Damien Hoffman makes a case against Nouriel Roubini’s status as all-knowing prophet of doom.

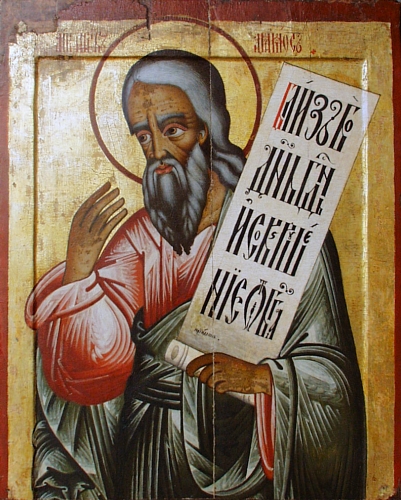

Is Nouriel Roubini a False Prophet?

Courtesy of Damien Hoffman at Wall St. Cheat Sheet

Psychics and prophets have been in business since that other oldest profession. Like the more commonly referred to oldest profession, the secret to success for psychics and prophets is to turn many tricks.

As a lawyer by training, I have been rigorously conditioned to see the logical techniques employed in everything I hear and read the same way Neo from The Matrix sees the 1’s and 0’s underlying superficial reality. So, I am concerned when I watch self-proclaimed psychics and prophets use the equivalent of logical black magic to seduce their prey.

Wall Street has a laundry list of such charlatans. They tend to capture the spotlight during the heat of emotional peaks in the markets because emotion and reason tend to maintain an inverse relationship. During times of crisis we need something, sometimes anything, to reduce our pain and restore order to an uncomfortable new chaos.

During the height of the most recent economic crisis, the media offered the center-stage spotlight to NYU Economics Professor Nouriel Roubini to comfort us with his soma. At the peak of the crash, Roubini was as ubiquitous as Coca-Cola and cellphones. He was the go-to guy because his PR team branded him as “The Prophet of Doom.” A perfect fit when you need someone to call at an overwhelmingly bullish place like Wall Street.

During the height of the most recent economic crisis, the media offered the center-stage spotlight to NYU Economics Professor Nouriel Roubini to comfort us with his soma. At the peak of the crash, Roubini was as ubiquitous as Coca-Cola and cellphones. He was the go-to guy because his PR team branded him as “The Prophet of Doom.” A perfect fit when you need someone to call at an overwhelmingly bullish place like Wall Street.

Roubini is clearly an intelligent fellow who has produced some interesting works. However, just as clearly, he is not a prophet or anything close. More accurately, Roubini has disingenuously promoted himself as nailing the crisis, when truthfully he was wrong until other hard working analysts fixed his broken crystal ball.

Like any lawyer preparing to argue in front of the Supreme Court (of public opinion, in this case), I made sure to do my homework and collect my evidence boxes of smoking guns. Rather than bore you with a full recount, I have pulled the most important comments from each source and linked to the original material for your due diligence pleasure. So, without further ado, I respectfully address the court:

As we can see, in March 2005 Roubini started by predicting a crisis caused by Foreign Central Banks diversifying out of US Dollars. (See: ‘Does Overseas Appetite for Bonds Put the U.S. Economy at Risk?’) In February 2006, Roubini still solely focused on foreigners diversifying out of US Treasury debt and further incorrectly predicted that “our current patterns of spending above our incomes” would cause a crisis by 2013. (See: ‘Taste of the Future‘.) Given that the credit markets (which Roubini never mentions until others show him the light) imploded recently, I think we can conclude that “spending above our incomes” doesn’t have to do the crisis perp walk. During the same month as The Washington Post article, Roubini’s press releases peppered the New Yorker with his message: “Roubini is among those who fear that America’s profligacy will eventually create a crisis of confidence on the part of its creditors, leading to a run on the dollar, an upward spike in interest rates, and a deep recession.” (See:‘ Moneyman’ and ‘Ominous Warnings and Dire Predictions of the World’s Financial Experts’.)

At a transition point in August 2006 (most likely when Roubini realized he picked the wrong causes), he threw the entire kitchen sink into the center of the causation ring. The USA Today reported, “He [Roubini] spells out a long list of potential risks that could push the country into trouble. Among them: unregulated hedge funds, housing, foreign trade uncertainty, the need to finance the nation’s huge trade deficit, Middle East unrest and the potential for terrorism.” In another article, Roubini added to his laundry list by adding just about everything under the sun: “Among other factors, Roubini cites ‘trade protectionism and asset protectionism; hedgy and trigger-happy investors and rising geopolitical risks; the risk of a disorderly fall in the U.S. dollar; a slush of financial derivatives that are a black box that no-one understands … frothy markets where years of too easy money have created bubbles galore – the latest in housing – that are ready to burst; a bubble of thousands of new hedge funds with inexperienced managers … a housing market whose rout may trigger systemic effects …’” (See: ‘Is Economy Headed to a Soft Landing?’ ‘Surprise: Bears still growling about 1987′ and ‘Recession Isn’t My Greatest Fear’.) How about adding to that list butterflies flapping their wings on the other side of the world, or an attack of the flying space monkeys?

At a transition point in August 2006 (most likely when Roubini realized he picked the wrong causes), he threw the entire kitchen sink into the center of the causation ring. The USA Today reported, “He [Roubini] spells out a long list of potential risks that could push the country into trouble. Among them: unregulated hedge funds, housing, foreign trade uncertainty, the need to finance the nation’s huge trade deficit, Middle East unrest and the potential for terrorism.” In another article, Roubini added to his laundry list by adding just about everything under the sun: “Among other factors, Roubini cites ‘trade protectionism and asset protectionism; hedgy and trigger-happy investors and rising geopolitical risks; the risk of a disorderly fall in the U.S. dollar; a slush of financial derivatives that are a black box that no-one understands … frothy markets where years of too easy money have created bubbles galore – the latest in housing – that are ready to burst; a bubble of thousands of new hedge funds with inexperienced managers … a housing market whose rout may trigger systemic effects …’” (See: ‘Is Economy Headed to a Soft Landing?’ ‘Surprise: Bears still growling about 1987′ and ‘Recession Isn’t My Greatest Fear’.) How about adding to that list butterflies flapping their wings on the other side of the world, or an attack of the flying space monkeys?

This specific tactic — expanding the “prediction” data set of possibilities — may be the most popular for false prophets and psychics. Usually, there will be a group willing to hang on to the one correct cause out of the many incorrectly asserted. Then, afterward, the charlatan works tirelessly to rewrite history or distract his victims from what was exactly said in the past. It’s like a fake shaman warning the villagers of rain (an inevitable fate) by means of angry gods when in fact the true cause was heavy cloud droplets. Yet, once the rain falls he quickly raises his voice about how he “predicted” the rain. Yes, rain followed the shaman’s warning, but this is not a “prediction” for obvious reasons.

Moving along, in September 2006, Roubini spontaneously switched his focus onto a new cause: the housing market. However, as we can see, he still completely misses the most important detail that the cause of the crisis was the funding of houses in the credit markets — not basic economic fundamentals of the underlying housing market. (See: ‘The Descent’.) But can you really blame an economics professor for getting pigeon-holed by his lifelong macroeconomic framework? If Roubini were to have actually found the afikomen (Hebrew translation “dessert”), he would have needed an ear to the extremely niche, real-world Collateralized Debt Obligation (CDO) markets which he had no reason to follow at NYU.

Clearly, the evidence above indicates Roubini never understood that the CDO market was the largest buyer of Mortgage Backed Securities (MBS). Moreover, he never mentioned that once the Fed took away the punchbowl with consecutive rate increases, the ability to refinance crap loans would disappear like a breath in the wind. Rather, Roubini incorrectly attempted to predict that the collapse of the US Dollar would cause the Fed to raise rates, thereby causing “a sharp slowdown of the US and global economy.” (See: ‘Does Overseas Appetite for Bonds Put the U.S. Economy at Risk?’) So, we are left to conclude that Roubini was simply tossing generalities into the press as not to miss the call until too long after the media found another darling.

By this point it must be noted that other bright yet less media friendly economists and fund managers were chattering about the true details of what would ultimately cause the crisis. Thus, Roubini was at liberty to take others’ research and repackage it as his own to a journalist at the New York Times who did not do his fact-checking, Fourth Estate duties. (See: ‘Dr. Doom’.) Once Roubini was legitimized by The New York Times, subsequent journalists assumed the original facts were checked and lazily relied on The Times’ reputation rather than double-check.

By this point it must be noted that other bright yet less media friendly economists and fund managers were chattering about the true details of what would ultimately cause the crisis. Thus, Roubini was at liberty to take others’ research and repackage it as his own to a journalist at the New York Times who did not do his fact-checking, Fourth Estate duties. (See: ‘Dr. Doom’.) Once Roubini was legitimized by The New York Times, subsequent journalists assumed the original facts were checked and lazily relied on The Times’ reputation rather than double-check.

I am not writing this article because I care about Roubini. Like countless others, he is a talking-head trying to make money in a capitalist system. I am writing this article because it is time to give out the medals to the true heroes who put their careers in jeopardy to uncover truths no one wanted to hear — especially the general plasma-screen engorged public, prospective clients, bonus-induced professionals on Wall Street and at real estate/housing related companies, and politicians with record tax collections in their purses.

So, this piece serves two purposes: 1) mainstream journalists need to start fact-checking before allowing one bit of bad journalism to become a false truth heard ’round the world, and 2) I am laying the groundwork and sweeping the streets for the true heroes’ parade. Stay tuned …