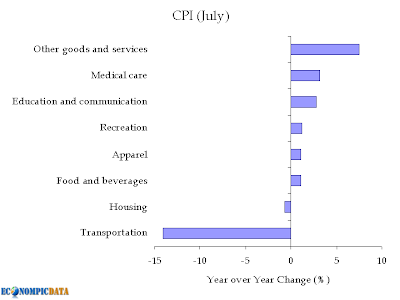

CPI Down Most Since 1950

Courtesy of Jake at Econompic Data

I was right and wrong. Right in the fact that year over year CPI was lower than expected (down 2.1%), but wrong in the month over month change (flat as expected, but down on a non-seasonally adjusted basis). But, long bonds are rallying thus far (we’ll see what happens post Industrial Production data) so I am happy. WSJ Reports:

U.S. consumer prices fell last month at their fastest annual pace since 1950, an indication that inflation isn’t a threat to the economy or the Federal Reserve. The consumer price index was unchanged on a monthly basis in July from June, the Labor Department said Friday, matching economist expectations, according to a Dow Jones Newswires survey.

The core CPI, which excludes food and energy prices, rose 0.1%, which was also in line with expectations. Unrounded, the CPI posted no change last month. The core CPI advanced 0.091% unrounded.

Consumer prices plunged 2.1% compared to one year ago, the largest 12-month decline since January 1950. Most Fed officials think a positive inflation rate around 2% is consistent with their dual mandate of price stability and maximum employment.