Barofsky Discovers The Bailout Was Based On A Big, Fat Lie

At the heart of the clash between TARP watchdog Neil Barofsky and his critics in the Obama administration is that Barofsky thinks that the bailout should be publicly accountable for meeting its public goal: Keeping banks lending money to fuel the economy.

The Treasury Department, meanwhile, is happy with the secret goal–recapitalizing banks and consolidating weak banks with stronger ones.

This dichotomy is vividly portrayed in this essay by Glen Greenwald:

Barofsky wants to compel banks to account for those [TARP] funds and then publicize that information, while the administration opposes such efforts, claiming that accounting for TARP monies is impossible due to the "fungibility" of those funds. To disprove that claim, Barofsky sent out voluntary surveys to the bank which proved that those funds could be tracked (and he found TARP funds were being used by receiving banks largely to acquire other institutions and/or create "capital cushions" rather than increase lending activity, the principal justification for TARP).

Now it’s been obvious to many of us for quite some time that financially unhealthy banks would never use the TARP money for anything but hoarding, paying bonuses and trying to prop themselves up. But that’s because we’re as cynical as the architects of the TARP. Barofsky, a career prosecutor, takes the entirely reasonable view that government programs shouldn’t be based on lies.

On a deeper level, what Barofsky is running into is a core problem with the way the TARP was designed. There’s simply no way the government could use capital injections to spur lending into a recessionary economy. It was bound to be used to increase capital cushions. And that’s because the Treasury Department and the Federal Reserve simply lacked the political imagination to find a way to shore up the financial system without propping up zombie banks.

On a deeper level, what Barofsky is running into is a core problem with the way the TARP was designed. There’s simply no way the government could use capital injections to spur lending into a recessionary economy. It was bound to be used to increase capital cushions. And that’s because the Treasury Department and the Federal Reserve simply lacked the political imagination to find a way to shore up the financial system without propping up zombie banks.

What else could they have done? Very simply, we could have allowed failing firms to fail, wiped out shareholders, devastated bondholders, seized depositor assets, perhaps while increasing liquidity to make sure healthy financial institutions had enough cash on hand to deal with any panic.

See Also:

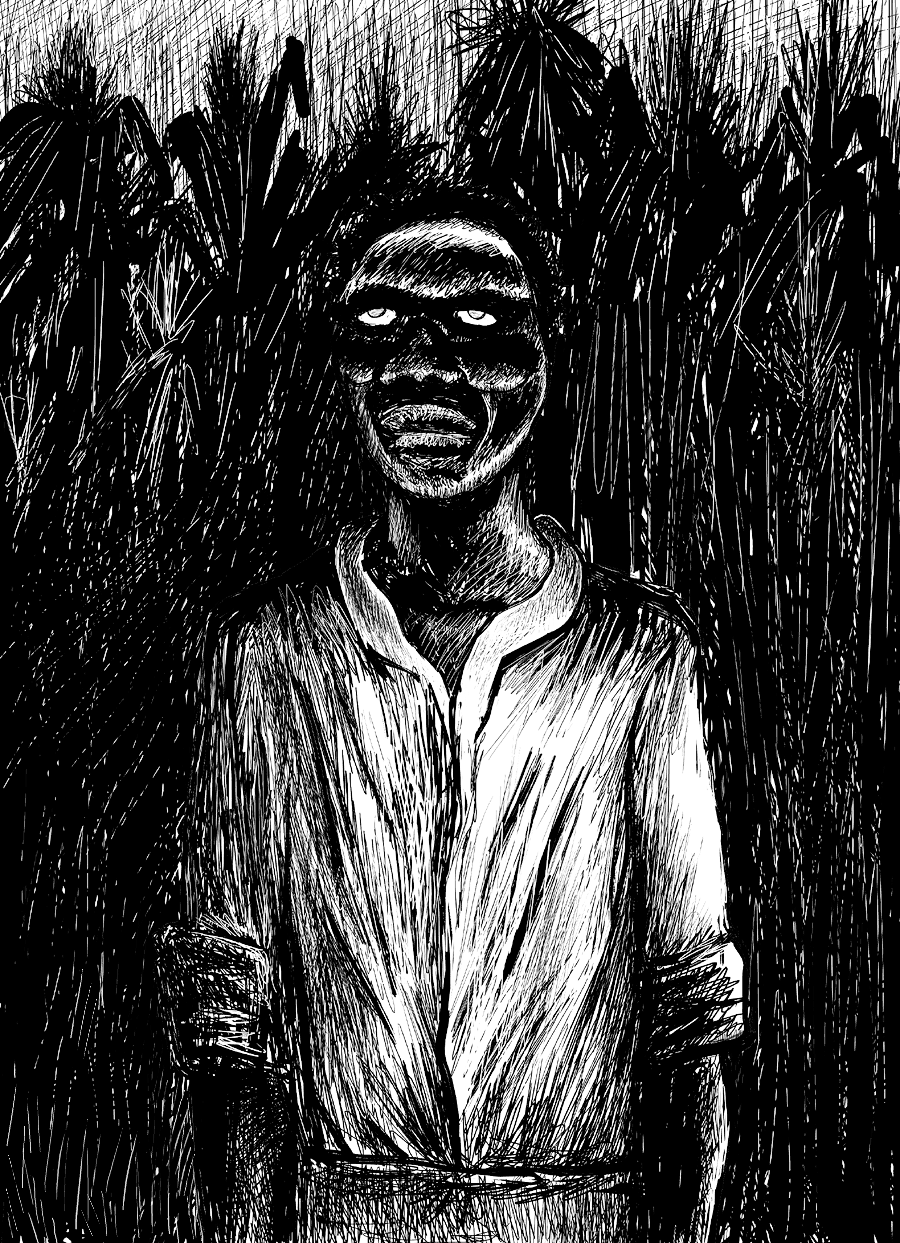

Second photo: Zombie haiti ill artlibre, license at Wikimedia.