This coming week we have a number of important economic indicators and earnings that will help shed more light on unemployment, the manufacturing sector, and the housing industry. Many analysts and "buzz" seem to be saying this might be a week for profit taking, a nice breather, and a chance for investors to look for bargains to get into what is looking more and more like a long term bull market.

Mike Sheldon from RDM Financial Group said, "A majority of positive earnings news is behind us, so it wouldn’t be surprising at all, in fact it might be healthy for the market, to see a brief pullback to refresh and bring new investors back into the market."

My personal opinion is that the market is in a great position for shorting this week and picking up inverse ETFs. The market has been heavily overbought and overvalued. Almost every sector has jumped way too fast, and a healthy pullback is in order. Technically, the market is way overvalued on RSI, nearing upper bands, overbought on stochastics, and all these indicators together point to the fact that just good news won’t be able to hold the market up this week, and mediocre news will be reason to sell.

Important Economic Indicators This Week:

- Monday: ISM Manufacturing Index, Construction Spending, Domestic Vehicle Sales

- Tuesday: Core PCE Price Index, Personal Spending/Income, Pending Home Sales

- Wednesday: Challenger Job Cuts, Nonfarm Employment Change, Factory Orders, Crude Inventories

- Thursday: Initial Jobless Claims, Natural Gas Storage

- Friday: Nonfarm Payrolls, Unemployment Rate

We are looking at some crucial market moving economic data this week. I think the sectors that will really be market leaders or draggers will be manufacturing, housing, REITs, and energy. I have been bearish on the housing market, as it is overvalued, and people are expecting way too much from it. The all important unemployment rate on Friday may not be as crucial as people think. I think people have priced in that expected 10% rate. If it is better than expected, the market could soar on Friday. And a worse than expected number may not cause a dramatic drop.

Important Earnings This Week:

- Monday Pre-Market: Humana (HUM), Loews (L), Marathon Oil (MRO), Tyson Foods (TSN)

- Monday After-Hours: Centex Corp. (CNX), Chesapeake Energy (CHK), Pulte Homes (PHM)

- Tuesday Pre-Market: CVS Caremark (CVS), Simon Properties (SPG)

- Tuesday After-Hours: Kraft Foods (KFT), News Corp. (NWSA)

- Wednesday Pre-Market: P&G (PG), Transocean (RIG)

- Wednesday After-Hours: Cisco Systems (CSCO), Prudential (PRU)

- Thursday Pre-Market: Comcast (CMCSA), DIRECTV (DTV),

- Friday Pre-Market: Ritchie Bros. (RBA)

So, as we can see, many homebuilders will be reporting. I don’t like to predict earnings, and my guess is most of these companies will beat estimates as everyone has. The question, though, is how will the market react? I think earnings will have to really be stellar to keep on pulling the market up. The good earnings and better than expected earnings are priced into these companies now, so anything below great is actually bad. With how overbought all these stocks are, it will be hard to keep the momentum going.

Buy of the Week: SRS

For the reasons listed above, my buy of the week is Ultrashort Proshares Home and Real Estate (SRS). The stock is at its all-time lowest price ever currently in its entire history. The housing stocks have been on a rampage with the great earnings season and some bullish data. That rally, however, should not be able to last. As Allen Greenspan warned on ABC’s “This Week” with George Stephanopoulos, while he is optimistic about the economy, he is worried the housing industry could have a secondary pullback as demand weakens with continuing rising unemployment. With earnings coming from Pulte Homes, DR Horton, Simon Property Groups, Beazer Homes, and other REITs and residential home builders, there are many of chances for disappointment. Additionally, pending home sales, will be getting a boost in estimates due to the new home sales index. If that even comes relatively close to missing, the market will sell off and SRS will rise. Technically, SRS is very oversold and close to its lower Bollinger band. The moving average is around 20 per share, but it is currently near 15. I just think there has been way too much optimism. Two years of problems should not be reflected in two weeks of data and earnings. The Tuesday pre-market earnings are really key. If you want to play risky get in on bargain prices Monday or wait for Tuesday. If they are bad, SRS should go green the rest of the week after so much selling, and you should still make some good profits.

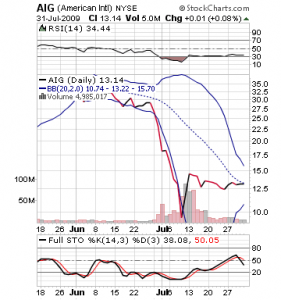

Sell of the Week: AIG

I hope most people don’t own this stock. It is a perfect candidate to short sell for this week. The stock should see some downward movement to start the week after getting downgrades from Moody’s Corp. over the weekend for two of its units, American General Finance Corp. and International Lease Finance Corp. The two units were downgraded one notch to practically junk territory, and they were put on watch for further downgrades. AIG over the past three weeks, in the bull market, rallied and then has traded sideways over the past week. The company has a lot of room for downward movement, and since the stock is heavily traded, it should see a lot of sellers taking their quick profits. I am expecting it to do poorly in the general market pullback I’m expecting this week. If the insurance agencies releasing earnings this week don’t beat earnings and forecast exceptionally, the whole market will face downward pressure, AIG more than most. Prudential on Thursday afternoon is important and will influence AIG’s Friday fate. I like to short the stock on a rise tomorrow, as futures are still positive for tomorrow.

Good Investing,

David Ristau