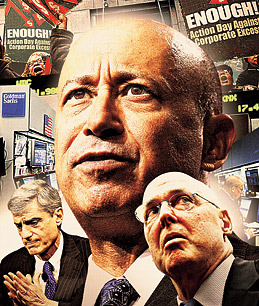

The Rage over Goldman Sachs

By William D. Cohan, courtesy of TIME

By William D. Cohan, courtesy of TIME

Lloyd Blankfein, the 54-year-old chairman and CEO of Goldman Sachs, is powerfully perplexed. In the past six months, his investment-banking and securities-trading firm has roared ahead in profitability by taking risks — that other firms would not — for itself and its clients in an edgy market. It has paid back the billions of dollars, and then some, of taxpayer money the government forced it to take last October; raised billions of dollars in capital from private investors, including $5 billion from Warren Buffett; and urged its cadre of well-paid and high-performing executives to show some restraint on the conspicuous-consumption front.

For this, the level of resentment and ire directed at Goldman — from Congress, from competitors, from the media, from the public — has never been higher. Blankfein, only the 11th leader of the 140-year-old firm, is having a tough time understanding why.

A recent story in Rolling Stone, of all places, in which the author described Goldman as a "great vampire squid wrapped around the face of humanity," has been particularly troubling to him. "Oddly enough, the Rolling Stone article tapped into something," he says in an interview. "I saw it as gonzo, over-the-top writing that some people might find fun to read. I was shocked that others saw it as being supporting evidence that Goldman Sachs had burned down the Reichstag, shot the Archduke Ferdinand and fired on Fort Sumter." Suddenly a firm that few Americans know or understand has become part of the zeitgeist, the symbol of irresponsible Wall Street excess, the recovery from which has pushed the nation’s treasury to the brink.

It’s an odd contradiction: an excelling company being reviled in a country that embraces the profit motive. And without question, Goldman Sachs under Blankfein has recalibrated, in very large numbers, its place as Wall Street’s most astute, most opaque and most influential firm. In the first and second quarters of 2009, the company earned $5.3 billion in net income, the most profitable six-month stretch in Goldman’s history. Goldman’s stock has more than tripled since its low last November, to more than $160 per share.

The U.S. unemployment rate has risen too, nearing 10%. In stark contrast, Goldman Sachs has set aside some $11.36 billion so far in 2009 in total compensation and benefits for its 29,400 employees. That’s about on pace with the record payout the firm made in 2007, at the height of the bubble. Thanks to Andrew Cuomo, the New York State attorney general, we know that in 2008, while Goldman earned $2.3 billion for the year, it paid out $4.82 billion in bonuses, giving 953 employees at least $1 million each and 78 executives $5 million or more (although Goldman’s top five officers, including Blankfein, declined a bonus).

Goldman’s riches have deflected the spotlight from what should be great story fodder: Blankfein’s personal journey from one of New York City’s poorest neighborhoods to its most élite investment bank — and his astounding rise within Goldman. Instead, he has to explain Goldman’s performance — and connections — in the face of the nation’s epic financial calamity.

Friends in High Places

Not least of those explanations has to do with Blankfein’s appearance in the call logs of Henry Paulson, his predecessor as Goldman CEO, who was Treasury Secretary while the financial crisis started to unfold in early 2007 up until January 2009. For instance, in the week after Paulson allowed Lehman Brothers to collapse into bankruptcy last Sept. 15 — and while the Secretary was playing a major role in deciding whether to pump $85 billion into the rescue of insurance behemoth AIG — Paulson and Blankfein spoke 24 times. On one level it makes sense: a Treasury official discussing a financial crisis with a trusted expert and industry leader. A mention in a call log is not the same as an actual conversation, Blankfein correctly points out. He recalls only a handful of actual conversations with Paulson or Timothy Geithner, then the president of the New York Fed. "Now, that was AIG week," he says, "but it was also breaking the buck on [money-market firm] First Reserve week, and it was the week when Lehman’s bankruptcy caused huge problems in the prime brokerage system in London. There were a million things that I would have been talking to Geithner or [Paulson] about."

The confounding thing, of course, is that after the bailout of AIG, Goldman got $12.9 billion from AIG in the form of collateral that Goldman already had in its possession and a cash settlement of ongoing margin disputes. "The fact of the matter is, we already had the collateral," Blankfein says. "If AIG had defaulted, guess what — we would have kept the collateral from AIG and from the banks we’d bought protection from. The government’s decision to bail out AIG was about the risks to the system. It wasn’t about Goldman Sachs."

Still, an AIG default could have been catastrophic for Goldman, although Goldman claims to have been perfectly hedged against an AIG bankruptcy. "If AIG would have gone bankrupt, it would have affected every institution in the world, because it would have had a big effect on the entire financial system," explains David Viniar, Goldman’s CFO. He countered, though, that Goldman would have most likely figured out how to make money trading in such a volatile environment.

Nevertheless, critics have feasted on the Paulson connection as just another example of how Goldman Sachs benefits from "Government Sachs" — the propensity of Goldman alums to turn up in top federal financial posts after they leave the firm.

To Blankfein, the criticism seems distorted. "Something that was a virtue now looks like a vice," he says. "I don’t think we’re going to go far in this country if we make it a bad thing for people to migrate from business into other activities like writing or philanthropy or public service." Goldman, he notes, has already paid back the $10 billion — plus $318 million in dividends and an additional $1.1 billion to buy back warrants (at above-market value, he adds) — that Paulson forced it to take last October from the $700 billion Troubled Asset Relief Program. Taxpayers’ annualized return on their nine-month investment in Goldman Sachs? A cool 23%.

If anyone shoulders the "blame" for Goldman’s golden performance, it is Blankfein. Self-deprecating and seemingly unassuming, the former gold salesman has been ruthlessly ambitious for his firm and its continued success. "He takes it very personally when people act against the firm or show disloyalty," says a former Goldman executive.

After taking the reins of the company when Paulson went to Treasury in July 2006, he accelerated Goldman’s transformation from a firm that depended on its clients for investment-banking revenue — fees generated from advising on deals to underwriting debt and equity securities — to one whose clients are driving a resurgent trading and risk-taking business. Goldman has a tradition of taking trading risks. In the postwar era, the firm’s DNA has always combined the interlocking strands represented by two of the world’s foremost risk arbitrageurs — first Gus Levy and later Robert Rubin — with the investment-banker pedigree of former senior partners, including Sidney Weinberg, John Weinberg, John Whitehead, Stephen Friedman and Paulson. "We would never let our reputation as the key M&A adviser ebb in favor of being a principal," Blankfein says. "We’re very self-conscious that our franchise hinges on our client relationships and the business that those relationships generate."

In an era of derivative-driven innovations and massive leverage, Blankfein is the firm’s chief advocate for taking risks but also its chief risk watchdog. He has a far different perspective from that of most of the previous Goldman bosses. In December 2006, Viniar led a meeting of senior Goldman executives to examine ongoing daily losses in the firm’s mortgage portfolio. Goldman had already underwritten and sold billions of dollars’ worth of mortgage-backed securities, much of it labeled investment grade by ratings agencies. It was, in fact, junk. But Goldman realized earlier than most that rot was setting in and famously decided to pull back from the mortgage market. The firm then shorted various mortgage-securities indexes — betting that prices would fall — at the very moment that other firms were still making big long bets on the securities. Goldman avoided losses while other firms infected themselves with the cancerous securities.

Blankfein’s deftness under pressure impressed his partners. "He is a totally independent-minded guy," says another senior Goldman official. "Ten years ago, I think most people would have said that it is highly unlikely that Lloyd would be CEO and highly unlikely that he would succeed. But he has done both, and it seems like a dream in this environment … It’s a bit of a miracle. It was unpredicted."

A Man and His ‘Hood

Then again, Blankfein is different. Born into modest circumstances in the South Bronx, he moved with his family to the East New York section of Brooklyn "in search of a better life," Blankfein says, when he was 3. The family lived in the Linden Houses, a complex of 19 buildings completed in 1957 that contained 1,590 apartments. After losing his job driving a truck, Blankfein’s father took a night job sorting mail at the post office — "which in our neck of the woods was considered to be a very good job, because you couldn’t lose it," Blankfein says. His mother worked as a receptionist at a burglar-alarm company — "one of the few growth industries in my neighborhood."

Young Blankfein thrived. He stayed out of trouble by not getting off the school bus when he saw things happening that made him uncomfortable. He studied hard. He was the valedictorian of his 1971 graduating class at the predominantly black Thomas Jefferson High School. At 16, he applied to Harvard, solely because Harvard had gone to the school to recruit. Using a combination of financial aid and scholarships, he graduated in 1975. Ben Bernanke was in his class. In the class-of-’75 yearbook, Bernanke was pictured near Blankfein, who was wearing a fashionable houndstooth blazer with groovy wide lapels. Blankfein then enrolled at Harvard Law School, from which he graduated in 1978. "At some point, I can’t say that I had a disadvantaged background," he says. "After a while, I kind of evolved into having an advantaged background." Following law school, he was hired at Donovan, Leisure as a corporate tax lawyer.

These early triumphs in the face of adversity understandably shaped his ambition and his worldview. "You can never forget that Lloyd came from a pretty significantly challenging environment," explains Robert Steel, Blankfein’s former partner at Goldman and an Under Secretary for Paulson at Treasury. "That’s at the root of Lloyd." Steel recalls that Blankfein shared stories about life at Thomas Jefferson High School. "You survive by either one of two things," Steel says Blankfein told him. "You were either a great athlete or funny and entertaining, and I decided to go with funny and entertaining."

Blankfein also developed some pretty bad habits. Once upon a time, he smoked two to three packs of cigarettes a day. He was overweight. He often dressed inappropriately or ostentatiously. And he had a love of gambling in Las Vegas.

By 1981, Blankfein was on partner track at Donovan, but then he had what he calls a pre-midlife crisis and decided to make the switch, if he could, to investment banking. He applied for banking jobs at Dean Witter, Morgan Stanley and Goldman. He did not make the cut in Goldman’s famously exhaustive recruitment process (or at the other two firms either). "It wasn’t a nutty decision. I was a lawyer," he says. "I didn’t have a finance background." Instead, in 1982 he landed a job as a gold salesman for J. Aron & Co., an obscure commodities firm that Goldman had purchased in November 1981 for about $100 million. According to the Wall Street Journal, when Blankfein told his then fiancée Laura — now his wife and the mother of their three children, one of whom is at Harvard — that he was leaving law for J. Aron, she cried, thinking that he was burning a high-paying career. (Ironically, Donovan, Leisure closed its doors a decade ago.)

Over time, Blankfein became a major part of J. Aron’s success. But at first, he says, he was not very good at the job. "I had trouble with the language, with the speed and the pacing." Soon enough, though, he designed a lucrative $100 million trade — then the largest of its kind Goldman had ever handled — for a Muslim client to comply with the religion’s rules against receiving interest payments. In 1984, Goldman partner and J. Aron chief Mark Winkelman put Blankfein in charge of a group of foreign-exchange salesmen and later in charge of all foreign-exchange business. Rubin, then on the firm’s management committee and responsible for both risk arbitrage and J. Aron, had advised Winkelman against it. According to Charles Ellis’ 2008 book about Goldman, The Partnership, Rubin told him, "We’ve never seen it work to put salespeople in charge of trading in other areas of the firm. Are you pretty sure of your analysis?"

Blankfein’s career took off. He seemed to have a sixth sense about when to push traders to take more risk and when to take their collective feet off the accelerator. "It’s not about hanging on to a predisposition," Blankfein told FORTUNE in March 2008. "The best traders are not right more than they are wrong. They are quick adjusters. They are better at getting right when they are wrong." Blankfein too was becoming a quick adjuster.

In 1994, in the wake of Winkelman’s departure from the firm after he’d been passed over for the top job at Goldman in favor of Jon Corzine (now governor of New Jersey), Blankfein was selected to run J. Aron. His appetite for risk quickly surfaced. In 1995 he chided his fellow partners for being too risk-averse and promptly left a conference room where they were meeting to place a multimillion-dollar bet with the firm’s money that the dollar would rise against the yen. Blankfein’s bet — one of his favorites — paid off, and he impressed his partners as a prudent risk taker. He would do the same thing — exhort them to take greater risks — 10 years later and then persuade them to reverse course after December 2006.

In December 2003 he was named Goldman’s chief operating officer and co-president after the departure of John Thain — Blankfein’s rival to lead the firm — who left to become CEO of the New York Stock Exchange. By then, Blankfein had impressed Goldman’s board of directors and especially Paulson, then the CEO, with his tenacity, ambition and hands-on management style. "Hank became increasingly concerned about whether [John] Thornton or Thain" — the co-presidents of Goldman before Blankfein — "would assume responsibility for the business units and show they could run things," says a former Goldman partner. "Lloyd showed a willingness to assume responsibility." Paulson and Blankfein became an effective team, with Paulson globetrotting and hobnobbing with clients and Blankfein assuming more and more operational control of the firm. Year after year, the company was earning billions. "Lloyd made everything run," says the former partner.

Defending Goldman’s Crown

When, in July 2006, president Bush tapped Paulson to be Secretary of the Treasury — in the great Goldman tradition — Blankfein’s journey from a Brooklyn housing complex to the pinnacle of American capitalism was complete. By then, all of Blankfein’s quirky bad habits had been eliminated too. Blankfein has since become a snappier dresser, has lost weight and has given up smoking and gambling. He shaved his once unsightly beard. "I wasn’t going to make myself taller," he once quipped when asked about his transformation. He in effect reduced the risks in his personal life as he ratcheted up the risks — prudent, to be sure — that Goldman was taking under his leadership.

He is now exceedingly wealthy. In 2007, the year of Goldman’s record profit, the board paid him $68.5 million, a record payout for a Wall Street CEO. His 3.4 million shares of Goldman are worth about $540 million. He bought a tony $27 million Manhattan apartment at "Wall Street’s new power address," as the New York Times called it, 15 Central Park West. He also owns a 6,500-sq.-ft. (600 sq m) home in Sagaponack, N.Y., near the ocean.

Goldman’s CEO and other top execs are set for another huge payday this year, although some of his former partners wonder about the backlash against him and the firm as a result. Blankfein is worried too. How is he to juggle the firm’s great success — and the attendant increasing bonus expectations of the high achievers working at the firm — with the inevitable public outcry that will result from paying out multiple millions of dollars in bonuses at a time when people all over the country are still reeling from a financial calamity largely of Wall Street’s making?

Figuring out how to balance the proper ongoing motivation of some of the nation’s best and brightest people with the still simmering public anger toward Wall Street — and, at the moment, toward Goldman Sachs in particular — may be Blankfein’s biggest management challenge yet. And he knows it. "Everybody’s goal in life is to get 105% credit for all the good things they do and much less recognition for all the bad things they do," he says. "But with us, bizarrely, the view seems to be, What’s good is bad and what’s bad is good. There’s clearly some resentment. There are people who are disposed to think that because we were careful and successfully avoided many of the pitfalls, it should be thought of as some kind of conspiracy."

Blankfein is convinced that Goldman Sachs is good for its clients, for the world’s capital markets — and yes, for America as well. "I would like for us to be thought of as always doing the right thing and for people at the firm to be confident that they are doing the right thing," he says. Now if only he could get the public to see things this way too, he’d be all set.

Cohan, a contributing editor at FORTUNE, is the author, most recently, of House of Cards: A Tale of Hubris and Wretched Excess on Wall Street.

Read "Goldman’s Profits: Gambling with Taxpayer Money?"