Looking over today’s poor economic data, Tom Lindmark at But Then What concludes the numbers were "just plain dismal." – Ilene

A Spate Of Bad Economic News

This was a good morning not to get out of bed. All that euphoria about being out of the depression woods got tempered a bit by a good dose of ugly financial news.

This was a good morning not to get out of bed. All that euphoria about being out of the depression woods got tempered a bit by a good dose of ugly financial news.

Employment

The DOL reported that initial claims for unemployment insurance were up 4,000 last week to 558,000. Of more concern, the four-week moving average increased 8,500 to 565,000. This breaks the down trend in claims but they are still 93,750 below the peak.

The WSJ Real Time Economics blog reports that mass layoffs were still widespread in the second quarter.

Employers engaged in 2,994 mass layoffs last quarter, the Labor Department said Wednesday, taking 534,881 workers off the job. That’s more than 70% higher than the 1,756 mass layoff events in the same period last year, as the economy continued to weaken through the end of 2008 and into the beginning of this year.

Only 38% of the firms that engaged in mass layoffs said they expect to hire back some of the workers. Earlier this year 51% said they planned to recall some of those laid off.

And just to round out this sunny collection, the Kansas City Fed is out with a paper that suggests it could take a decade to get unemployment down to the 6% range. The authors of the report don’t see a recovery that typically follows a recession. They point to the lingering effects of the credit crisis as the reason for the long recovery period. One has to wonder how many mini-recessions we might have in that decade of recovery. (Link Here)

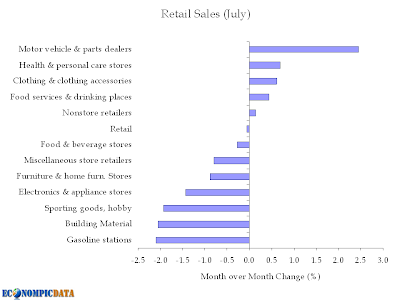

Retail Sales

This was a big surprise. Most economists and analysts expected to see an increase in retail sales driven by “cash for clunkers.” Indeed, car sales increased nicely by 2.4% but the consumer cut back elsewhere. Overall, retail sales were down 0.1% for July and off 8.3% year-over-year. If you throw out car sales, retail sales were down 0.6%.

I think it’s fair to say that the consumer has its pocketbook snapped shut. They’re either rebuilding balance sheets of they are lucky enough to have jobs or hanging on by their fingertips. I’m beginning to think that it may be more of the latter than we suppose.

From Jake at EconomPicData.com, here is a graphic representation of sales by category.

Foreclosures

Realty Trac reported that foreclosures rose 7% from June to July and are up 32% YOY. There were 360,149 foreclosure filings in July or one for every 355 houses in the country. Nevada came in first followed by Arizona and California.

A couple of weeks ago, I wrote that we might be seeing the foreclosure pig work its way through the python and that it didn’t appear that there was more food going in the snake’s mouth. I think I might have been wrong. It seems as if we aren’t as far through the process as I thought.

So there you have it. You can’t spin these numbers, they’re just plain dismal.

More: here (Housing Wire-Foreclosures) and here NYT (Retail Sales) and here (WSJ Economists Reactions To Retail Sales).