Positioning for Oil’s Slide

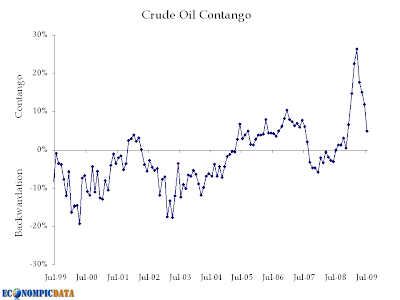

Courtesy of Jake’s Econompic Data

Regular readers of EconomPic shouldn’t be surprised that I believe oil will trend lower in coming months (see here and here for a few posts on the subject). While I in no way believe that history always repeats itself, there are many parallels between sentiment now and as it existed last summer before last year’s crash (concern over inflation causing investors to pour money into commodities / the belief that the worst is behind us).

Not surprising then that the path of oil in 2009 has followed the path we saw in 2008 (hat tip Hugh Hendry in his June commentary for the chart).

But it isn’t only my view on oil that has been the cause of my increased short position in USO (U.S. Oil Fund ETF) via puts. The additional reason is that USO performs poorly when there is contango in the oil market. As detailed in the USO prospectus via Market Folly:

in the event of a crude oil futures market where near month contracts trade at a lower price than next month contracts, a situation described as ‘‘contango’’ in the futures market, then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to decline as it approaches expiration. As a result the total return of the Benchmark Oil Futures Contract would tend to track lower. When compared to total return of other price indices, such as the spot price of crude oil, the impact of backwardation and contango may lead the total return of USOF’s NAV to vary significantly. In the event of a prolonged period of contango, and absent the impact of rising or falling oil prices, this could have a significant negative impact on USOF’s NAV and total return.

And this is exactly what has happened so far this year. The market was in extreme contango (a post on contango more generally is here) which resulted in the ETF underperforming the actual spot price by 40%!

And while no longer extreme, the market does remain in contango.

In addition, this offers an explanation as to why the recent drawdown in crude isn’t necessarily good news for oil bulls. Stephen Schork (via FT):

The market is paying you to build supplies by virtue of the discount on nearby material. If the recent run-up in price was based on real demand for wet barrels, then this discount would disappear, i.e. the market would be moving from contango toward backwardation. That is not the case at this time. Thus, the ongoing drawdown in U.S. crude oil supplies (outside of Cushing) is not demand driven, but rather a function of lower domestic production and fewer imports. In other words, refiners, as any good grocer would tell you, are aggressively emptying the shelves, as it were, of surplus material.

With all that said, there is still reason for concern that the price level will continue to rise. Away from additional investor flows into the asset class, large commodity players are in such control of the price, that regardless of the economic conditions that could be cause for a drop in price, the price may remain elevated. The Oil Drum sums it up eloquently:

The manipulation in the oil market is taking place at a different “meta” level to the Leesons and Hamanakas. The Goldman Sachs and J P Morgan Chase’s of this world do not break rules: if rules are inconvenient to their purpose they have them changed.

The Market is the Manipulation.