Strategically induced stock market bubble? Karl Denninger thinks so. See also Stocks: The latest Fed bubble in Fortune (H/t Zero Hedge). – Ilene

Another Bottom Caller: Remember This One

Courtesy of Karl Denninger at The Market Ticker

Let’s keep this image around for later…..

Several times I have tried to reach these folks with my commentary. Several times they have ignored me.

I guess guest columnists are not welcome, nor is any sort of balance in their commentary.

Calling "all clear, go back in the pool" after a 50% run in the market is one of the dumbest things you can listen to, but heh, that’s what they’re all doing here. Cramer, Kudlow, Kneale, Liz Sonders, pick someone from Fall (your account balance) Street and that’s what they’re doing.

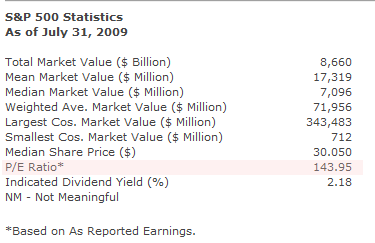

Nobody talks about risk and reward on Fall Street, because that would force them to talk about valuations. You know, that pesky thing that S&P tabulates? Let’s have a look.

One hundred and forty-three?!

Yeah.

Don’t worry, its time to "buy buy buy" (snicker), even though the P/E on the S&P 500 has never been this high. In fact, its more than double its all-time high print, which incidentally happened as the 00/01 train wreck began.

Is it different this time? I guess it could be.

But what about the probability that it’s different this time? If you’ve got 100+ years of history on valuations and over time they tend to correct back to the mean, what sort of growth is implied by a P/E of 143.95, and what are the odds that this growth in earnings (and GDP) will be realized?

That, my friends, is the key question for investors (not traders, who can – and are – playing what is, quite-clearly from a valuation perspective, yet another hype-driven bubble.)