"Recession’s Over, Recovery Underway": What’s Missing in Action

Courtesy of Charles Hugh Smith, Of Two Minds

The mainstream media is gleefully hyping "the recession is over, the recovery is underway." Nice, except for everything that’s missing in action.

"The recession is over, the recovery is underway." Exactly what will be driving this fabulous "recovery"? Let’s check in on the usual forces which have powered previous recoveries:

1. Autos/vehicles: missing in action (MIA). Annual sales have plummeted from 17 million vehicles a year to about 9 million a year, and the U.S. probably contains about 30 million surplus/lightly used vehicles ( a number snagged from economist David Rosenberg’s latest report). Modern vehicles can easily last 15-20 year, so the "need" to replace vehicles is rather low. Actual "necessary" replacement might require as few as 5 million vehicles a year.

With unemployment at 16%, assets down by $10 trillion and the FIRE economy (finance, real estate and insurance) in disarray, where does anyone think the consumer borrowing firepower will come from to finance an extra 8 million vehicles a year?

2. Housing/real estate: missing in action (MIA). Let’s see: new home sales down from 1.4 million a year to 350,000 a year and the headlines are screaming "recovery in housing" even as house prices are down 50% from the bubble peak and still declining. The Case-Shiller index just came in at a year-over-year decline of 17% and the market is cheering because it’s a few tenths of a percent "better than expected."

The U.S. has 18.7 million vacant homes and even if you bulldoze a couple million in shrinking rust-belt cities we still have 16.7 million vacant dwellings, plus thousands more foolishly being constructed every year.

Furniture sales and auctions of old furniture are in the ditch; ditto draperies, carpeting, hardwood flooring, etc. etc., much of which is still manufactured in the U.S. No wonder the manufacturing sector is still contracting as well.

The bubble in commercial real estate has yet to pop but the needle is currently being inserted into the balloon. Too many malls, too many strip malls, too many office towers, too many CRE buildings everywhere.

3. FIRE economy: missing in action (MIA). Finance, real estate and insurance were the boomtown industries in the housing bubble. They’re diminished and will never come back; the consumer must save now to avoid a retirement in a cardboard box, flipping houses for profits is history and people are paying off debt, not churning new loans.

4. Healthcare: missing in action (MIA). Everybody and their brother has been touting healthcare as the "growth industry" but since it already consumes 17% of the entire U.S. GDP, there’s very little oxygen left. The ever-expanding entitlements of Medicare and Medicaid are actually being trimmed, and those 15 million people who have lost their jobs and/or benefits can’t go to the doctor and have their insurance carrier billed $10,000 any more. Healthcare has peaked and a growing share of the government’s revenues will be going to pay interest on the ballooning national debt, not expanding healthcare. Any other view is fantasy; the interest on the debt is already $400 billion a year and interest rates haven’t even started rising.

5. Education: missing in action (MIA). This is the other highly touted "always expanding" jobs factory. Tell that to the thousands of teachers, janitors, and administrators being laid off as local government tax revenues crater. And people are finally waking up to the unfortunate fact that private diploma mills are not actually offering much of an edge in the real world; in fact, neither are pricey private universities.

When it comes time to create your own job, nobody cares about your diploma–they only want value and results. The current crop of graduates may be in some sort of elevated state of denial–i.e. believing the job drought will end next year–but the old ploy of going back to graduate school to wait out the recession may not work unless you’re getting a graduate degree in stem cell research or network security. In any event, education is no longer the "guaranteed job factory" because funding for all local government functions is being slashed.

6. Local government: missing in action (MIA). The same can be said for government itself, which continued to add tens of thousands of jobs even as the recession began slashing and burning the private sector economy. The reductions in local government headcount have yet to really kick in, as Federal stimulus funding is staving off cuts that would have resulted from plummeting tax revenues. All the stimulus has done is push the job cuts in state, county and city governments forward into 2010.

All three of these sectors–government, education and healthcare–expanded dramatically because tax revenues skyrocketed as a result of the bubble. For example, look at this chart of the total assessed value of Florida real estate 1990 to 2005: it tripled. Now think of all those luscious property taxes which gushed into local government coffers:

All those expecting unlimited growth in government, education and healthcare seem to forget that all these expanded as a result of the bubble in tax revenues derived from the bubble in credit, stock and bond markets and real estate.

7. Small business: missing in action (MIA). Small businesses are the real job engine of the economy, but unfortunately very few small businesses are expanding and anxious to hire more employees. The vast majority are still trying to stave off insolvency and are looking to cut more hours and staff positions. There simply is no alternative as the State (all levels of government) increases the tax load on small business even as they claim to "care about small business." True, in one way: they care the way parasites care about not killing the host outright but merely bleeding it to the point of near-death.

Unfortunately, the parasites misjudged and their host is expiring.

8. Domestic manufacturing: missing in action (MIA). While the manufacturing sector is still formidable in many areas, as we all know much has been shipped overseas for the basic, classic capitalist reason that the move increased profits stupendously. Now, however, a "recovery" or "export boom" in manufacturing cannot pull the entire economy any longer because the manufacturing sector has shrunk to such a small percentage of the overall economy.

9. Structural reform: missing in action (MIA). Instead of cleaning out the embezzlement, fraud, gaming, leverage, exploitation, obfuscation, etc. at the heart of the U.S. financial sector, the guilty have been rewarded with gargantuan bailouts and the innocent (taxpayers) punished. The public pension systems which boosted retirement benefits in the bubble years are heading for insolvency but rather than reform them the unions and political lackeys are shoving this reality under the rug lest various interest groups get angered.

Healthcare, a.k.a. sick-care, is in desperate need of deep structural reform but instead we are treated to a Kafka-esque nightmare charade in which another trillion dollars will be squandered "to save money later." The special interests have this "industry" in a chokehold and will only release their grip when the poor old system expires, as it most certainly will, and soon.

10. Strong dollar: missing in action (MIA). If the dollar loses half its current exchange value (as measured by the DXY Dollar Index) as many expect then the cost of all imports such as oil magically double. Thus we could see $130/barrel oil even as the price in gold or other currencies didn’t move at all or actually became cheaper.

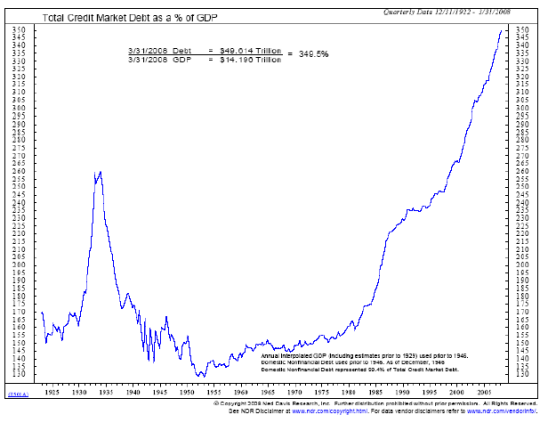

11. Collateral/borrowing power: missing in action (MIA). You’ve probably seen this chart or one like it recently:

With $10 trillion of assets down the drain and the entire economy maxed out on credit, where do economists expect new credit growth to come from? Martians with good credit landing and hurrying into Bank of America for loans?

12. Leadership: missing in action (MIA). We have few leaders in any sector, public or private; we have panderers to various special interests and voting blocs, similar to any run-of-the-mill Third World kleptocracy. To my knowledge only Ron Paul speaks to fundamental issues such as getting rid of the Federal Reserve and the failure of the entire Keynsian "intervention/manipulation of free markets to save them" project. Few speak to the end-state of all government dependent on credit bubbles for its growth and policy: insolvency.

If you want more troubling/revolutionary/annoying analysis, please read Free eBook now available: HTML version: Survival+: Structuring Prosperity for Yourself and the Nation (PDF version (111 pages): Survival+)

Of Two Minds is now available via Kindle:

Of Two Minds blog-Kindle