I am sorry for the lateness of my post, but I had some major computer issues all morning that were hindering my ability to post earlier. For that same reason, this post will be shorter than usual, as I will be just getting right into the meat of things.

Due to my lateness, I am able to base my picks off of the 8:30 AM economic data. Housing starts and building permits for July were released this morning, missing expectations to the lower side. Building permits came in at 0.56M, which was actually below the June levels. Housing starts came in at 0.58M, while expectations had been for 0.60M. Additionally, the PPI and Core PPI were released this morning, missing estimates. All four major economic indicators missed.

Due to my lateness, I am able to base my picks off of the 8:30 AM economic data. Housing starts and building permits for July were released this morning, missing expectations to the lower side. Building permits came in at 0.56M, which was actually below the June levels. Housing starts came in at 0.58M, while expectations had been for 0.60M. Additionally, the PPI and Core PPI were released this morning, missing estimates. All four major economic indicators missed.

Going into that data, the market was trading futures up around 35 points at the Dow. At 8:40 AM, the futures are now at . The market definitely wants to rebound today, and I think it will start the day that way. However, with this weak economic and continued sentiment that we need a pullback. I think we will top out this morning after some rising, and then make a move back down from there.

When that happens? I don’t think we will have to wait long. If we get up 50-60 points on the Dow, profit taking will occur, but it may not take that long.

Buy Pick of the Day: Ultrashort Proshares Real Estate (SRS)

As of 9:45 AM, the ETF is still trading down, but it is making its move back up in pre-market trading. It is still down 1%. SRS had a pretty major jump yesterday of almost 10%, and some profit taking might be expected. However, that is where you and I will benefit. There is going to be some early downward pressure on the ETF, and it probably will open lower than expected. Yet, you can’t rally on Home Depot’s beating expectations alone when there were four missed economic indicators. The housing sector has become way too overvalued, and it is need of more correction still.

Across the board, everything is pointing down this morning. Saks’ earnings were a miss as were Solarfun Power’s. The only other good news is Target beat expectations, but that was already priced in after Wal-Mart beat expectations. I just don’t see anything to move this market. The upwards open we are seeing is just reactionary to the losses taken yesterday. I don’t think we will see the same losses as yesterday, but that is good for intraday movement because SRS won’t open 8% higher, and it can make a large swing one way or another.

The global markets did trade up, but our own economic data should outweigh the data of Germany. We don’t really have any other indicators coming out during the day, and so, I think this higher open will be very short lived.

The global markets did trade up, but our own economic data should outweigh the data of Germany. We don’t really have any other indicators coming out during the day, and so, I think this higher open will be very short lived.

On the charts, SRS is still undervalued on RSI, it is still oversold, and it has upward room to grow to 20 before it gets toppy. The stock has moved up a lot on fast stochastics because of its jump yesterday, but even that indicator still could move upwards.

Check back at the morning levels for closer entry and exit prices.

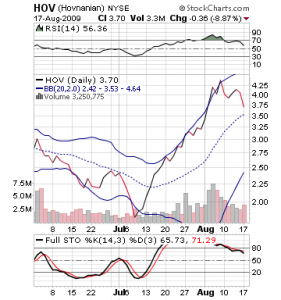

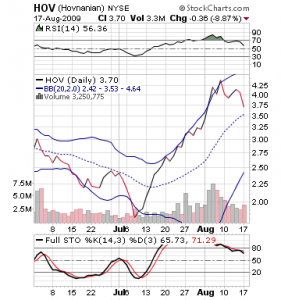

Short Sale of the Day: Hovnanian Enterprises Inc. (HOV)

Shorting any housing stock today is a good play. However, for some reason, Hovnanian is up 3% in pre-market trading. The company does not have any news coming out. The stock fell nearly 10% yesterday, but I see it playing out similar to SRS. It may rise some this morning, but it should top out and trend downwards. The housing data was simply too weak and other economic indicators, to justify any type of run up in the market.

My analysis is similar to SRS. Technically, HOV is still overvalued and overbought. The stock is above its 200 day moving  average, and it should still be able to see a healthy pullback of another 20%. Today, I think it will top out around 4% before sliding back down, as the technicals are starting to show this stock is in a pullback.

average, and it should still be able to see a healthy pullback of another 20%. Today, I think it will top out around 4% before sliding back down, as the technicals are starting to show this stock is in a pullback.

Check back at morning levels for closer entry and exit prices.

Good Investing!

David Ristau