I have to travel this morning, and I won’t be able to write the report at the usual time. That is why it is going out now. I will be available for comments and questions throughout the morning and day. What I am going to do is provide a similar report to the typical one, but I am also going to include some more guidance later this morning based on what could happen either way this morning.

So, as we all know, today is job reports day. The unemployment numbers, the payrolls, the hours worked, and all the job data will be released at 8:30 AM. It is highly anticipated, but it raises a lot of questions. For example, is the data already priced in? We have known for quite some time we were going to 10% unemployment. If we hit that, will it scare the markets? If we beat, how much will it help the market? Have we gone too far up that news that is better than expected but still pretty awful enough to keep a rally? Those are tough questions. What I do believe is that if the numbers are good, we are not going to want to be shorting a lot of things. If they are bad, we don’t want to bank on a lot of upward movement on a buy.

So, as we all know, today is job reports day. The unemployment numbers, the payrolls, the hours worked, and all the job data will be released at 8:30 AM. It is highly anticipated, but it raises a lot of questions. For example, is the data already priced in? We have known for quite some time we were going to 10% unemployment. If we hit that, will it scare the markets? If we beat, how much will it help the market? Have we gone too far up that news that is better than expected but still pretty awful enough to keep a rally? Those are tough questions. What I do believe is that if the numbers are good, we are not going to want to be shorting a lot of things. If they are bad, we don’t want to bank on a lot of upward movement on a buy.

How to play this then? What I want to do is find a way to almost hedge the job reports or undermine it a bit. So, I am looking for other big news that will play a role in the markets. One of those bits is NVIDIA’s (NVDA) earnings. The company improved its profits, year over year, by 8%, and it beat EPS estimates by 350%. Further, the company was up 8.5% in after hours. The news was very bullish for the chip sector, which has not seen as great of a rally and pull backs as of late. Another important piece of information was the fact that Japan Airlines reported a Q2 $1 billion loss, which was more money lost in all of 2008.

Going into tomorrow, the futures are currently mostly slightly down as Asia and Europe are both losing as expectations are not looking good, according to those continents, for American job data. When the reports are released, we will want to watch those future levels very closely to see how the market reacts. That will help you gauge how well or poorly the market might actually end up doing.

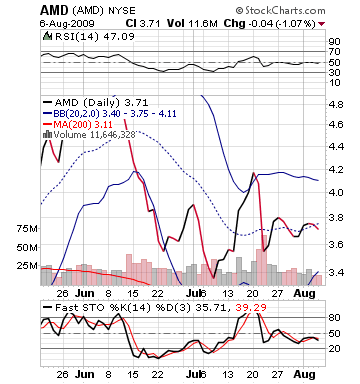

Buy Pick of the Day/Short Pick of the Day: Advanced Micro Devices Inc. (AMD)

AMD will benefit from those very positive NVDA earnings that appear to be bolstering the entire Nasdaq currently. The company will definitely make a gap up no matter what the jobs data says. What it does from there, though, really depends on the data. If the data is bad then this has become a really great short off those higher levels. If the report beats expectations, then I would want to buy on a slight pullback at the beginning of the day. Again, you will want to check back for exact entrance and exit levels.

AMD will benefit from those very positive NVDA earnings that appear to be bolstering the entire Nasdaq currently. The company will definitely make a gap up no matter what the jobs data says. What it does from there, though, really depends on the data. If the data is bad then this has become a really great short off those higher levels. If the report beats expectations, then I would want to buy on a slight pullback at the beginning of the day. Again, you will want to check back for exact entrance and exit levels.

The reason I like AMD is because the stock is at a completely sideways stand still. The stock is right at 50 on the RSI, meaning it is neither overvalued nor undervalued. The stock is right at a medium between bought and sold. The stock is a bit below its three month moving average. This is very good because investors are trying to break it out either up or down. With the NVDA news it should be able to gap up, but the job numbers could erase any early gains.

AMD really needs to be making a move, and the NVDA earnings and job reports force current investors to decide to be a seller or holder on the data.

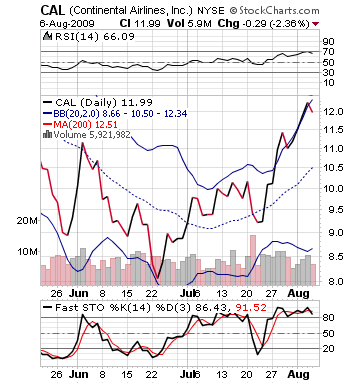

Sell Pick of the Day: Airlines – Continental Airlines

I think that it could be a weak day in the airlines. If there is a beat on the job reports, which I don’t expect at all to happen, then airlines will be a perfect short sell. This industry is  probably at the top of being overvalued and overbought. As a catalyst to help selling was Japan Airlines’ loss of $1 billion in one quarter. The conditions for Japanese airlines are definitely different, but it cannot go unnoticed. If the jobs data is bad, as well, it will compound this report, making these stocks very weak.

probably at the top of being overvalued and overbought. As a catalyst to help selling was Japan Airlines’ loss of $1 billion in one quarter. The conditions for Japanese airlines are definitely different, but it cannot go unnoticed. If the jobs data is bad, as well, it will compound this report, making these stocks very weak.

One stock, in particular, that is due for correction is Continental Airlines. The stock is extremely overvalued and overbought. It is trading right below that upper bollinger band, and it just came below it today. The stock has risen nearly 33% in the past few weeks, and it should be time for a correction. Things are not as hunky dory in this market as many think.

Look for more on entry and exit, and how I want to play this based on jobs data in updates.

Good Investing,

David Ristau