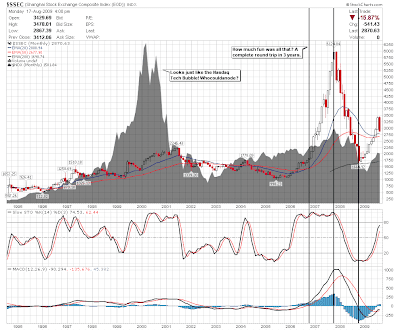

China: Back in a Bear Market

Courtesy of Financial Ninja Ben

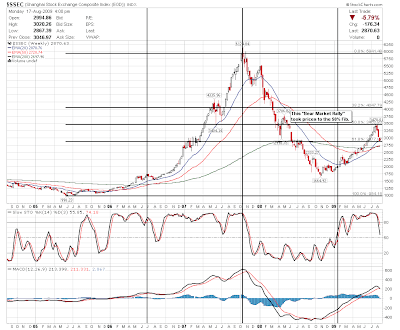

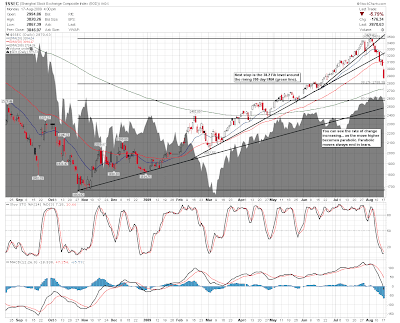

FN: Chinese stock hit that magical 20% peak to trough decline and are now in a "Bear Market"… again. Like I said yesterday: Parabolic Moves Always End in Tears [below].

Stocks Fall as China Slumps; Commodities Drop, Yen, Bonds Rise: "China’s stocks dropped, briefly dragging the benchmark index into a so-called bear market and triggering declines in equities and commodities worldwide. The yen and Treasuries rose as investors sought less risky assets.

The MSCI World Index of 23 developed nations sank 0.4 percent at 8:54 a.m. in New York and futures on the Standard & Poor’s 500 Index slid 1.1 percent. China’s Shanghai Composite Index slumped as much as 5.1 percent, extending its drop from a 2009 high to more than 20 percent, the common definition of a bear market. Copper fell 3.3 percent. The yen strengthened against all 16 of the most-traded currencies tracked by Bloomberg and the pound weakened. The 10-year Treasury yield dropped to its lowest level since July 14.

The U.S. and Chinese governments pledged more than $13 trillion to combat the worst financial crisis since the Great Depression, helping to fuel a nine-month rally in the Shanghai Composite that pushed the index’s price-to-earnings ratio to almost double the valuations for the S&P 500, according to data compiled by Bloomberg. Earnings for Chinese companies that reported since July 8 have trailed analysts’ estimates by 12 percent on average, Bloomberg data show."

Shanghai: Parabolic Moves Always End in Tears

FN: Parabolic moves always end in tears. Always. BTW, thats where the Chinese stimulus money went. From the central banks it went into the corporations and retail investors… and from there straight into the equity markets.