPM put spread into earnings that worked well the next day as JPM fell $1.50 on the news.

Wednesday we wondered: "Would we hold it?" but a pre-market super-pump shoved us right over our watch levels and we were, as I said in the morning post, "off to the races." The Industrial Production report kicked us into overdrive, causing me to comment: "Well the market has little excuse NOT to do well on all this sunny news so we’ll be very concerned with any weakness. We’ll be testing 5% gains off our lows at around our upper levels and we will not be too impressed unless we see them broken AND held. If we do get there though, we enter a nice bear squeeze territory that can take us quite a bit higher but, on the whole, I’d rather get there the hard way so we know we have a solid base, something that was sorely lacking the last time we went over the magic 8,650 line." That's the line we stopped dead at into the close and were rejected from on Thursday morning.

My play of the day was to short FAZ and FAS at $45 each on the theory that the typical deterioration of ultra-ETFs would mean they were very unlikely to ever total $90 again. FAZ finished the week at $42.30 and FAS finished at $47.53 so $89.83 so far. Not thrilling but, as I said at the time, I think this may be a sure thing! We'll keep tabs on it as time goes on… We kept poking at DIA puts (offsetting our very bullish positions from the prior week of course) but the levels kept stopping us out. QID $31 calls were a huge mistake as well and those two plays gave us a bad finish for the week as the Dow rampaged up another 200 points. We had a spread on CHSI and another, longer put spread on GS and we sold naked FXP Aug $11 puts to hedge the $100KP, rather than our usual financial puts as I was worried the financials would continue to rally and waste our covers. TASR was picked at $5.11 for the $100KP, now $5.08, but we hedged that one down to $4.28/4.64 so that's what we're looking to hold. Another spread that didn't work was a bear-call diagonal on the DIA as selling the $86 calls for .70 with the Dow at 8,600 was not enough margin of error in this crazy market.

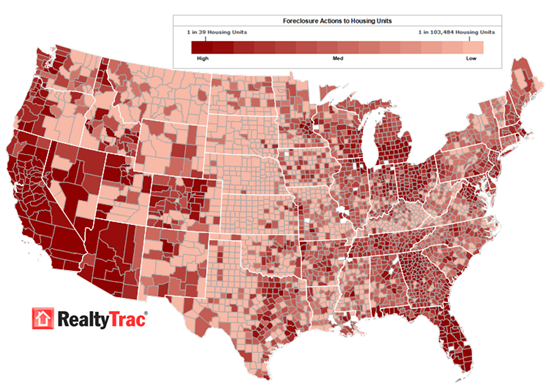

Thursday morning I said "Show Us the Jobs!" and they kind of did with "only" 522,000 people losing jobs this week. I was skeptical for a number of reasons including the horrifying 1.9M foreclosure filings in the first half of the year along with 1.5M foreclosures that actually took place (so don't fall for that BS that most filings don't end in foreclosure). Despite my misgivings my morning commentary was: "Still, your headline shoots don’t get any greener than this so we’ll see if we break over our levels this morning (we are already well over on most) or take a pause and do the 1.25% retrace we expect before, hopefully, consolidating (some say flatlining) into the weekend at right about our upper levels."

Thursday morning I said "Show Us the Jobs!" and they kind of did with "only" 522,000 people losing jobs this week. I was skeptical for a number of reasons including the horrifying 1.9M foreclosure filings in the first half of the year along with 1.5M foreclosures that actually took place (so don't fall for that BS that most filings don't end in foreclosure). Despite my misgivings my morning commentary was: "Still, your headline shoots don’t get any greener than this so we’ll see if we break over our levels this morning (we are already well over on most) or take a pause and do the 1.25% retrace we expect before, hopefully, consolidating (some say flatlining) into the weekend at right about our upper levels."

That was what I said ahead of the jobs report. By the close of the post I had to admit: "Well, I was wrong about jobs so we’ll have to see how the morning plays out. We’re still going to be looking for a 1.25% technical pullback in the major indexes but, if they hold that, then we may have something to build off." Our play was not quite as open minded though and we kept on the DIA puts and shorted SNDK, which stopped out with a quick loss. An MCD spread was easy money at least (so far) and MOS puts stopped us out with a 25% loss on Friday but we shorted them again to great effect. We took a long, long BPOP spread for fun and TTWO was also a long vertical, playing the takeover rumors. A VIX spread remains to be seen but I feel good about selling Aug $25s for $5 (now $4.75) and covering (although not a real cover) with the Dec $25s at $6.40 (now $6.60). V puts went nowhere and stopped out even. Another DIA spread was taken, this time the $87 calls for .24 and the $86 puts for .33. We took the $87 calls off the table at .50 into the close and left us with "cheap" puts that ultimately were wiped out.

We were still looking for bearish plays and we finally found one that worked with the SRS, both on the straight stock and as an Aug bull call spread ($16/$19). On the bull side, YRCW seemed cheap enough at $1.37 but they managed to go down on Friday to $1.31 so we'll see. We were too bearish Thursday afternoon because the market jumped on comments supposedly made by Nouriel Roubini that we knew had been taken grossly out of context and shot the market up 100 points into the close. Sometimes, knowing something other people don't know doesn't help you because, if enough other people all bet one way – you can be very right and still be very, very wrong!

Friday morning I noted we were back where we had started the last option expiration day but we decided not to try to guess. I said in that post: "Not much trading to do today other than fun, speculative plays on the action. We are going to be well-covered into the weekend with some speculative downside bets, especially if we don’t get a pullback in today’s action. Next week it’s all earnings and little data with 1/3 of the S&P 500 reporting and we will continue to pick our spots in the $5KP but I think we’ll give it a pass over the weekend" and that's just about where we are now!

We added the QID Aug $31s at $1.40 (now $1.35) and messed around with DIA puts (to no avail) but we did get a nice, quick double off the GOOG $430 puts, which actually went from $1.35 to $3.50 and back to $1.35 for another entry and then back right to $2.70 for another double. OIH Aug $95 puts were supposed to be a quick win at $3.65 but turned into a weekend hold despite hitting our original $3 stop as we questioned the massive run-up in oil. AAPL Aug $150s seemed a little pricey at $6.60 (now $7.65) so they were sold against the Jan $170s at $7.60 (now 8.43) and we'll see who does better over earnings but I said to members at the time: "you have to be willing to DD on the long side and roll caller to 2x something else if they have great numbers and fly up" so it's really a short play for people who actually like AAPL over the longer term.

We closed the week with a bullish play on CPKI and our DIA put spreads left us a little bearishly covered into the weekend (unhedged bullish plays were cashed out) but we were not buying the final stick save at all as the Dow snapped back 40 points in the last 30 minutes of trading, despite all the other indexes showing red. We'll see what sticks next week but a lot of this run seems overdone and it will take some fairly spectacular earnings results next week as we hear from 130 S&P 500 companies in 5 days. Stay tuned, it's going to be a wild one!