Wheee, that was fun!

Wheee, that was fun!

There's nothing like a good sell-off when you are prepared for it. Roll out of bed and drop 20 feet unexpectedly and it's terrifying but willingly climb to the top of a waterslide to plunge 50 feet and it's exhilarating. By the way, if you do drop 20 feet rolling out of bed – it may be a good idea to move your bed and if your virtual portfolio took a big hit in yesterday's very minor correction, it may be time to move some of those positions as well.

We were not just prepared for a drop, we were almost bored stiff waiting for it but, in the end, the call to cash out our bull plays into the weekend was a very solid one and now we have 150 points to go before we have to consider a re-entry at those levels. So far, we have a very minor 1.5% pullback off a 15% run since July 13th so 1.5% more to go for a 20% retrace. That will give us 9,118 on the Dow which is, amazingly right about our 5% rule off 8,650 (9,082 to be exact) so let's call that 9,100 and VERY significant. Our other 3% pullback lines are S&P 980, Nasdaq 1,950, NYSE 6,400 and Russell 550. This is the great thing about being the creator of the 5% rule – I can round off if I want to because, IT'S MY RULE.

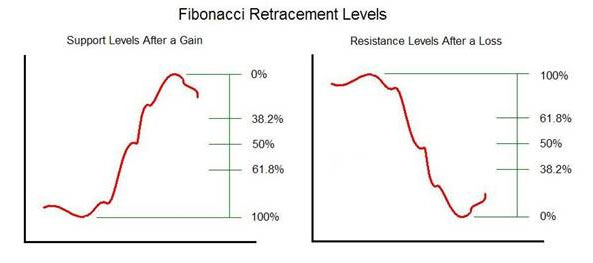

I'm sure if Fibonacci were alive today he'd say: "38.2%, 40% – what's the difference, it's just a guideline!" Fibonacci discovered his sequences in his search for a way to blend math, art and nature. Clearly the stock market is ruled by math and human nature but too many chartists forget the art of the thing. That's why our 5% rule bends around psychological chart resistance points, the flexibility we have to take market psychology into account is what allows us to hit our targets on the nose a year in advance but it's the "art" of it that tends to bother people because it does require an intelligent person to look at a chart and decide which moves are real and which are not.

Why did we predict the market would be 40% off the top at the end of Q2 earnings last November? It was a combination of our fundamental analysis of the real damage that had been done to the economy as BSC, LEH and others imploded and the above Fibonacci series, that paints 50% off the bottom and 38.2% off the top as significant points as well as our 5% rule, which places great significance on 20% market moves. That led us to conclude that the proper Dow trading range for Q2 would have a mid-point of 8,650 and 5% below it was (again, we round) 8,200 and 5% above was 9,100. This is roughly equal to S&P 880 to 980, Nasdaq 1,750 to 1,950, NYSE 5,700 to 6,300 and Russell 500 to 550.

As I pointed out a few weeks ago, this does not make me bullish or bearish in my outlook, only "rangeish." At the top of our range, we flip bearish until the market proves to us that our range should be expanded. We've been very demanding with our breakout zone and I've insisted we need to see 100% of our indexes over the line. When push came to shove – it was only the Russell that couldn't punch through 574, just like it was only the NYSE that couldn't break out for us in June and led us to flip bearish right at the top.

The lack of a retrace was getting downright unhealthy. As I often complain – rapid rises in the market, especially when accomplished through what we call "stick saves" create virtual air pockets in stock prices and make investing more and more dangerous as we move up. A simple example I use for members is to imagine the stock market has just 100 total shares. In March, those 100 shares were worth $1,000 and there was $1,000 sitting on the sidelines in cash. Shares are bought and sold every day but it doesn't really matter as they are never all bought or all sold. The bottom line is that perhaps 25% of the cash actually moved off the sidelines but the market has gained 50% since March. Where does that leave us? Well that means we now have 100 shares of stock "worth" $1,500 but now there is only $750 on the sidelines to buy it.

The lack of a retrace was getting downright unhealthy. As I often complain – rapid rises in the market, especially when accomplished through what we call "stick saves" create virtual air pockets in stock prices and make investing more and more dangerous as we move up. A simple example I use for members is to imagine the stock market has just 100 total shares. In March, those 100 shares were worth $1,000 and there was $1,000 sitting on the sidelines in cash. Shares are bought and sold every day but it doesn't really matter as they are never all bought or all sold. The bottom line is that perhaps 25% of the cash actually moved off the sidelines but the market has gained 50% since March. Where does that leave us? Well that means we now have 100 shares of stock "worth" $1,500 but now there is only $750 on the sidelines to buy it.

That makes it exponentially harder to move the market higher as the values grow as it takes more and more sideline capital to grow the market each day. Since low interest rates, unemployment and debt are still keeping the sideline capital from growing – the market holders face a diminishing pool of sellers. In fact, the entire expansion of "value" of the market is an illusion as it WAS possible in March to exchange 100% of the stocks for the cash on the sidelines for $1,000 (assuming everyone on the sidelines would make the trade). Now that we have USED 25% of the sideline money to inflate the apparent value of the stocks, we have a serious problem because, even if EVERY SINGLE DOLLAR of sideline capital were exchanged for stocks in a panic sale, there is only enough to pay out 50% of the market's current "value."

I'm not saying that the market is drastically overvalued but I am saying that, if we were to have a panic event, we could have a drop that makes last year look like practice. This is the problem with moving the peg of market value up the field without letting the growth be fueled by real earnings and real capital inflows. In a normal market, stocks and sideline cash keep pace with each other as buyers and sellers balance out and the rises in the market are driven by capital inflows which come from the creation of additional REAL wealth, not the paper wealth of a virtual portfolio increase. None of that has happened here. Real wealth was destroyed by the Trillions, the market dropped to reflect that fact but now over 25% of the stocks are back within 20% of their all-time highs. It does pay to consider that we may have gone a bit too far, too fast…

So color me skeptical and let's move on to review today's markets:

Apropos of the above discussion, China's Shanghai Composite plunged to the 5% rule today on concerns that a pullback in bank lending will drain the liquidity that has, so far, fueled the 100% rally in 2009. Yes the Shanghai was at 588 in 2007 so 350 may not seem too extreme but I'm sure anyone who owned a home in 2007 knows what would happen if you tried to get that price now. The same is true in the US markets – they were never WORTH what they were selling for in 2007 so get returning to those levels right out of your head. Your 1,000 square-foot Manhattan apartment was only worth $1M to an idiot and if you found that idiot and sold it to him 2 years ago then congratulations and, if you were that idiot – you may in fact be the last link in the chain of the "greater fool theory." As a disclosure, a long FXP position (ultra-short China) is a mainstay hedge in our $100,000 Virtual Portfolio.

China does not do things in half measures, bank lending didn't just pull back a bit in July – it was off 77% from June! That's only 23% away from zero… "Even though the Chinese government insists it'll keep a loose monetary policy, the reality may be that some credit tightening measures have already been implemented," said Ben Kwong, chief operating officer at KGI Asia. "The market is worried that a significant slowdown in lending means less liquidity and [investors are] taking profits." Mr. Kwong also listed the fall in commodity prices because of the U.S. dollar's recent strength as a contributor to the slump. "Investors seem to be nervous after sizable rallies recently, and they also want to check whether the Fed hints at an 'exit strategy' timing during the meeting," said Choi Seong-lak at SK Securities in Seoul, referring to the potential for the Fed to reverse monetary easing measures.

The Hang Seng dropped 3% (638 points), back to last week's low at 20,400 and the Nikkei dropped just 1.4% back to fill the gap to Friday's close at 10,400 but that index was clearly saved by the bell as the dollar came under attack iin overnight trading and sparked a sell-off in exporters. The Baltic Dry Index hit the 2.5% rule and finished the day at 2,623, falling below our 2,750 line and likely on it's way to retesting 2,000, where we'll be happy to buy shipping stocks again. What's wrong in Asia? Well one fine example is this Bloomberg story that lead inventories in China are now double the size of the global stockpiles held at the London Metal Exchange. Evidence suggests that the entire Q2 materials rally was little more than China stockpiling raw materials. That means, at best, there will be much less demand going forward as China works off their inventory or, at worst, the global metals market are under constant threat of collapse should China shift policy and decide to sell back some of what they bought.

Europe is hanging on ahead of the US open (9am) depsite reports that the UK jobless rate hit a 13-year high of 7.8%. Bank of England Governor Mervyn King warned when presenting new economic forecasts Wednesday that totals will continue rising "for the foreseeable future." 20% of the people aged 16-25 (not in school) are out of work with 925,000 people under the age of 25 looking for jobs in a country the size of California. Even the U.K's best-qualified graduates are struggling to find work as the employment situation deteriorates. Oliver Courtney, an Oxford graduate about to complete a master's degree from another elite college, said he has been sending out applications for the past year and has secured only two interviews. "Pretty much every student, no matter how qualified, is in the same boat. There's going to be a real sense of despair unless things start to pick up," he said. The UK actually has one of the LOWEST rates of unemployment in the EU.

We'll be watching our 3% levels to hold on the pullback as well as our usual breakout levels which we went over in the morning post but keep in mind we have the Fed at 2:15 and a single word one way or another can send the market flying. In all likelihood, we'll be working our way into a DIA spread today, those usually work well on Fed weeks but we reamain cautiously bearish as down still seems like the easier path for the markets. Like any good waterslide, we're in the tunnel and we're not sure where it's going to stop – Wheee!