For Monday, The Oxen Group is looking at a market that may be moving up early on the day, however, whether or not those gains will be able to be held throughout the morning is crucial. Going into Monday’s trading day, we are seeing futures up to extremely high levels, almost too high. The Dow is up over 80 at 8:00 AM. They are rising on a strong European market and Asian market. Japan was the only major market to close in the red thus far today. Other bullish news includes the AP Economic Stress Index report. The Associated Press said that "foreclosures stabilize in key states." Further, we have good earnings coming in this morning from Humana and Tyson Foods. Humana saw profits rise 34%, beat estimates, and forecasted above full year estimates in there earnings report. Oil is up in early trading, and things are shaping up for a green start. However, the most important data, the ISM Manufacturing Index, does not release until 9 AM, and it will be very crucial to whether or not the market can open so positive and maintain any extended rally this morning.

Buy Pick of the Day: UNH

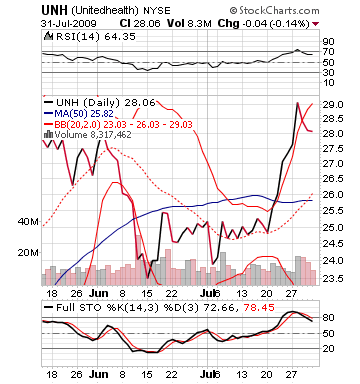

With Humana’s very bullish earnings and 34% profit increase, it should bring some bullishness to healthcare insurers across the board. UnitedHealth Group Inc. (UNH) has seen some great upward movement over the past couple weeks, but it moved back sharply at the end of last week after peaking outside its upper bollinger band on a Credit Suisse upgrade. That downward movement has allowed it to have some room to increase more heavily when compared to some of its competitors. With futures looking solid and the foreign markets looking strong, American markets should hopefully continue the trend. UNH was up over 7% in XETRA trading, but down in other markets. This signals that the stock is heavily overbought and ready to be sold off, and without the Humana news or some catalyst, it may be another sell day. The Humana news, coupled with the market’s future readings, makes me believe, however, this stock could be primed for 2-3% upward movement.

This is how I would recommend playing UNH, in association especially with ISM Manufacturing Index report at 10 AM. If the ISM report is bullish, then the stock will continue to gain on what I expect to be earnings in the first 30 minutes. If its good, then we will want to buy in right away. This way we will get in the stock at a good price and can move up from there as it moves up from there and we can sell off. Wait to get into UNH until around 35-45 minutes into the day. Due to the strong Humana earnings and the continued flow of liquidity, investors will most likely pump stocks back up if they lose momentum. If the ISM report is weaker than expected, we will want to wait for the stock to pullback to levels around 28.15 – 28.20 before buying into the stock. I think it will move back up from a sell off after ISM numbers even if they are weak.

Technically, United Health is definitely overbought and overvalued, however, of the healthcare insurers, it is the farthest below its upper band. The stock should be primed for a 2-3% gain on entry prices recommended.

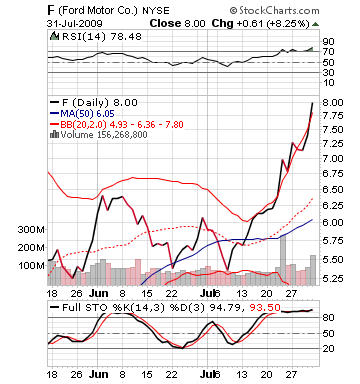

Sell Pick of the Day: F

While I would love to see Ford Motors Co. be the buy pick of the day, this is a stock to short sell for Monday. Ford came out on Sunday, saying they were posting their first monthly sales gain in over two years for the month of July in today’s auto sales reporting. The company was helped by tremendous successes of the "cash for clunkers" program. This is great news for the stock and company, however, for a day trade, we want to pull the trigger on some downward movement and profit taking. The stock is up at an almost 7% gain for its opening price in morning trading. This comes on a stock that in three weeks of trading has moved almost 50% in gains. While long term, the stock may be at a bargain price, it will not be able to hold these gains. I do not doubt that the stock will end in the green, but those levels are just too high for traders to ignore. The stock passed above its bollinger band on Friday. Sound the sirens because that is the ultimate short selling signal of all time. I think you want to buy in on a short sell in the morning after it increase around 1-2% on its opening price with the market’s current forecasting. If the ISM is weak, however, short sell right after the report comes out, and take 2-4% gains.

Good Luck today!

David Ristau