The market for Friday is going to come down to the GDP, and its reading. What will it say?

Recession eases; GDP dip smaller than expected

Recession eases; GDP dip smaller than expected

It is hard to tell, but whatever does happen it will be difficult to initiate a spectacular day trade because the market will move so greatly in one direction right out of the gate. Therefore, in order to make the most of movement in the market tomorrow, The Oxen Group wants to play Direxion’s Daily Oil/Energy 3x ETFs, depending on the GDP report.

The market is bullish going into the GDP, with futures up and the President making calls on it Thursday evening. Asia is currently up on their own bullish economic data and a reaction to our positive day. The only person that seems scared of the GDP is me. We were at nearly 5% decline in Q1. Where are we at Q2? Estimates are around 1.5%. I just think that is too low.With unemployment rising, revenues dropping for most companies in their Q2, and really not a strong upswing in good orders and manufacturing numbers, it is hard to imagine GDP rising that greatly.

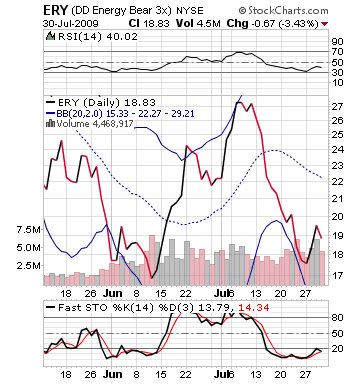

However, even if it does miss, you won’t be able to make a move until everyone already knows that. Therefore, entry/exit will be crucial. If the GDP misses, buy ERY right away. The oil market will sell off and with Chevron reporting earnings, which should be weak, this will give the oil market fuel to the fire to make a downward movement. I would buy into ERY right away if GDP is bad as it should move down throughout the day. ERX should be bought on a pullback from the open, however, take profits quickly here as this stock may peak intraday and move back down, as the market again is toppy like it did Thursday.

Entry: See entry recommendation above.

Exit: We recommend exiting after a 2-4% increase.

Stop Loss: We recommend a 3% stop loss on all buy in prices

Upper Resistance: For ERY, 21.50. For ERX, 33.00