US Housing in a Deep Dive Says Buba

Courtesy of Jesse’s Café Américain

Courtesy of Jesse’s Café Américain

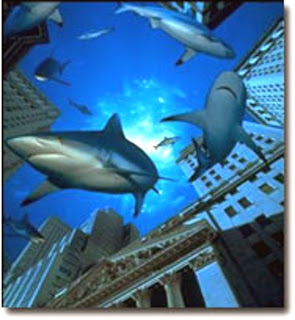

Do banks ever stop swimming?

Ben will need to print quite a bit more manure to throw on those green shoots, tout suite.

Its almost feeding time.

Bloomberg

‘Underwater’ Mortgages to Hit 48%, Deutsche Bank Says

By Jody Shenn

August 5, 2009 15:32 EDT

Aug. 5 (Bloomberg) — Almost half of U.S. homeowners with a mortgage are likely to owe more than their properties are worth before the housing recession ends, Deutsche Bank AG said.

The percentage of “underwater” loans may rise to 48 percent, or 25 million homes, as prices drop through the first quarter of 2011, Karen Weaver and Ying Shen, analysts in New York at Deutsche Bank, wrote in a report today.

As of March 31, the share of homes mortgaged for more than their value was 26 percent, or about 14 million properties, according to Deutsche Bank. Further deterioration will depress consumer spending and boost defaults by borrowers who face unemployment, divorce, disability or other financial challenges, the securitization analysts said.

As of March 31, the share of homes mortgaged for more than their value was 26 percent, or about 14 million properties, according to Deutsche Bank. Further deterioration will depress consumer spending and boost defaults by borrowers who face unemployment, divorce, disability or other financial challenges, the securitization analysts said.

“Borrowers may also ‘ruthlessly’ or strategically default even without such life events,” they wrote…

Home prices will decline another 14 percent on average, the analysts wrote.