Well, yesterday, I decided to no longer just be in this bear camp, but I am pretty neutral ready to throw myself to the wind on day to day movement. Today, I am sitting back in the bear camp, but it is just a one day thing. The spark is the ADP Employment Change, which showed that 371,000 private sector employees lost their jobs in July. It was higher than expected and is a precursor to Friday’s numbers. The futures were just slightly lower at 8:10 AM going into the report at 8:15 AM, but the futures have dropped much more since that report. I don’t think this is like yesterday because there was still some good news to buoy the loss in consumer spending.

Today, at 10:00 AM we still have those ISM non-manufacturing index and factory orders. This, though, are much lower rated economic data compared to the employment change vs. the consumer income compared to pending home sales. Other reasons to be worried are that while P&G narrowly beat expectations, the futures are down on a profit drop. In Asia, today, the market opened slightly higher but receded throughout the day. This was due to what analysts commented was profit taking, investors pricing in higher than expected earnings, and awaiting jobs data. To me that is a red flag…at least for today. Some weak earnings came in from bigger institutions, such as, Transocean, Boyd Gaming, and Marsh & McClellan. For these reasons, I am ready to take two short sales for today’s market.

The short sale I am more excited about and will place in the usual Buy Pick of the Day is…

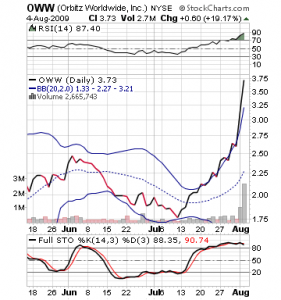

Short Sale of the Day #1: Orbitz Worldwide Inc. (OWW) – Welcome to the world of jumping 16% in one day going into earnings and topping out. Orbitz did beat earnings, hitting a profit of $10 million by cutting costs, while watching a revenue drop of 19%. However, the company hit an EPS of 0.12, while analysts hit -0.06. Those are definitely great earnings, and I realize that. However, with the way the stock worked going into earnings, I think that beat was priced in when Expedia released earnings. The company has jumped over 50% in five trading days. The stock will gap up going into the morning for sure, and it may end in the green. Yet, the way the stock has moved up, I expect profit taking to occur for OWW as the earnings report has finally come out. This trade will work similar the way Ford worked going into auto sales. Everyone knew sales would be good, and they were. However, the stock was a great short sale from open to close dropping 4%.

Short Sale of the Day #1: Orbitz Worldwide Inc. (OWW) – Welcome to the world of jumping 16% in one day going into earnings and topping out. Orbitz did beat earnings, hitting a profit of $10 million by cutting costs, while watching a revenue drop of 19%. However, the company hit an EPS of 0.12, while analysts hit -0.06. Those are definitely great earnings, and I realize that. However, with the way the stock worked going into earnings, I think that beat was priced in when Expedia released earnings. The company has jumped over 50% in five trading days. The stock will gap up going into the morning for sure, and it may end in the green. Yet, the way the stock has moved up, I expect profit taking to occur for OWW as the earnings report has finally come out. This trade will work similar the way Ford worked going into auto sales. Everyone knew sales would be good, and they were. However, the stock was a great short sale from open to close dropping 4%.

Entry – The early trading pre-market for Orbitz is up another 13% to 4.20. That is just way, way too high. Buy this stock on a higher open, but I think you can even wait to buy in at 4.30 – 4.35 in the first ten to fifteen minutes.

Exit – I would think that you can see some really nice movement on this stock. I would not settle for less than 3% from entry up to 4%, looking for an exit around 4.15 to 4.10 on a 4.30 entry. We are looking for downward movement around 0.15 – 0.20.

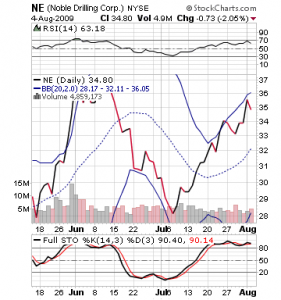

Short Sale of the Day #2: Noble Corp. (NE) – Another company that should have some significant downward momentum is  Noble Corp. The company is a contract drilling company that provides offshore drilling units, ships to transport oil, and is highly connected to oil. The company released earnings back on July 22, and has moved over 10% since reporting those earnings that were strong. However, this morning Transocean Ltd. (RIG), a very similar company to Noble Corp., missed earnings. With the market conditions and the similarities of these companies, I expect RIG’s earnings to bring down Noble Corp. I don’t want to play RIG because it is already down 4% in pre-market trading, and we don’t want to be shorting into a stock that has already seen that downward movement. Noble should open at a much less lower level, and it, therefore, has much more ability to drop on the news and the market sentiment. The stock is overbought and heavily overvalued, technically, like most stocks.

Noble Corp. The company is a contract drilling company that provides offshore drilling units, ships to transport oil, and is highly connected to oil. The company released earnings back on July 22, and has moved over 10% since reporting those earnings that were strong. However, this morning Transocean Ltd. (RIG), a very similar company to Noble Corp., missed earnings. With the market conditions and the similarities of these companies, I expect RIG’s earnings to bring down Noble Corp. I don’t want to play RIG because it is already down 4% in pre-market trading, and we don’t want to be shorting into a stock that has already seen that downward movement. Noble should open at a much less lower level, and it, therefore, has much more ability to drop on the news and the market sentiment. The stock is overbought and heavily overvalued, technically, like most stocks.

Entry – I am not getting any pre-market numbers on this stock, but I would expect it to open down 1% or so, which puts the stock around 34.40 – 34.50. I think we should buy in right away at the market open. I think that things will drop right away in the morning in the market for this sector, so I want to be in right at the entry.

Exit – I think we want to take 2-3% off the entry prices of the open. So, if 34.40, 33.70 on the low side 33.50 on the high side will be what we are looking for.