The big news coming out this morning was that the Shanghai Composite Index fell 5% today before closing down 4.3%. The retreat the country’s market took should signal investors that stocks might be a bit overvalued. At 7:30 AM, futures were down fairly low, with the Dow set to open 75 points lower and the Nasdaq set to open 15 points lower.

The big news coming out this morning was that the Shanghai Composite Index fell 5% today before closing down 4.3%. The retreat the country’s market took should signal investors that stocks might be a bit overvalued. At 7:30 AM, futures were down fairly low, with the Dow set to open 75 points lower and the Nasdaq set to open 15 points lower.

The rest of the world’s markets have fallen suit, with the rest of Asia trading down around 1% to 1.5%. European markets opened very low, but they have made up some ground. Bad economic data out of Germany and Great Britain concerning falling prices and Britain’s industrial sector are also weighing on those markets.

So, on the agenda for today, well…nothing. No major economic data this morning. At 10:30 AM, the market will get crude inventories, but that is pretty sector specific data. We did however get some mixed to strong earnings. Deere (DE) reported beating estimates with an EPS of 0.99 compared to market’s expectations of 0.57. The 27% decline in profits and the company’s signaling they were seeing their largest sales drop in 50 years, however, has pulled the stock down nearly 3% in pre-market trading. Another solar company reported worse than expected earnings. Yingli Green Energy (YGE) missed estimates, reporting an EPS of -0.44 versus estimates of 0.04.

On my most recent check, futures are slowly creeping up this morning to around 65 now down on the Dow but still 15 on the Nasdaq. Weighing on the Nasdaq were those disappointing Hewlett Packard earnings.

So, what does this all mean for the market?

Well, I think it may be today a day to see where we really stand. There are enough bearish signals out there right now, but if we can’t manage much of a pullback then maybe the large pullback people are expecting won’t happen. What we want to do then to try and avoid putting all are eggs in one basket is to find some stocks that are either way overvalued or undervalued this morning and look for them to have some major movement.

Buy Pick of the Day: Direxion Daily Technology Bear ETF (TYP)

I do not like technology on the day. Tech was sort of lagging a lot of yesterday, and it is has seen a major rise in most indices across the board. The Nasdaq composite (^IXIC) over the past two months has risen over 10%, which is huge for an index. The SPDR Tech ETF (XLK) has seen similar results, as it has increased over 12% in the past month. Most of these ETFs and stocks are right now seeing their bollinger bands squeezing in and tech as a whole looks to me to be a powder keg waiting to explode one way or the other.

With little to no tech earnings left and the market looking helpless, I am venturing to say it’s going down. To play this downward movement, I want to take a look at Direxion’s Daily Technology Bear ETF (TYP). This ETF has dropped over 40%  in the past month, but it can make some serious movement on any given day with its high volatility. The stock looks ready for a breakout; it is way undervalued and oversold. Plenty of reason to think this ETF has some definite potential.

in the past month, but it can make some serious movement on any given day with its high volatility. The stock looks ready for a breakout; it is way undervalued and oversold. Plenty of reason to think this ETF has some definite potential.

The Hewlett Packard earnings were not well received. While the company barely beat estimates, investors latched onto its profit slide of 19%, and it is down over 2% in pre-market trading. Another tech company, Yingli Green is down 8% in pre-market, after the solar chip maker reported a gigantic EPS miss of over 100%.

Another interesting aspect of the ETF is its holdings. TYP is an inverse of Apple, Cisco, Google, Hewlett Packard, Intel, IBM, Microsoft, Oracle, Qualcomm, and the Russell 1000 Tech. Out of those stocks, every single one of them is trading down in pre-market trading close to 1% or more. A lot of these stocks are resilient, but they have all seen heavy movement in an earnings season that was very positive for technology.

The lack of news to move this market, HP’s poorly received earnings, and what could be a major selling day in the markets, all appears to set TYP up for some solid movement.

Check back at the morning levels post for my entry and exit guidance.

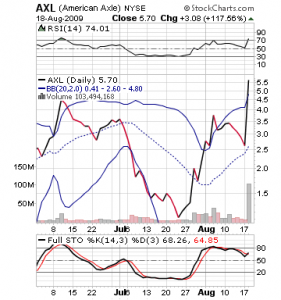

Short Sale of the Day: American Axle and Manufacturing Holdings Inc. (AXL)

Yesterday, this stock jumped 117%. No, that is not a small typing mistake I just made. ONE HUNDRED AND SEVENTEEN PERCENTAGE POINTS. That rise came after winning a credit reprieve based on the positive cash for clunkers program. You know what the result typically of an over 100% increase, going into a very bearish looking day…not positive.

The company is down over 4% in pre-market trading, but I would not even be worried about that high end pullback. I typically don’t want to get involved in something that has moved more than 4% in pre-market, but after 117%, 4% seems pretty small. The long term fundamentals of this stock have not gotten significantly better. The stock did get a positive cash infusion … from a company that just got out of bankruptcy and needed a cash infusion themselves. Moving 117% on the news was just mind blowing.

The stock’s chart, not surprisingly, went from trading right at its 3 month moving average to busting out the top of its bollinger band. Will the stock rise in the next couple weeks? My guess is yes. Today, though, my guess is no. On any type of upward movement like the one seen in AXL, investors are going to want to take profits. The early morning especially should see a dip, and I would not be surprised to see a lot of demand come in as this thing gets down 6-7% on the day. Over the long haul, the stock is very cheap for its future prospects.

band. Will the stock rise in the next couple weeks? My guess is yes. Today, though, my guess is no. On any type of upward movement like the one seen in AXL, investors are going to want to take profits. The early morning especially should see a dip, and I would not be surprised to see a lot of demand come in as this thing gets down 6-7% on the day. Over the long haul, the stock is very cheap for its future prospects.

It is nothing against AXL, but in a bear market day, a stock that jumped that much is going to be under heavy selling pressure.

Check back at the morning levels post for entry and exit guidance.

Good Investing!

David Ristau