Does it matter if we have a good GDP and no jobs?

Does it matter if we have a good GDP and no jobs?

That's a question that will have to be considered today as the powers that be try to make a big deal of the fact that we are getting worse more slowly, even as the Q2 GDP report is expected to be 60% WORSE (-1.6%) than last quarter (-1%). It's very possible we get a small beat today (it will be tragic if we don't) as crude oil prices jumped 25% in May and June (forcing Americans to spend money – yay GDP!) and exports nearly doubled, non-defense capital goods gained about 5% and, of course, the stock market jumped 15%. In the 3 months of Q2 we lost 1.3M jobs and the average workweek for those lucky enough to still be working dropped by 4% AND their pay dropped 1.5% but hey, who cares, AIG's stock is up!

My daughter has it all figured out, she lost a tooth last night and got a visit from the tooth fairy and at breakfast she was speculating that the little pixie is probably using all those teeth to build houses for homeless people. I didn't have the heart to tell here that, at $5 per tooth, it was probably cheaper to stick with lumber but she may be on to something as TOL blew through $472M in their last quater, losing $2.93 a share on the sale of just 792 homes in the entire United States of America (about 5 homes per month per state). That's almost 100 Million teeth! Maybe my daughter is onto something with this tooth house idea as clearly the wooden ones can't be sold profitably…

TOL isn't the only one running on empty last quarter. We all know that the GDP is currently being boosted by the largest government stimulus package in history. Government spending this year is trending to 30% of GDP, that compares to 12% at the height of Roosevelt's New Deal. Of course we don't actually HAVE 30% of the GDP – we were running a huge deficit before the government had to jump in to "help" and we are now borrowing almost 40% of our spending and really we're borrowing 62.5% of what we spend because WE'RE NOT SUPPOSED to be using Social Security and Medicare money to pay for current programs.

TOL isn't the only one running on empty last quarter. We all know that the GDP is currently being boosted by the largest government stimulus package in history. Government spending this year is trending to 30% of GDP, that compares to 12% at the height of Roosevelt's New Deal. Of course we don't actually HAVE 30% of the GDP – we were running a huge deficit before the government had to jump in to "help" and we are now borrowing almost 40% of our spending and really we're borrowing 62.5% of what we spend because WE'RE NOT SUPPOSED to be using Social Security and Medicare money to pay for current programs.

That of course, went out the window when we gave George Bush II the keys to Al Gore's lock box but no sense crying over a spoiled economy is there? And how much of our government's spending is going on these New, New Deal programs? Less than 5%. In fact, the grand total of all Non-Defense Discretionary spending slated for 2010 is 18.5% of the government's budget. That is less money than we spend on the interest on the existing debt! No wonder brother cannot spare a dime as Big Brother's intakes (which are 62.5% short of break-even) are 81.5% taken up by items over which they have no control.

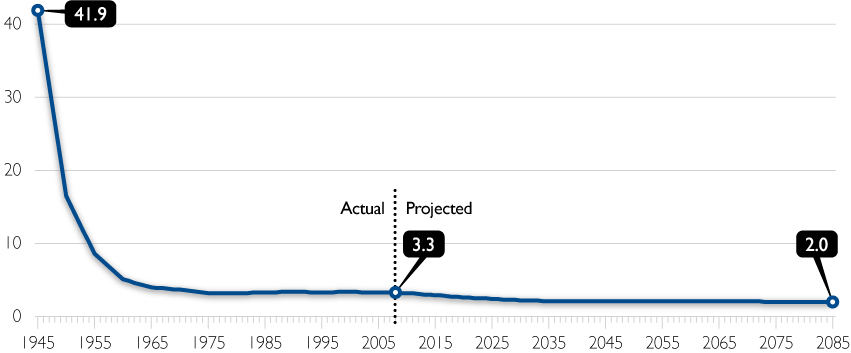

Well, I say no control as if we HAVE to spend 19% of our government's budget on Defense. Japan spends almost nothing on Defense, that's why they can afford to finance our deficit with all those cheap Yen. Our "entitlement programs" of Social Security, Medicare and Medicaid take up a whopping 38.2% of the government's budget and accounts for $600Bn a year in spending. Over the past 60 years, about $7Tn has been collected by our government FOR Social Security and Medicare. We can see from the above chart that the program had a huge boost in the 40s and 50s when the government plan was "give us lots and lots of money you can't get back for 20 years and hopefully you'll die before you can collect." This was a GOOD plan and we lived on decades of "supluses" and you would think that a person who worked from 1965 to 2005, having 14% of his wages put away for SS and Medicare could expect that 5.6 year's worth of his income invested over 40 years would be enough to carry him through his retirement.

After all, even if the man earned just $20,000 a year and was forced to give just $2,800 to the government and even if they invested in with an average return of just 4% over 40 years, then the government should have $276,714 set aside for him. This is something the conservatives just don't get when they rail against "entitlement" programs. It's an entitlement because it's THEIR money, not yours. The money the retirees saved was effectively stolen in order for the government to pretend it was OK to lower taxes and, now the health care costs are spinning out of control and straining what little is left to pay out for the program – it's the program that's being vilified while attempts to control costs by fixing health care are being shot down in one of the biggest smear campaigns in the history of American politics (and we have had some doozies!).

Why am I bringing this up today. Because it doesn't matter how good or bad the GDP numbers are – it's the jobs that matter. Less workers is less income for the government and less money going to Social Security and more borrowings by our government every month and more people to support and less people to buy and a 4% drop in the workweek for those left working and a 1.5% drop in pay is another 5.5% effective unemployment so that's another 7.7M people's worth of lost jobs through wage cuts IN ONE QUARTER.

I am outraged this morning because our friends at Bloomberg, who I thought were above the GS/MSM market manipulation game "just so happened" to choose this morning to vilify our friend Nouriel Roubini saying: "Anyone attempting to apply Roubini’s wisdom to stocks may be forgiven for missing the biggest rally since the 1930s as the Standard & Poor’s 500 Index climbed 52 percent in six months. While Roubini said in March the advance was a “dead-cat bounce,” that it may “fizzle” in May and warned in July that the economy’s “not out of the woods,” the MSCI World Index was posting a 58 percent gain, the largest since it began in 1970."

I am outraged this morning because our friends at Bloomberg, who I thought were above the GS/MSM market manipulation game "just so happened" to choose this morning to vilify our friend Nouriel Roubini saying: "Anyone attempting to apply Roubini’s wisdom to stocks may be forgiven for missing the biggest rally since the 1930s as the Standard & Poor’s 500 Index climbed 52 percent in six months. While Roubini said in March the advance was a “dead-cat bounce,” that it may “fizzle” in May and warned in July that the economy’s “not out of the woods,” the MSCI World Index was posting a 58 percent gain, the largest since it began in 1970."

What Bloomberg fails to mention is had that same investor heeded Roubini's warnings and gotten out when the S&P was at 1,500, they would still be 50% ahead of the people who don't believe in fundamentals and are BUYBUYBUYing today. I myself have turned negative on the market since we broke over my 9,100 range on the Dow but I am, as yet, unrepentant about not taking full advantage of the last leg of this rally as it just doesn't seem justified by the fundamentals that are underlying the market. Sure we've taken plenty of long plays but they have been cautiously hedged and we still feel the big money is going to be made on the downside in the near future.

Asia sold off this morning (about 1%) and Europe is mixed and our GDP did, indeed, come in much better than expected at just -1%. "Only" 570,000 people lost their jobs this week vs. 580,000 expected so we should be off to the races but we are not and one could only conclude that that is because we are already too high. If the market doesn't finish the week at or above the mid-week highs, I think we may have finally found a top. Meanwhile, we have continued to be wishy-washy with our covers but that will end this weekend, where we are more likely to go more bearish.

We have had trouble filling our new $100K Virtual Portfolio and I decided yesterday we should wait to see what happens after the GDP so today will be more watching and waiting but I see nothing in the actual figures that indicates a strong enough economy to justify the p/e ratios we are being asked to pay for so many stocks (91%) that are above their 200-day moving averages.