I am starting a new trade as part of my new section here at Phil’s Stock World. I am going to call it the "Gamble of the Day." It will be for all you heavy risk takers that thrive on risking a lot for sizeable gains. I have never done this before, so it may take some time to get it into a nice system of success. But….let’s go for it.

The way it will work is I am going to pick a stock that I think can make considerable movement in after hours and gap up or down significantly that you can buy at the end of one day and sell the next day for some nice profits…I hope.

Today’s Gamble: MedAssets, Inc. (MDAS)

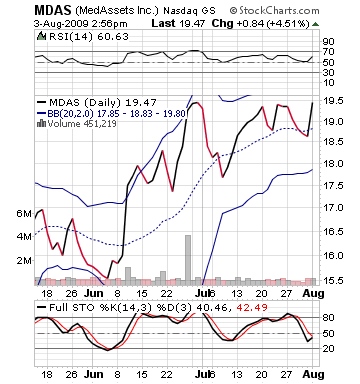

MedAssets will be reporting its Q2 FY09 earnings in after hours today, and it could make for some very interesting movement for the stock. MDAS has trended lower as the whole medical sector has seen less gains over the past few trading sessions. The stock is currently right at a 50 RSI reading, which means that is neither oversold or overbought. It has trended up today going into earnings, but its selling off means that its earnings are not priced into the stock, which is key to being able to have a significant gap.

I like MedAssets because of the successful earnings we have seen in the medical information sector for this quarter. In the past few days we have seen suprise beats from a lot of healthcare information providers, including McKesson Corp. (MCK), HLTH Corp. (HLTH), and AllScripts-Misys Healthcare Solutions Inc. (MDRX). MedAssets most similar competitor McKesson Corp. beat estimates by over 25%, and the company the next day jumped 8%. HLTH jumped 5% the next day, and MDRX bumped up 2%. This was a simple gap up.

MedAssets going into tomorrow is not overbought, so that means it has good potential for a jump. Obviously, if the company misses, it also means that it may not feel as much pain as a company that has already priced in earnings and is expecting something that does not happen. For the full year, the company expects EPS of 0.56 – 0.64, and in Q1 only made 0.11. Estimates for this quarter are just 0.11 and next quarter are just 0.17. Even on the low side of those full year earnings, analysts are below those FY guidance marks that have been reaffirmed by the company twice.

I will not be surprised by a beat.

Good Investing,

David Ristau