In the past couple days, I have heard a number of analysts commenting on how the American markets follow the Shanghai Index very closely. Yesterday, the Shanghai index traded down over 4%. The American market…up! The same was true on Wednesday, as well.

All of Asia was lifted on Thursday as those markets rebounded from heavy losses. The American markets, however, have no need to rebound, so will we still be guided higher on China and Europe’s movement higher?

My belief is that we can throw this out the window. Today, it is all about jobless claims and how they come in as investors are being extremely fickle about their optimism vs. pessimism. If the jobless claims are strong then continued upward movement is most likely the path to take, whereas, a higher than expected number could signal that unemployment is not abating at the rate economists and investors want it to dwindle. That news could send the markets plummeting. We will know that answer at 8:30 AM, and it should turn the futures one way or another, which as of 7:45 AM are slightly higher with the Dow up almost 20 points. The futures, though, look cautious as investors want to see these numbers come in at 8:30.

My belief is that we can throw this out the window. Today, it is all about jobless claims and how they come in as investors are being extremely fickle about their optimism vs. pessimism. If the jobless claims are strong then continued upward movement is most likely the path to take, whereas, a higher than expected number could signal that unemployment is not abating at the rate economists and investors want it to dwindle. That news could send the markets plummeting. We will know that answer at 8:30 AM, and it should turn the futures one way or another, which as of 7:45 AM are slightly higher with the Dow up almost 20 points. The futures, though, look cautious as investors want to see these numbers come in at 8:30.

In other news, Sear’s announced earnings this morning that were much worse than expected, earning an EPS of -0.17 versus expectations of 0.35. Additionally, the company missed revenue targets by $200 million. The company cited the housing crisis and recession as a major hit to the company. Sear’s shares were down over 11% in pre-market trading as of 8:00 AM. On the other hand, the market received beats from Heinz, Buckle, and Suntech Power.

In one major upgrade, Allied Capital Corp. received the nod from Keefe, Bruyette & Woods Inc. The financial analyst for KBW commented that ALD had reach agreements to restructure its debt. This is a big move in the right direction for the company. ALD is up over 6% in morning trading. Duetsche Bank threw Regions Financial (RF), my stock sell of the week, a downgrade because they believe the stock is overvalued due to its recent run up.

Definitely some mixed news coming in this morning, and it appears most of our direction will come from the jobless claims report at 8:30 AM.

8:30 AM Update: The jobless claims for weekly fluctuation in the number of persons filing for unemployment came in higher than expected at a level of 576,000, which is a rise of 15,000 from last week, and it was way above estimates that were looking for a drop in jobless claims from last week. Those estimates were for 548,000 jobs lost.

The 10:00 AM Manufacturing Index will still be important to the market, but futures have fallen into the red on the news.

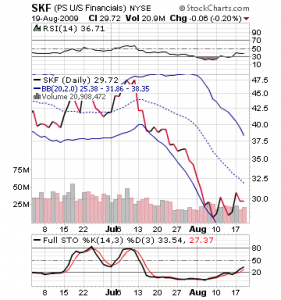

Buy Pick of the Day: Ultra Proshares Financials/Ultrashort Proshares Financials (UYG/SKF)

I think the easy bet is that the markets are going to decrease on the bad jobs report, but the futures really are yet to reflect the news. They have moved down at 8:45 AM, but they really have not moved down to the levels that would be significant. I think we should be worried about the Philly Manufacturing Index to move the market up and down for the day, as well. I think this will be a major market mover due to how bullish the manufacturing data was one week ago. Therefore, I am not buying until after this comes out. If it comes out bullish, I want to move my money into UYG. If its bearish, I like SKF. One would think that the market would pullback, but I am not seeing any movement downwards.

I think the easy bet is that the markets are going to decrease on the bad jobs report, but the futures really are yet to reflect the news. They have moved down at 8:45 AM, but they really have not moved down to the levels that would be significant. I think we should be worried about the Philly Manufacturing Index to move the market up and down for the day, as well. I think this will be a major market mover due to how bullish the manufacturing data was one week ago. Therefore, I am not buying until after this comes out. If it comes out bullish, I want to move my money into UYG. If its bearish, I like SKF. One would think that the market would pullback, but I am not seeing any movement downwards.

I also don’t think the market is going to make a ton of movement off the gate. It might dip a bit lower, but UYG and SKF are both trading below 1% up and down, respectively.

Does manufacturing have a ton to do with banking? Not exactly. What it does affect is market sentiment, and that is a fundamental of this market. I can make a ton of cases for why the financials are bullish and why they can be bearish, so I am waiting for some signals. The market has confused me and beaten me up the past couple days. I want something solid before I buy into this thing.

UYG has a lot of upward movement capabilities up to 5.50 or more. SKF has upward capabilities, as well. When that Philly Manufacturing Index comes out at 10 AM, we are going to pull the trigger on whichever way that Index goes. The market is looking for direction, and this index will be extremely important to today’s movement.

I say enter the stock right on the news breaking in whichever way those numbers come into the market. My bet is on UYG for the day, but I have been wrong before and am being cautious today.

Check back at 10 AM for my entry place and exit.

Short Sale of the Day: JC Penney Co. Inc. (JCP)

JC Penney seems to be a very nice short sale for today’s trading session for Monday. A number of reasons for this short sale that begin with the Sear’s earnings. The company’s earnings were extremely weak. The company was hit mostly in its housing and appliance industry, whereas JC Penney does not have a significant housing department. However, a 13% drop in Sear’s should hinder the lower end department stores, such as JCP and Kohl’s, due to its worse than expected earnings.

However, in my opinion, this is not even the largest problem for JCP. The company, on Monday, lowered their Q3 guidance below analyst estimates. The market sold off on Monday, but the stock recovered Tuesday, and traded sideways on Wednesday. With the Sear’s news acting as a catalyst, I am thinking we should start to see these numbers priced into JCP. If they are not priced in today, they have to be at some point.

The jobs data came in worse than expected. This should also hurt the market as a whole, and be a further catalyst for JCP. I like that its morning levels are not even down 1% with all those factors weighing against the stock, and I look for the stock to falter today and see a major selloff throughout the morning into the day.

The jobs data came in worse than expected. This should also hurt the market as a whole, and be a further catalyst for JCP. I like that its morning levels are not even down 1% with all those factors weighing against the stock, and I look for the stock to falter today and see a major selloff throughout the morning into the day.

On the charts, JCP is still has come down off of its highs in the 34s to the 31s over the past week and a half, but the stock is still above its 3 month moving average, which is right at 29 points per share. The stock is showing a lot of downward momentum on slow stochastics, on fast stochastics, and the RSI is hanging right around 50. The stock is a downward trend, and this should also help pull the plug on this one.

Check back for morning levels for entry/exit points.

Good Investing!

David Ristau