Post-Crash Dynamics

Courtesy of John P. Hussman, Ph.D.

Courtesy of John P. Hussman, Ph.D.

The U.S. economy lost a quarter of a million jobs in July. Meanwhile, over 400,000 workers abandoned the labor force (and are therefore no longer counted among the unemployed), which prompted a slight decline in the unemployment rate despite the job losses. In the context of an economy still strained by high levels of consumer debt and still record delinquency and foreclosure rates, labor market conditions are still troublesome. Still, the pace of job losses and new unemployment claims has clearly softened from the pace we observed early in the year.

If we knew that this was a standard economic downturn, we might conclude that the recent improvements are durable. However, nothing convinces us that this is a standard economic downturn. As for market action, the major indices have generally been strong, as has breadth (as measured by advances versus declines), but the “investor sponsorship” evident from trading volume has been uncharacteristically dismal compared with initial advances of past bull markets. So here too, we have very strong concerns that the recent advance may not be as durable as investors appear to believe.

All of that said, we aren’t inclined to fight even what we view as errant analysis, and the Strategic Growth Fund has about 1% of assets allocated to near-the-money index call options – about enough to gradually close down about 40% of our hedge in the event that the market advances markedly higher from here, but without putting us at risk of much loss in the event of failure. With investors now anticipating and pricing in a sustained economic recovery, as well as a spectacular earnings rebound (see Bill Hester’s piece – Earnings Growth Forecasts May Require a Robust Economic Recovery – additional link below), a lot of things will have to go right from here in order to sustain higher prices than we currently observe.

Frankly, our call option allocation here is something of a paean to a notion – a sustained economic recovery and new bull market – that I have no belief in whatsoever. But at this point, the broad strength in the major indices, even lacking volume sponsorship or favorable valuation, requires that we allow for the possibility of additional investor speculation. Even if we do observe such an outcome, it’s difficult to envision that the S&P 500 will clear the 1000 level for all time, without revisiting it again in the months (not to mention years) ahead. To the extent that we don’t clear 1000 permanently, establishing investment exposure here with anything but call options amounts to a game of trying to “ride” the market higher and to get out before it returns to or below current levels. With the market strenuously overbought already, that game strikes me as exquisitely difficult to get right. Hence the use of a modest allocation to call options only, without closing our downside hedges.

Frankly, our call option allocation here is something of a paean to a notion – a sustained economic recovery and new bull market – that I have no belief in whatsoever. But at this point, the broad strength in the major indices, even lacking volume sponsorship or favorable valuation, requires that we allow for the possibility of additional investor speculation. Even if we do observe such an outcome, it’s difficult to envision that the S&P 500 will clear the 1000 level for all time, without revisiting it again in the months (not to mention years) ahead. To the extent that we don’t clear 1000 permanently, establishing investment exposure here with anything but call options amounts to a game of trying to “ride” the market higher and to get out before it returns to or below current levels. With the market strenuously overbought already, that game strikes me as exquisitely difficult to get right. Hence the use of a modest allocation to call options only, without closing our downside hedges.

Call me skeptical. But if you look carefully at the economic data that shows improvement, and correct for the impact of government outlays, it is difficult to find anything but continued deterioration in private demand and investment. What we do see is a government that has run what is now a trillion dollar deficit year-to-date, representing some 7% of GDP. That sort of tab will undoubtedly buy some amount of Cool-Aid, but it has been something of a disappointment to watch how eagerly investors have guzzled it down. It is not at all clear that short-term, deficit-financed improvement necessarily implies sustained growth in the context of a deleveraging cycle. This is like somebody borrowing money from their Uncle and then celebrating that their income has gone up.

Moreover, it might be enticing to look at a chart of the S&P 500 and envision a quick return to 2007 highs and beyond, but it is important to recognize that those highs were based on profit margins about 50% above historical norms, combined with an elevated P/E multiple of about 19 against those earnings. Even if the economy is poised for a sustained recovery here, the belief that those joint outliers will be quickly re-established goes against historical precedent.

Moreover, it might be enticing to look at a chart of the S&P 500 and envision a quick return to 2007 highs and beyond, but it is important to recognize that those highs were based on profit margins about 50% above historical norms, combined with an elevated P/E multiple of about 19 against those earnings. Even if the economy is poised for a sustained recovery here, the belief that those joint outliers will be quickly re-established goes against historical precedent.

In any event, we’ve got some call option coverage to gradually allow participation if this run continues.

Post-Crash Dynamics

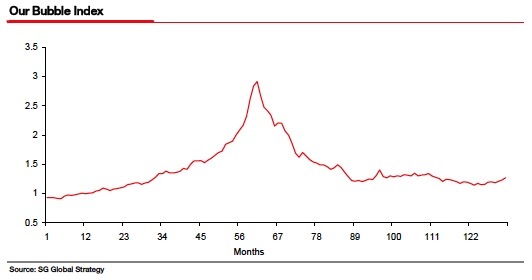

When markets crashes are coupled with changes in the fundamentals that supported the preceding bubble – as we observed in the post-1929 market, the gold market of the 1980’s, and the post-1990 Japanese market, and currently observe in the deflation of the recent debt bubble – they typically do not recover quickly. Indeed, the hallmark of these post-crash markets is the very extended sideways adjustment that they experience, generally for many years.

The chart below updates the position of the S&P 500 (red line) in the context of other post-crash bubbles. The horizontal axis is measured in months. Note that very strong and extended interim advances have been part and parcel of similar experiences.

The intent here is not to argue that the U.S. stock market must by necessity follow the same extended adjustment that followed prior burst bubbles. Rather, the intent is to underscore that it is dangerous to infer that structural difficulties have vanished simply because a market enjoys a strong post-crash advance.

My friend James Montier at SocGen draws a similar pattern from a larger historical collection of post-crash bubbles – including the above instances, as well as others such as the South Sea Bubble and the Railroad Bubble of the 1840’s. The underlying theme is that the adjustment period following the bursting of a bubble tends to be very extended.

I understand the eagerness of investors to put the entire credit crisis behind them and look ahead to a recovery of the prior highs, but these hopes are based on the assumption that a positive boost to GDP, once achieved, will propagate into a full-fledged recovery. Again, however, no economic improvement is evident in the behavior of consumer demand and capital spending, once you adjust for the impact of government spending (particularly transfer payments).

Yes, we have observed a massive reallocation of global resources from savers (who have bought newly issued Treasury debt) toward mismanaged financial institutions that made bad loans. Yes, there are certainly favorable short-run economic numbers that can be achieved by running a year-to-date federal deficit equal to seven percent of the U.S. economy. The problem is that this money does not come from nowhere. We have effectively sold an identical ownership claim on our future production to those individuals and foreign governments who bought the Treasuries. Government “stimulus” is not free money. The continued attempt to bail out bad loans with good resources (largely foreign savings) will end up costing our nation some of our most productive assets, which will be acquired by foreign countries and investors for years to come.

From my perspective, investors have gotten entirely too far ahead of themselves with the assumption of a sustained recovery. Nevertheless, we again have about 1% of assets in index call options to allow for further market strength if it emerges. I expect that if they move “in the money,” we will leave their strike prices unchanged unless market internals deteriorate measurably. Leaving our call option strikes fixed would open us up to losing on any subsequent downturn whatever we make on a further advance, but again, our opening exposure is fairly limited. We’ll let the market put us into a more constructive position if investors are inclined to continue their exuberance here.

Market Climate

As of last week, the Market Climate for stocks was characterized by unfavorable valuation and mixed market action, but enough evidence of speculation (reasonable or not) to own about 1% of assets in index call options. We are otherwise hedged.

During earnings season, there are often days where most of the performance of the Fund is driven by significant movement in a small handful of Fund holdings. These movements can be positive or negative, and may cause the Fund to move differently than one would expect that the Fund “should” move based on our investment position, and on what the market did on a particular day. As I’ve frequently noted, short-term movements, particularly day-to-day, are not effective indicators of the Fund’s investment position, or predictors of Fund performance. Performance is always best measured from the peak of one market cycle to the peak of the next, or over an extended period of years representing neither a peak-to-trough nor trough-to-peak movement in the market.

Based on our standard methodology, which considers normalized earnings (not the far more depressed level of current earnings) the S&P 500 is now priced to deliver 10-year total returns in the area of 6.9% annually. This is a figure that has historically been associated with bull market peaks, including 1969 and 1987. In most instances, such valuations turned out badly in reasonably short order. It is, however, true that prospective returns were even worse prior to the 1929 crash, and during the bulk of the period since 1996, so there have been some historical periods where speculators have driven valuations to higher levels, and during these times, it has not been particularly effective to stand in front of speculators saying “no, stop, don’t. “

Ultimately, all of those periods where valuations were driven to higher levels were followed by poor long-term returns, with stocks generally trading at lower levels at some point one or more years later. So we can say with a reasonable degree of confidence that even if the present advance continues, investors will most likely observe current levels again either within the current market cycle or (worse) several years out. Overvalued markets simply do not “run away” for good. Still, it can be painful or at least unenjoyable to remain defensive during a speculative advance. Our approach is sensitive enough to that to have a small allocation (about 1% of assets) in index call options here, but is not sensitive enough to risk what may very well be substantial deterioration if the expected continuation of economic improvement fails to materialize.

In bonds, the Market Climate last week was characterized by relatively neutral yield levels and moderately unfavorable yield pressures. As usual, we will tend to increase our bond durations on spikes in yield (weakness in bond prices), and these are becoming more interesting – though not strongly attractive. Our most recent extension of durations was in the 3.9%-4% area for 10-year Treasuries, and a push materially above that level would represent enough of a yield pickup to move a modest amount of short-maturity Treasury allocations into mid-maturities. As I’ve noted in recent weeks, we don’t anticipate much in the way of extended directional movement in the bond market, so most of our portfolio activity will probably tend to be modest reallocations in response to yield fluctuations. At the point where we observe either fresh inflation pressure or general declines in Treasury yields (i.e. general downward pressure on real interest rates), I expect that we’ll observe fresh pressure on the U.S. dollar and upward pressure on precious metals shares. For now, those markets are likely to be somewhat range-bound as well.

We’ve got an extended economic adjustment ahead. Most probably far longer than most investors presently expect. As always, we’ll take our opportunities as the evidence emerges, with the objective of outperforming our respective benchmarks over the complete market cycle, and an additional emphasis on defending capital over the course of that cycle.

NEW from Bill Hester: Earnings Growth Forecasts May Require a Robust Economic Recovery

Prospectuses for the Hussman Strategic Growth Fund and the Hussman Strategic Total Return Fund, as well as Fund reports and other information, are available by clicking "The Funds" menu button from any page of this website. All rights reserved and actively enforced.

Photo from http://stevebrodner.com/art/.