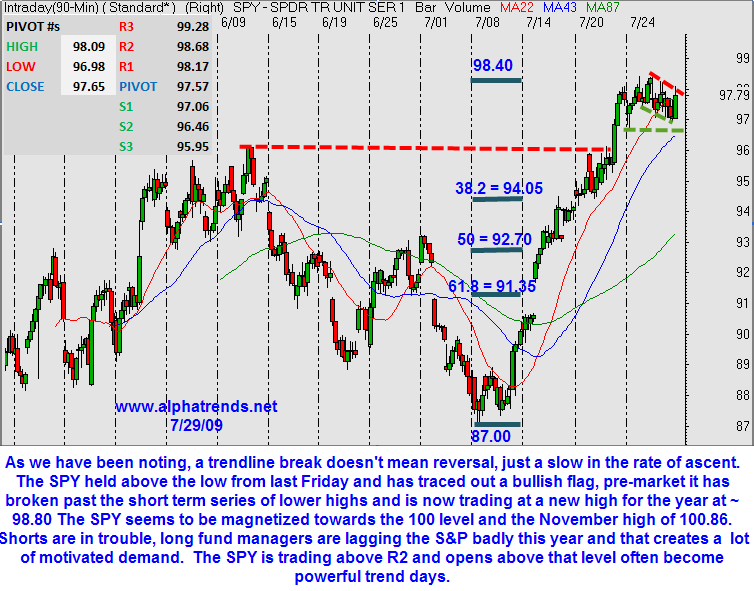

As we can see from AlphaTrends chart, that's going to be a tough breakout and, even if we do make it, can we hold it? In yesterday's post I said we were ready to switch off our brains and BUYBUYBUY the rally and our breakout levels did all hold yesterday but I decided, in Member Chat, that we needed to raise the bar slightly before we started shutting down our thought processes into the weekend. We simply used the 2.5% lines of Dow 9,297, S&P 1,000 (interesting!), Nas 2,017, NYSE 6,438, Rut 562 and SOX 308 in my 10:16 Alert as our official buying breakouts but those same levels gave us a great indicator to get out of our longs and press our shorts as they ALL failed by 11:09.

It is going to be very much up to the GDP report and we have a pretty low-bar expectation of -1.5% but that's a heck of an improvement over last quarter's -5.5% and this earnings season has been nothing if not a celebration of "getting worse more slowly." As we all know, personal consumption makes up 70% of the GDP while government is about 18% and business investment just 12%. Durable goods are only 8% of the GDP while consumables (which includes clothes and, obviously, food and fuel) are 20% and 40% is "services" but 1/4 of that number is Real Estate so that's a little confusing.

As we know, not much is actually getting better but that's not the issue with GDP as we are measuring "growth" compared to the prior 4 quarters and our prior year was a disaster! This is like when a raging fire causes a house to collapse and you stand there looking at the wreckage and say "at least most of the fire is out now."

The good news is the comps just keep getting easier and easier the worse things get so, at some point, you are bound to improve! As you can see from Briefing.com's Real GDP chart on the left, there's a pretty wide disparity between the Real and Nominal GDP and that's because the Real GDP meansures the production of goods and services valued at constant prices. So we aren't producing that much less, we're just getting less for it…

We'll get the scoop at 8:30 but our global partners weren't waiting with the Hang Seng jumping 1.7% and the Nikkei going them a little better with a 1.9% move. Japan had some better-than-expected earnings from the banking sector but it was exporters that led the rally to give the Nikkei a new high for the year as the Yen fell to 96 against the dollar even thought they dollar fell against other currencies (so the Yen fell even harder against the Euro). That enabled Japanese investors to shrug off $67 oil as well as 6-year high unemployment of 5.4% in June, up from 5.2% in May. "We don't envisage an improvement in the employment situation this year and deterioration is a major downside risk for consumption," Goldman Sachs economist Chiwoong Lee wrote in a note.

Consumption can't be that strong in Japan as consumer prices fell at a record pace in June (and this is a country that's had 10 years of deflation so that's a big record!). Prices ding fresh food declined 1.7 percent from a year earlier after sliding 1.1 percent in May, the statistics bureau said today in Tokyo. The decrease, the sharpest since the survey began in 1971, matched the estimate of economists. “It’s difficult to anticipate an economic recovery robust enough to lift Japan’s consumer prices anytime soon,” said Seiji Adachi, a senior economist at Deutsche Securities Inc. in Tokyo. “Prices may be stuck in negative territory beyond next fiscal year, and a rate increase is out of sight.”

Europe is much more subdued ahead of our GDP report. In Monday's Big Chart Review, we identified the CAC as the index most needing improvement with a 40% off target of 3,701 and they haven't even come close to it this week so that's a concern for us. Our other red indicators were Transports (target 1,868) and SOX (target 329) and they too are failing us. That made our Nasdaq move highly suspect and we followed through with our morning plan yesterday to sell our DIA calls into the move up and we ended up adding to those puts as well as our SRS (real estate ultra-shorts) calls. We went naked short on WHR in the $5KP and also shorted FSLR into earnings and GMCR on their rally so I guess you can say we were pretty bearish yesterday, mainly because of the level failure I noted above.

8:30 Update: Well, this is interesting: GDP is down just 1% BUT the last quarter has been revised to down an entire point, to -6.4% from -5.4%. Consumer spending was actually worse than last Q (but not down as sharply from the prior year so less of a negative impact) and what "saved" us this Q was much smaller declines in exports and business spending. Inventory liquidation subtracted less from GDP in the second quarter than it did in the first quarter, 0.83 of a percentage point versus 2.36 percentage points. Real final sales of domestic product, which is GDP less the change in private inventories, decreased at a 0.2% annual rate in the second quarter. First-quarter sales fell by 4.1%. Business spending dropped by 8.9%, after decreasing 39.2% in the first quarter. Investment in structures fell 8.9%. Equipment and software slid by 9.0%.

8:30 Update: Well, this is interesting: GDP is down just 1% BUT the last quarter has been revised to down an entire point, to -6.4% from -5.4%. Consumer spending was actually worse than last Q (but not down as sharply from the prior year so less of a negative impact) and what "saved" us this Q was much smaller declines in exports and business spending. Inventory liquidation subtracted less from GDP in the second quarter than it did in the first quarter, 0.83 of a percentage point versus 2.36 percentage points. Real final sales of domestic product, which is GDP less the change in private inventories, decreased at a 0.2% annual rate in the second quarter. First-quarter sales fell by 4.1%. Business spending dropped by 8.9%, after decreasing 39.2% in the first quarter. Investment in structures fell 8.9%. Equipment and software slid by 9.0%.

So yay – I guess… Business spending didn't drop ANOTHER 39%, it only dropped 9% lower than the already 39% down figure. Excellent! In another bit of "good" news, Trade ADDED 1.38% to the GDP because, even though our exports fell 7%, we imported 15.1% less, giving us a positive move in the balance! Residential fixed investment (housing) only fell 29.3%, which is better than last quarter's 38.2% decrease. As we expected, government spending saved us with a 10.9% increase, adding 2% to the overall GDP. PCE was up 2% so we're not producing anything but at least we're paying more for it!

This is not bullish for the markets and this is certainly not fuel for the S&P to break 1,000 but we've seen the markets rise for dumber reasons so we will continue to let our levels be our guide and see what holds today. I set the upside (see above) and it doesn't look like we're going there today so yesterday's breakdown levels are back in play. Keep in mind that below those, we have some dangerous "air pockets" and we could hit a pretty big correction, especially if oil gives up it's latest round of silliness and gets back below $63, which is the upper end of it's fair range.