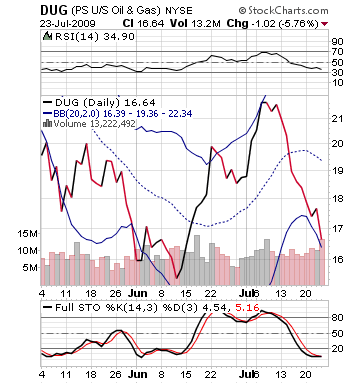

Buy: Ultrashort Proshares Oil/Energy ETF (DUG)

Courtesy of David at the Oxen Group

For Friday, it will be interesting to see if the market can hold any type of rally with weak earnings turned in by market movers in Microsoft and American Express. Asia and Europe shook off these bad earnings, and the American markets are already set to open higher with better futures but will these gains be able to be sustained.

For Friday, it will be interesting to see if the market can hold any type of rally with weak earnings turned in by market movers in Microsoft and American Express. Asia and Europe shook off these bad earnings, and the American markets are already set to open higher with better futures but will these gains be able to be sustained.

Overall, The Oxen Group does not believe that we have the technical capabilities to continue this rise on weak after hours earnings and little to no overly important market moving earnings reports. The one piece of data that really changes things is the Michigan Consumer Sentiment Index, which is released at 9:55 AM. If good, it could pump the markets for the next hour or so, but even then, that rally may die off as lots of sellers may be looking to take profits into the weekend. One market and ETF that could benefit from this feeling is the crude market. With bad economic data and a possible weak consumer sentiment index, the oil market may be ready to slide.

Even if the market opens higher, the upward momentum of the oil market and general market seems improbable. And even though Schlumberger beat expectations, their revenue was very weak and they saw weakened demand for exploration. The way to play DUG is if consumer sentiment is weak get in right away and ride out what should be a profit taking day. If its good, wait for the jump about 30-50 minutes after, buy in off a market high, and watch the market move the rest of the way downwards bringing down energy.

Entry: Recommend buying in based on consumer sentiment index explained above.

Exit: We recommend exiting after a 2-4% increase.

Stop Loss: We recommend a 3% stop loss on all buy in prices

Upper Resistance: 19.00

Note from Phil: DUG – I think they are cheap enough to make a nice buy/write here. Since they bottomed out at $15 when oil flew to $73, selling the Sept $15 puts naked for .75 is appealing. I just can’t see the market sustaining $75 oil this soon.