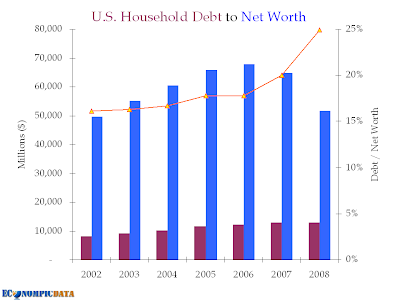

Household Debt to Net Worth Ratio Spiking

Courtesy of Jake’s Econompic Data

Below we take a look at household debt, net worth, and the subsequent household debt to net worth ratio (think of it as an analogy to a company’s debt / equity ratio). What we’ve seen is a large decline in household net worth, but unfortunately we haven’t seen a corresponding decline in household debt.

As a result, the debt to net worth ratio has risen from about 17% in 2006, to 25% by the end of 2008.

But of course, that’s not the whole story. Looking at the most recent data (hat tip Zero Hedge) from 2007, we see that the above debt to net worth ratio is significantly higher for the lower and middle class who have saddled themselves with debt in recent years (the lower level for the lower class tends to be smaller as the lowest percentile do not have much / any debt, as they typically do not have access to financing).

That said, the lower and middle class had debt in the range of 30-40% of their net worth in 2007, as compared to the 20% average for all individuals as of that date. The upper 10-percentile had debt at an average of only 10% of their net worth.

So where does this currently stand? While the richest were impacted the most in $$ terms, the lower to middle class tend to have more of their net worth stashed in real estate (i.e. their home). Thus, while the financial markets rebounded in 2009, it is likely that the lower to middle class didn’t reap the reward (housing has continued to fall). Thus, when data is updated for 2008 and 2009 (though too early to judge where we’ll end up this year), expect the discrepency to be even wider.

Source: Federal Reserve (hat tip reader Bryan Keller) / Zero Hedge