I woke up this morning thinking today would probably be a weaker day. I switched on the computer and went to check out the futures, and I could not believe my eyes. The Dow was down 180 points, the Nasdaq was down 30 points, and the S&P was down 22 points. Eeek!

What is with all the downward momentum? It began on Friday with some weak economic data from the Michigan Consumer Sentiment Index and neutral core price indexes. That ignited fears in the Asian markets, which were down more than 3% across all the major Asian indices. One of the catalysts for that sell off and the negative futures was a worse than expected GDP number from Japan. The combination of growing fears about the consumer and GDP began a market plummet. The one interesting aspect to note about the market was it dropped significantly and traded pretty much sideways throughout the day in that very negative zone.

What is with all the downward momentum? It began on Friday with some weak economic data from the Michigan Consumer Sentiment Index and neutral core price indexes. That ignited fears in the Asian markets, which were down more than 3% across all the major Asian indices. One of the catalysts for that sell off and the negative futures was a worse than expected GDP number from Japan. The combination of growing fears about the consumer and GDP began a market plummet. The one interesting aspect to note about the market was it dropped significantly and traded pretty much sideways throughout the day in that very negative zone.

Also adding to the mixture was the closing of Colonial Bank, announced this weekend. The bank’s closing was the sixth largest in the history of the country, and it should be a "gentle" reminder to investors that the financials are not out of the woods just yet. Additionally, the week started off on a poor note for earnings as Lowes Inc. (LOW) reported a 19% drop in profits earning $759 million or 0.51 EPS. That number missed consensus estimates that had placed Lowes’ earnings at 0.54 cents per share. The stock is down 11.50%, and the miss does not bode well for the housing sector.

We will be getting some interesting and important economic data before the market opens. My only concern is that the market’s downward momentum cannot be harnessed unless these numbers are really exceptional. At 8:30 AM we have the NY Empire State Manufacturing Index. The industrial production numbers on Friday were very solid, but the market had already made up its mind and took it lower. The most important indicator is at 9:00 AM, which is the TIC Net Long Term Transactions Index. This index measures the difference in value between US purchases of long-term foreign securities and foreign purchases of US long-term securities. The expectations are for a positive number in favor of US securities by $17.7 billion over foreign securities. Definitely watch out for these tow indicators. They are not market movers, but they could help bring up some of those pre-market levels, which would actually be more positive if we think the market is going to tank.

So, how to play this very negative looking day?

I want to find either an inverse ETF or two short sales that will be able to do well in a sell day. However, a lot of stocks and ETFs are going to open a lot lower, and I am not sure they will have the kind of movement I am wanting. For example, SRS is already up 7.33% going into the open. That level is just too high.

8:35 AM Update: The NY Empire State Manufacturing Index was pretty positive, showing its first growth since 2007. The Index shows improving manufacturing for New York state. Futures have improved off those lows.

Short Sale of the Day #1 (Buy Pick of the Day): The Gap Inc. (GPS)

I think retail will probably be one of the weakest sectors of today. Most of these similar clothing retailers, including Abercrombie, American Eagle, and Urban Outfitters are down over 3.5% in pre-market trading. Gap is down less than 1%. This appears to me to be a really great short sale opportunity. If the market is going to really sell off today, then most stocks are going to follow suit (duh David). Yet, what happens to a stock that opens in the green or at neutral. The market’s downward pressure is going to create a lot of sellers, and it will break out of its resistance level for a lot of downward movement.

The Gap Inc. has benefited significantly from a number of better than expected retail earnings this week. In the past month, the stock has gained more than 25%, and it gained 5% just last week. The stock is reporting its earnings on Thursday, which is part of the reason why it is not seeing the sort of selling pressure ANF and URBN are seeing, since they already released earnings. Yet, if the stock breaks the 18.50 levels, it should move down a lot further from there.

One of the other aspects of the stock I like is that its fast stochastics just have started to move downwards, signaling that there is mounting selling pressure for the stock. This trade is a trend technical trade with the fundamentals lying in the market as a whole. On Friday, Gap actually received an upgrade and ended in the green. Today, I think profit taking from traders who bought Friday and last week on the good earnings of other retailers will help move this stock down.

One of the other aspects of the stock I like is that its fast stochastics just have started to move downwards, signaling that there is mounting selling pressure for the stock. This trade is a trend technical trade with the fundamentals lying in the market as a whole. On Friday, Gap actually received an upgrade and ended in the green. Today, I think profit taking from traders who bought Friday and last week on the good earnings of other retailers will help move this stock down.

Check back for my morning levels alert for specific entry and exit points.

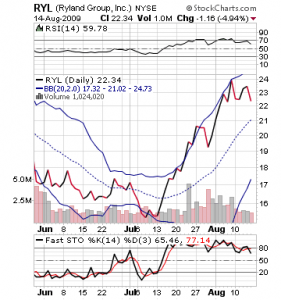

Short Sale of the Day #2: The Ryland Group Inc. (RYL)

The housing sector. It is one of the most overvalued sectors compared to the weakness of its fundamentals. I don’t think getting one batch of somewhat positive economic data and a couple really great earnings should make us jump into a water that for the past two years has been filled with piranha and sharks just because the water got a bit murkier. The housing market still has a long way to come.

Today should be a pretty weak day in the residential and REIT areas. One of those stocks will be The Ryland Group Inc. I like this stock for many of the same reasons of Gap. The individual stock does not have a ton of issues, but when most of the stocks in the sector are down over 6% in pre-market trading and RYL is only down 1.5%, it makes me wonder. It is not like this stock has some reason to not follow the pack. The company had one of the worst earnings reports of the sector, and it actually has moved up since that report. Personally, I think those earnings are yet to be priced into the stock as it is above market value.

The Lowes’ earnings, further, should be pretty disastrous for all the housing stocks, especially ones connected to residential construction. The NY Empire State Manufacturing Index has pushed up the morning levels, but we are still down nearly 2% going into today.

On the technical side, RYL is highly overvalued, even after the hit housing stocks took Friday. It is up almost 50% in one month, but the stock is starting to gain downward momentum on stochastics. Additionally, the stock’s RSI is starting to fall. Its been a long time since I have seen technicals that say anything compelling, but these look like they are pointing for a 2-3 point retracement for RYL in the near term.

Check back in morning levels for entry and exit points.

Good Investing,

David Ristau