Short Sell: KB Homes Inc.

Courtesy of David of The Oxen Group

Courtesy of David of The Oxen Group

The Oxen Group is definitely concerned for this week compared to the past two weeks. All the major indices are vastly overbought technically and some worrisome sectors are reporting this week, leading into the GDP announcement that will most likely have investors fearing and selling off. To start the week, we may see a major to minor pullback in the housing industry that has been one of the major movers over the past two weeks.

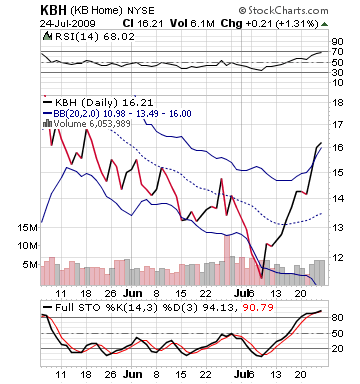

On Monday, the industry will get another major piece of data in new home sales, which is released at 9:00 AM. This barometer of how many new homes were sold in June could help the housing industry but only temporarily. One stock that is extremely overvalued is KB Homes (KBH). KB Homes has seen a 33% gain in the last two weeks. It has moved outside its upper bollinger band, it is way overvalued on RSI, and overbought. If home sales don’t meet expectations, KBH will likely be sold off and KBH will trend lower from the start. Investors can make a nice 2-4% gain on a short sell. If estimates meet or beat expectations, then the housing industry should move up in the morning, but with how toppy the housing market and KB Homes are, KBH should move down from an intraday peak even if the housing report is bullish. Futures for the market are bullish, but that is most likely due to Asia’s bullishness. American orders and stocks were not having the same amount of success.

Entry: Recommend selling short in early if the home report is weak, 45 minutes if report is good.

Exit: We recommend exiting after a 2-4% increase.

Stop Loss: We recommend a 3% stop loss on all buy in prices

Upper Resistance: (lower) 15.00